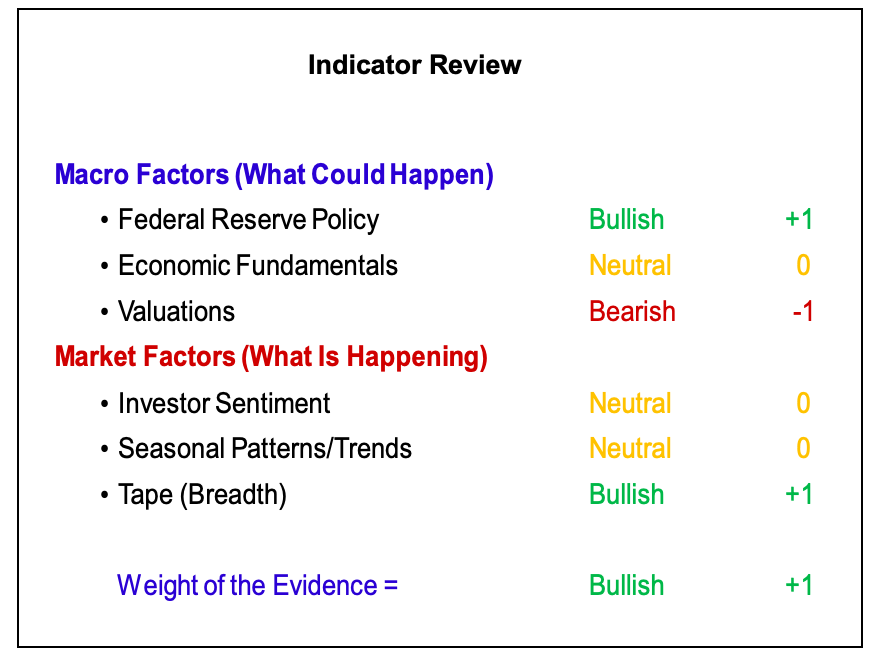

Weight of the Evidence Review:

Base case vs. Bull case vs. Bear case. These are useful thought exercises at year-end, but as we move into the New Year, our view on the market will be guided by the changes and developments in the weight of the evidence. The evidence improved over the course of 2019 and has a bullish bias as we prepare this outlook.

Fed Turns Friendly (Bullish)

Data from CME shows an expectation for at least one (and possibly more) rate cuts in 2020. While the three rate cuts in 2019 can plausibly represent a mid-cycle adjustment and helped turn our view of Fed policy to bullish, further easing in 2020 would challenge this. A better outcome from our perspective would be a Fed that stays on the sidelines in 2020 even as growth and inflation pick up.

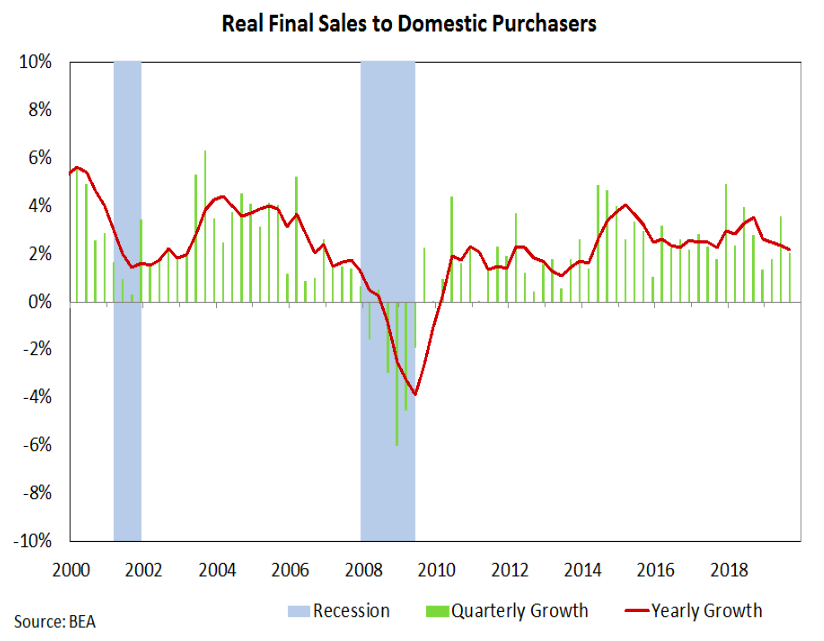

Economic Green Shoots Abroad but Strains at Home (Neutral)

Global manufacturing data is again expanding but US data is still decelerating. Yearly growth in domestic demand has slowed from 3.5% to 2.2% over the past year and is at its lowest level in 5+ years. ISM New Orders are at their lowest level since 2009. While a 2020 recession in the US remains a low-probability event (initial jobless claims, for example, are very much not raising alarm bells), the economy is in a more vulnerable spot than a year ago. CEO confidence remains weak while political tensions and global uncertainty threaten to weigh on consumer confidence.

A successfully negotiated Brexit and/or a trade situation with China that reaches status quo (not resolved, but not deteriorating) could restore confidence and buoy growth. A not-often-discussed scenario is one where US growth falters while global conditions continue to improve. Such a development could help contribute to a shift in equity market leadership away from the US and toward the rest of the world. If growth is more widespread, opportunities for portfolio diversification increase.

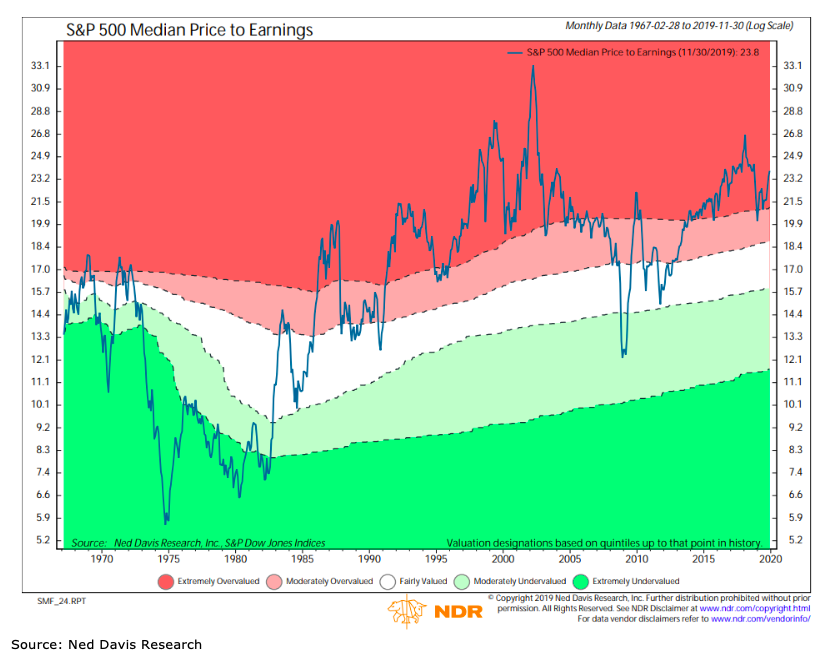

Sluggish Earnings Growth Stretches Valuations (Bearish)

Price gains for stocks have outpaced fundamental improvements in 2019 as well as over the past decade. Using either trailing or forward earnings data, Price/Earnings ratios are historically elevated. Valuations are not trustworthy short-term indicators but they do a great job from a longer-term perspective at elevating risks for stocks. Current valuations have been associated in the past with sub-par returns. Elevated valuations put pressure on earnings to come through if stocks are going to be able to rally.

Expectations are that earnings growth will rebound in 2020, though current estimates may prove to be too robust. One thing working against profits right now is that labor costs are rising at a faster pace than pricing. This downside to low inflation is a negative for profits – and it should not be overlooked that the broadest measures of corporate profits have not gone anywhere for five years. Expectations for an earnings rebound rely heavily on improving economic conditions.

Guarded Optimism but Deep-Seated Complacency (Neutral)

Shorter-term sentiment indicators mostly show optimism, though it is neither widespread nor excessive enough to weigh on stocks. Moreover, optimism has been quick to dissipate on any stock market pullbacks. There appears to be, however, a deep-seated complacency when it comes to equities. The public, with elevated exposure to equities and well-below-average exposure to cash, has been lulled into a false sense of security after a decade of historically remarkable gains for US large-caps.

Near-term optimism fading the moment stocks stop rising seems to be a consequence of investors being strongly conditioned for higher stock prices. This complacency can lead to unwise risk taking by adding to crowded assets (with the view that time in the market is all that matters) at the expense of relatively unloved assets (including cash). A historical note: forward returns for equities tend to be inversely correlated to household exposure to equities and according to data from Ned Davis Research, current household equity exposure is in the top 10% of all readings in the past 70 years.

Political Fights Likely to Dominate Seasonal Trends (Neutral)

Presidential election years since World War II have tended to see stocks struggle early, rally late (after election uncertainty subsides) and finish with an average gain of nearly 7%. Years ending in zero (depending on your accounting either the first year of a new decade or the last year of an old decade) have seen an average decline of 3% over the past century. The prospect of a presidential primary campaign and a Senate impeachment trial in the first quarter of 2020 is likely to exacerbate the tendency for early-year volatility.

If President Trump’s approval rating in the Gallup poll remains above 35% or so, the impeachment effort is unlikely to go anywhere and its conclusion could turn the market’s attention more squarely on the election. Either way, 2020 is shaping up to be noisy and full of political conflict and uncertainty. The best opportunity for a seasonal tailwind may be closer to the actual election if its outcome starts to come into focus.

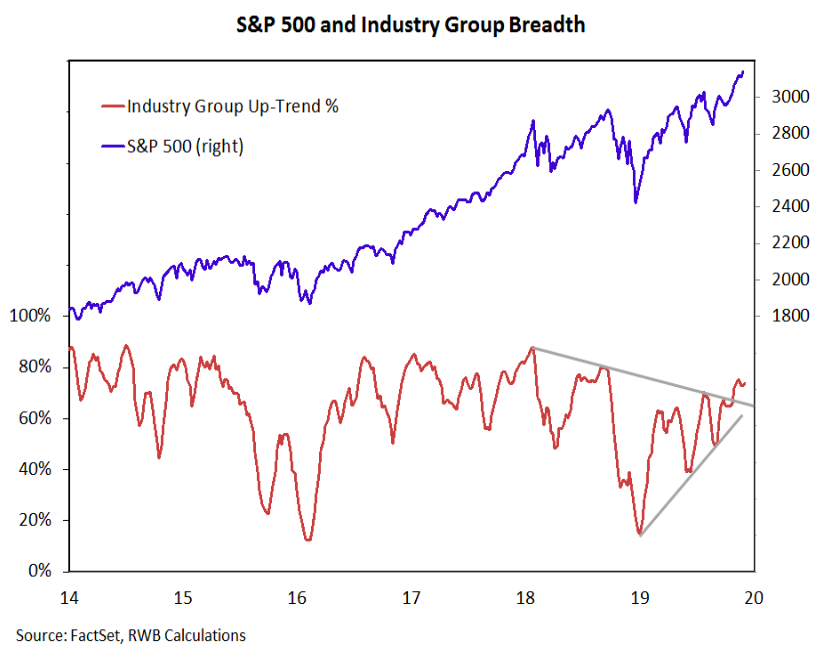

Better Breadth Fuels Strength (Bullish)

The improving broad market backdrop over the course of 2019 provides support for the view that a new cyclical bull market has emerged. Early-year breadth thrusts helped fuel the recovery from the 2018 lows, and additional breadth thrusts and improving trends on a global basis have helped sustain the rally.

There is still room for improvement. Indexes that track the performance of the median stock have been more uneven (and, as of this writing, have not surpassed their April 2019, let alone September 2018, peaks) and the number of stocks making new highs has struggled to expand. Taken all together, however, the late-2019 new highs on the S&P 500 have been accompanied by improving domestic and global trends and that is a meaningful improvement over the new highs that were seen in early 2019 and mid-2018.

Thoughts on Portfolio Management for a New Decade:

While a 60/40 portfolio (60% exposure to equities and 40% exposure to bonds) may be a good benchmark, it may not be the right allocation. Just as historically average returns are rarely observed in any given year, it may not make sense to strictly adhere to an average benchmark asset allocation. In fact, a new paradigm may be at hand which will encourage thoughtful and dynamic asset allocation around given benchmarks.

As an industry we have moved through actively managing active products (stock picking), passively managing active product (buying and holding mutual funds) and passively managing passive product (buying and holding ETFs). This point of peak passive may be yielding to a new approach, actively managing passive product (dynamic allocation with ETFs). The emphasis on passive exposure with ETFs was fueled by (and helped fuel) a decade of remarkable strength in U.S. large-cap stocks.

With domestic valuations stretched and global growth stabilizing, renewed opportunities for and benefits from diversification are emerging. We highlighted this in a Portfolio Perspectives (After U.S. Strength, Global Stocks Poised For Gains) piece published earlier this year. A strictly passive approach becomes more challenging to maintain when expected returns are compressed and expected volatility is elevated.

Over the next decade, the strategic view on equities and other assets may matter a lot less than what is done tactically around that view. This is in contrast with the last decade, where a tide of ample liquidity mostly lifted US large-cap boats. Through small and mid-cap funds from Baird Asset Management and our affiliation with Chautauqua Capital Management, Baird is well-positioned to help investors take advantage of shifting global equity market leadership trends.

Investors can prepare for this new environment by reimagining portfolio management and risk tolerance – moving away from a question of stock-bond-cash allocations and thinking about static vs. dynamic allocations across asset classes. Opportunities are likely to emerge and fade as the economy and global markets move into the forefront and US large-cap leadership ebbs. A dynamic approach may help investors stay in harmony with the underlying trends.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.