Stock market futures are lower as we begin trading on Monday and for the new week. This follows a third straight week of declines for the major stock market indices.

Performance for the week ending September 18: The Dow Jones Industrial Average closed down -0.3%, the S&P 500 -0.64% while the NASDAQ Composite -1.16%.

In a pleasant surprise, cyclical and small cap stocks are holding up and gaining ground (i.e. the Russell 2000 Index).

Central banks have taken extraordinary measures to provide liquidity to the markets over the past six months. They have cut interest rates to historic lows and initiated quantitative easing measures by purchasing corporate and government bonds.

The Federal Reserve has pledged to keep interest rates near zero through 2023 in order to support the economy. They recently announced a more flexible approach to targeting inflation where they will move to an “average” inflation target instead of the exact 2% level which has been their target in the past. This policy suggests that the Fed will allow inflation to run at or above 2%.This should allow inflation to be left in the vicinity of or moderately above 2% for many years before a rate hike is necessary.

The federal government’s support of individuals, small businesses and municipalities was essential in preventing the March downturn from turning into a more severe recession. Congress has struggled recently to reach an agreement on an additional aid package. Millions of Americans are still out of work. Many small businesses are suffering and state and local governments are experiencing shortfalls. We need the additional aid package in order to secure this economic recovery.

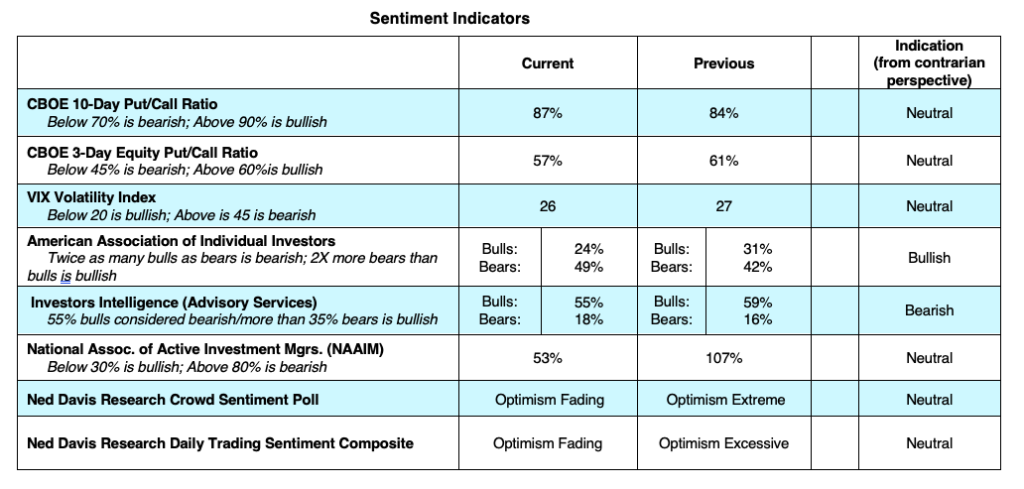

The reasons for further stock market gains are monetary and fiscal stimulus, evidence of a slowly recovering economy, and positive news on treatments and a vaccine for COVID-19 virus. However, there are concerns and volatility will likely remain high. Investors may lose confidence as Congress debates the next federal aid package. The markets may have factored in the lower for longer interest rate scenario from the Federal Reserve. Other headwinds include an inconclusive or contested presidential election and the technical data showing fully invested mutual funds and excessive call volume from the Chicago Board Options Exchange suggesting too much optimism which often signals a pullback.

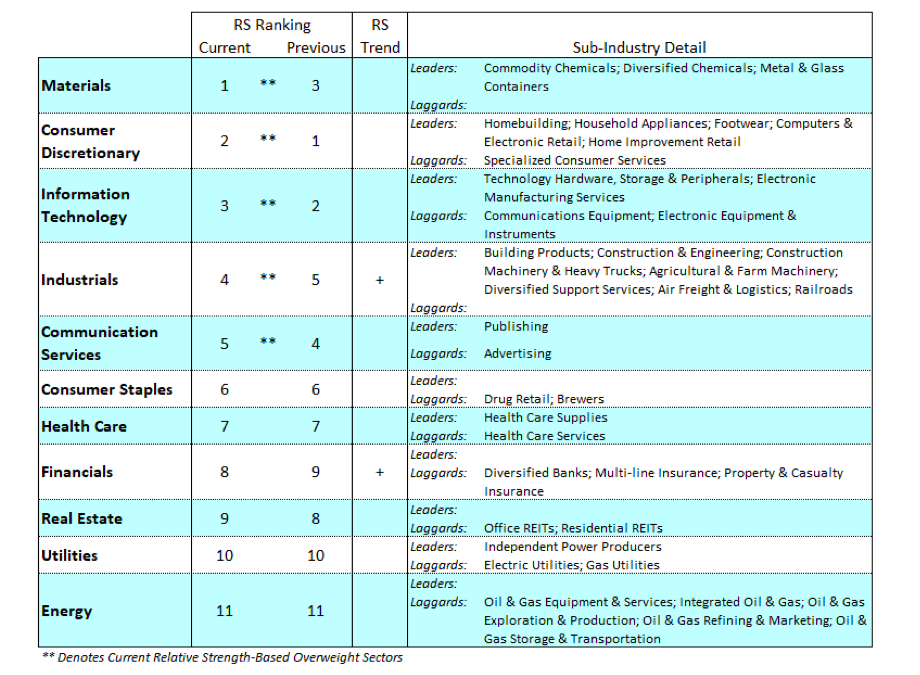

The largest five stocks in the S&P 500 – the mega cap stocks of Amazon, Microsoft, Apple, Facebook and Google – comprise roughly 23% of the market capitalization of the S&P 500, even after the recent correction. A pullback in these stocks pulls the rest of the market down. The Baird sector analysis shows information technology ranks number 3 on our list of strongest sectors and has held a spot near the top of the list all year – even before the pandemic happened. The technology sector will continue to benefit from the growing trends in internet retail, education, entertainment, medicine and work. But investors may want to take profits in some of their mega cap winners and move into the small cap tech companies. The past three weeks have seen a shift into the cheaper valuation areas of small and mid-size stocks as well as the cyclical sectors.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.