The US Dollar Index has been heading lower as the Federal Reserve hinted that they may be done with hawkish policy and that they are near the peak of the interest rates.

As a result, the US Dollar has sold off sharply while stocks have moved significantly higher and even extended within a strong bull market.

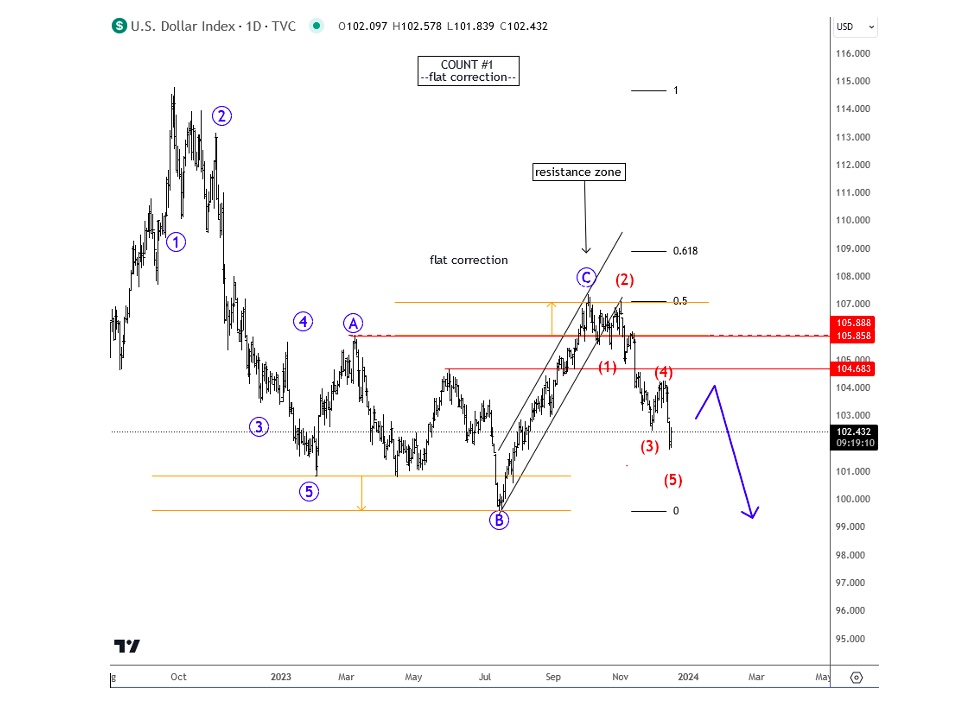

What we see on US Dollar Index is now a clear five waves down after prices got stopped at 104-104.50 resistance about we talked in the past articles. Well, this new low is very important now for the US Dollar and the next direction as five waves always show direction of a higher degree trend.

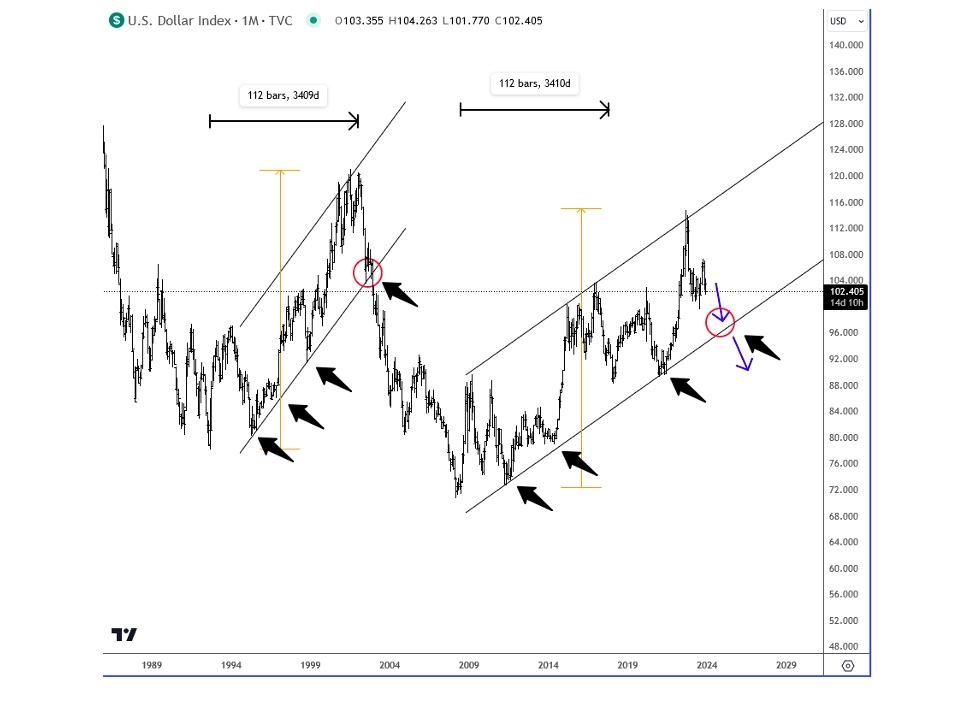

As such, we will expect more weakness on US Dollar, going into 2024 but of course there will be pullbacks within downtrend for sure. When looking at higher time frames, I also see room for 98 monthly channel.

Twitter: @GregaHorvatFX

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.