Financial markets remain in a reactive mode. Tensions between Russia and Saudi Arabia over oil production are exacerbating uncertainties over the economic effects of the increasingly global spread of the coronavirus.

Both the global health and economic effects of this outbreak remain uncertain.

That the US and global economy were experiencing a bit of rebound prior to this outbreak is encouraging and may offset some of the negative demand and supply chain effects that are now weighing on growth.

While the path forward is uncertain, we do know that global manufacturing activity had turned higher in early 2020 and the US economy surpassed expectations in terms of both aggregate payrolls and average workweek in February. While forecasted implications of the coronavirus outbreak abound, it is too early, from our perspective, to try to quantify the economic effects.

Even normally timely data appears stale, and the best indicators for providing real-time assessments come from the financial markets.

Bond yields moved sharply lower last week and the yield on the 10-year T-Note appears poised to begin the new week at a record low (near 0.50%).

Copper prices had been relatively resilient but (with other economically sensitive commodities) are now under renewed pressure. While stocks finished last week with a modest gain (as measured by the S&P 500), we have seen some evidence of fear.

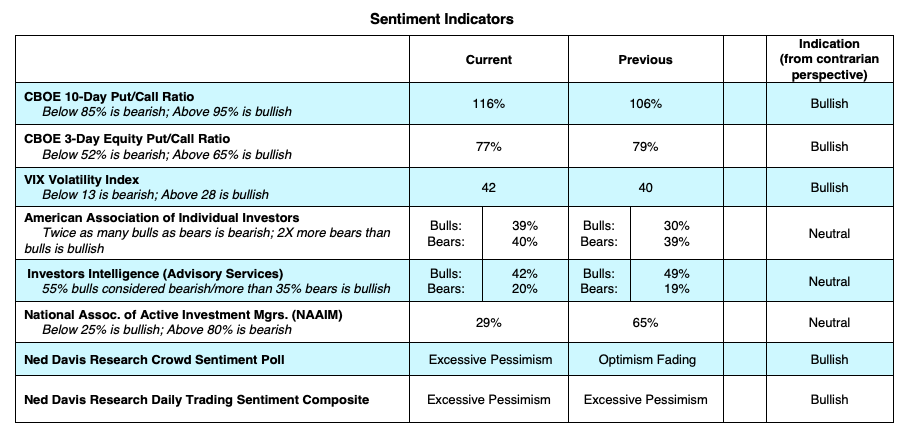

The VIX fear index crossed above 50 and reached its highest level since 2009. After showing signs of inflows early in the week, equity funds outflows accelerated last week – over the past four weeks, equity fund outflows have totaled nearly $40 billion. The NAAIM Exposure Index (which measures sentiment among active investment managers) experienced its largest two-week decline since 2008 and fell to its lowest level since January 2016.

While we are seeing near-term evidence of pessimism, the events of the past two weeks may be signaling that a deeper re-set in sentiment may be forthcoming. After a decade of remarkable strength in US equities, there is still evidence of deep-seated complacency and the volatility of the past two weeks has done little to resolve the valuation excesses that emerged as stock market prices rallied ahead of fundamental improvement.

Economic uncertainties make the fundamental outlook more challenging. While much of the 2019 rally in stock prices was premised on an improving earnings outlook for 2020, the latest data from FactSet shows that earnings for Q1 might struggle to expand at all.

It is hard to know in real time that an extreme has been reached. History suggests that we will know after the fact. This is why we have been counseling a patient approach until such time as we have evidence in hand that downside risks have subsided. Specifically, we are looking for two days where upside volume outpaces downside volume by better than 9 to 1. Rally attempts last week failed to produce even a single 9-to-1 up day.

The surge in day-to-day volatility can open the door for near-term bounces, but the opportunity for sustained strength is likely to be signaled by improving conditions beneath the surface.

The Bottom Line: We continue to counsel patience in the face of global economic uncertainty. Evidence of building pessimism is evident, though investor sentiment toward stocks may be facing a broader re-set. Two or more days of better than 9-to-1 upside volume would suggest near-term downside risks have diminished.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.