Noisy headlines are fueling volatility in the stock market, as well as the broad global financial markets.

Concerns about the economy and political developments pushed U.S stocks into the red last week.

The S&P 500 Index (SPX) finished lower for the third week in a row, though it was well off of its worst levels.

The Volatility (VIX) that was dormant in September has reemerged in October. All four trading days of the month so far have featured intraday swings of more than 1%.

With the pace of Q3 earnings reports set to intensify over the next several weeks, as well as continuing geopolitical developments (at home and abroad), there may be little respite from the noise in the near term.

According to data from FactSet, earnings are expected to have fallen more than 4% in the third quarter, with more pronounced weakness from companies that get a majority of their revenue from overseas.

Cloudy outlook threatens to weigh on economic confidence

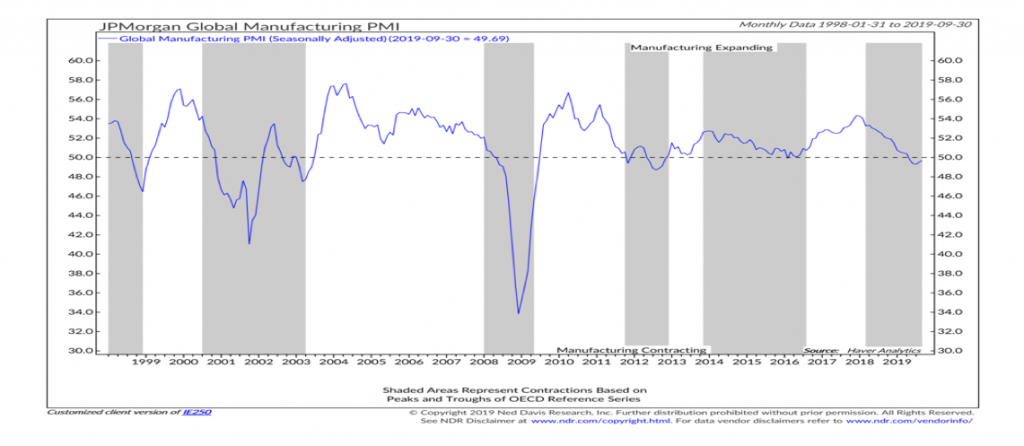

Economic data was generally disappointing last week, raising some concerns that localized weakness in manufacturing sector may be spreading to other areas of the U.S. economy. ISM data for both the manufacturing and non-manufacturing sectors were weaker than expected in September and the Conference Board reported that CEO confidence has dropped to its lowest level in a decade.

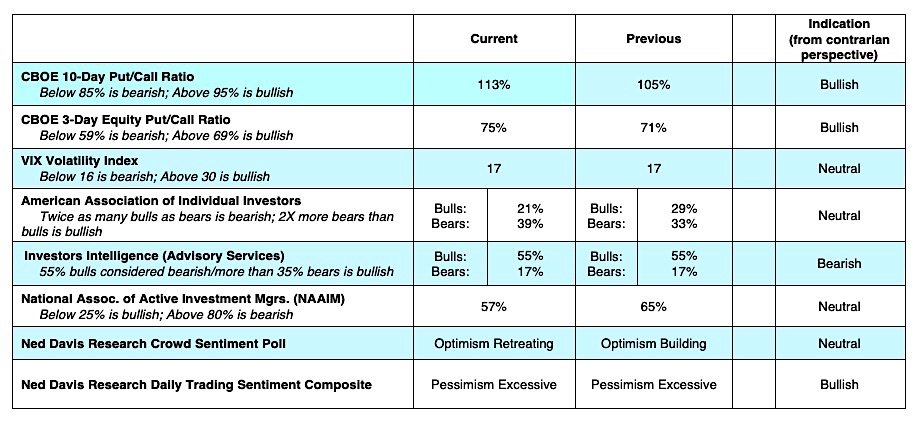

Friday’s job’s report showed the pace of hiring slowed and wage growth moderated, though the unemployment rate dipped to a new low and average weekly hours were unchanged. Investors have responded to this uncertainty by turning more cautious on stocks and pricing in a rate cut by the Fed later this month, both of which helped buoy stocks by the end of the week. While increased caution by investors can support stocks in the near term, the outlook for the economy would be negatively impacted if consumer confidence follows the path of business confidence.

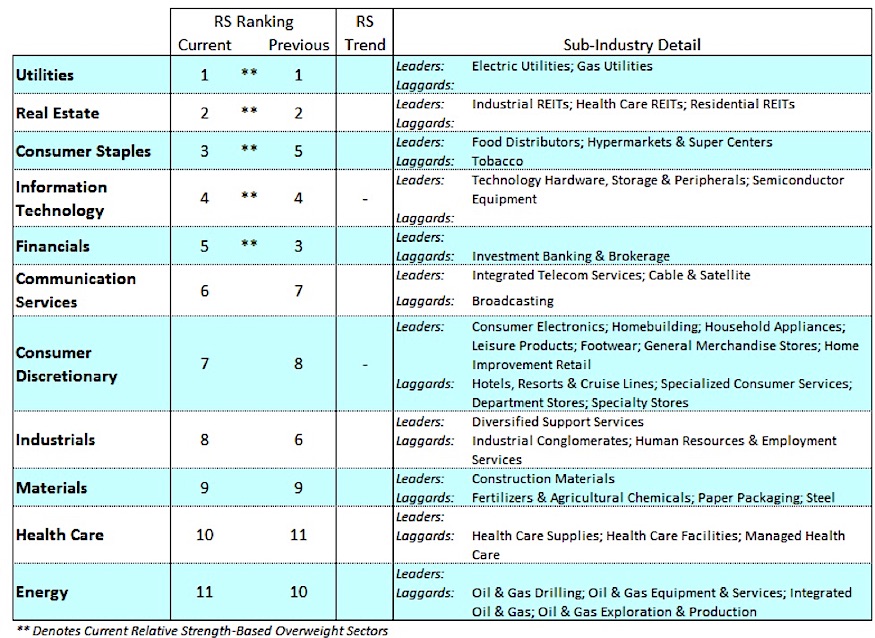

Not yet spring, but at least silver linings – Despite the noise and the clouds there are some reasons for cautious optimism. Copper, which can be seen as an important bellwether for the global economy (and emerging market stocks) did not make a new low last week. Likewise, benchmark 10-year yields in both the U.S. and Germany declined last week but have stayed above their recent lows. From a sector perspective, the Financials sector is the best performing sector over the past month (just edging out Utilities) and has moved into the sector leadership group for the first time since early 2018. Finally, while U.S. manufacturing data is deteriorating, global manufacturing data has actually ticked higher in recent months.

The Bottom line: Volatility in October could yield to a more constructive backdrop for stocks in the fourth quarter if recent tests of support in the financial market can be maintained and the consumer can remain resilient.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.