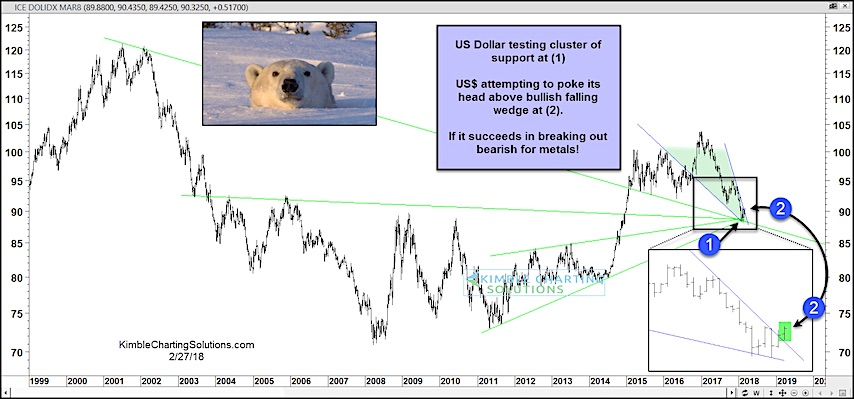

The last 14 months has seen the US Dollar Index fall nearly 15 percent (top to bottom). Sentiment toward the dollar has turned bearish as well.

From a contrarian standpoint, the US Dollar Index is nearing an oversold bounce. But could it lead to a stronger rally than expected?

Over the past two weeks, the Dollar has rallied over 2 percent.

And from a technical view, the Dollar is attempting to poke its head above a bullish falling wedge pattern. This all occurring after hitting a cluster of price support. Note that US Dollar strength would not bode well for precious metals. More on that below.

US Dollar Index – Bullish Setup?

If the Dollar succeeds in its breakout attempt, it could spell trouble for precious metals. Already struggling to make new highs with the Dollar at 3 year lows, a surge in the Dollar certainly wouldn’t help.

In the chart below we look at the ratio of silver to gold prices. Note that this ratio is testing critical support. If this breaks down, it would be a bearish signal for precious metals investors… especially if it occurs at the same time that the US Dollar turning up.

Note that KimbleCharting is offering a 30 day Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.