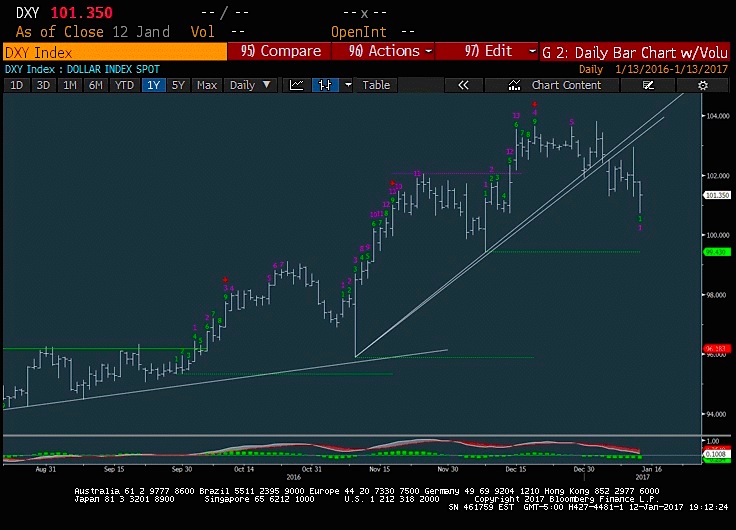

The US Dollar Index’s decline to start 2017 could prove important for the near-term, as we’ve seen a decent bounce in commodities that looks to have some trading “legs”. On a short-term basis, that may mean further strength for select commodities in the next 2-3 trading days.

The US Dollar index (CURRENCY:USD) weakness has carried on throughout this week. Thursday’s decline cut through last week’s lows, making a move down to 100 possible before a larger rally back to the highs.

For now, the near-term technicals on the Dollar are weak, while the intermediate-term remains strong. Our research says that any further pullback in the days ahead would be an excellent opportunity to buy the Bullish US Dollar ETF (NYSEARCA:UUP). Another option I’m looking at is the Proshares Ultrashort Euro (NYSEARCA:EUO), as a means towards selling the EUR/USD for a move to parity and possibly below.

For now, emerging markets have rallied on this USD weakness, but most of this should prove short-lived and a selling opportunity by the end of January. For now, the near-term decline has left the Dollar oversold, yet a bit more weakness still looks likely.

US Dollar Index Chart

Commodities are on the move again, with the Dollar decline proving to be a source of strength for the Commodity Index (CCI), which advanced up above the long-term base shown since last spring. This should allow for an upcoming test and breakout above last year’s highs in the weeks ahead. The metals have shown signs of rallying already in recent weeks while energy has snapped back after a false breakdown attempt earlier in the week. For now, stocks and ETFs that correlate positively with commodities are likely to outperform in the near-term. DBC, as one example, has been basing since early December, but likely to breakout to new highs in the days/week ahead.

Commodities Index Chart (CCI)

Thanks for reading.

Note that you can catch more trading ideas and market insights over at Newton Advisor. Thanks for reading.

Twitter: @MarkNewtonCMT

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.