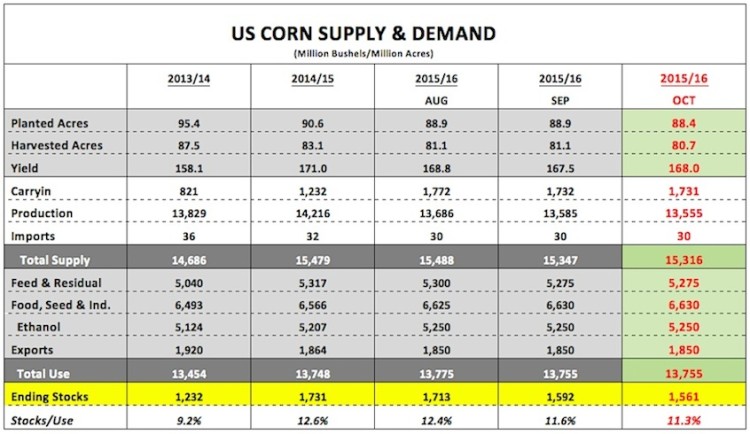

US CORN PRODUCTION FORECASTS FOR NOVEMBER 2015 WASDE:

This week a number of notable private production forecasts were issued for the 2015/16 US corn crop with the USDA set to release the November 2015 WASDE report next Tuesday. The widely followed Informa Economics estimated total 2015 US corn production at 13,718 million bushels via a yield of 170.1 bpa, which exceeded its October projections of 13,561 million bushels and 168.4 bpa. Reuters has since issued the following average trade estimates for the November Crop report:

- 2015/16 US Corn Production of 13,579 million bushels versus the USDA’s October estimate of 13,555 million

- 2015/16 US Corn Yield of 168.4 bpa versus the USDA’s October estimate of 168 bpa

- 2015/16 US Corn Ending Stocks of 1,597 million bushels versus the USDA’s October estimate of 1,561 million

- 2015/16 World Corn Ending Stocks of 188.43 MMT versus the USDA’s October estimate of 187.83 MMT

Clearly the majority is expecting the November 10th report to show supply-side increases nearly across the board. I do believe this has added additional selling pressure this week in December corn futures despite Monday’s Crop Progress report showing the US corn harvest now at 85% complete, which should equate to less commercial hedge (sell) paper. That said, psychologically, it’s likely going to remain difficult for CZ5 futures to find traction as long as the general market consensus believes the 2015 US Corn crop is still getting bigger. Traders and money managers will want to see a ceiling on production potential, and by extension US corn ending stocks, before shifting to a more supportive price outlook. Short-Term Price Impact of US Corn Production/Yield Potential = Bearish

#NoFilter: PRICE FORECAST

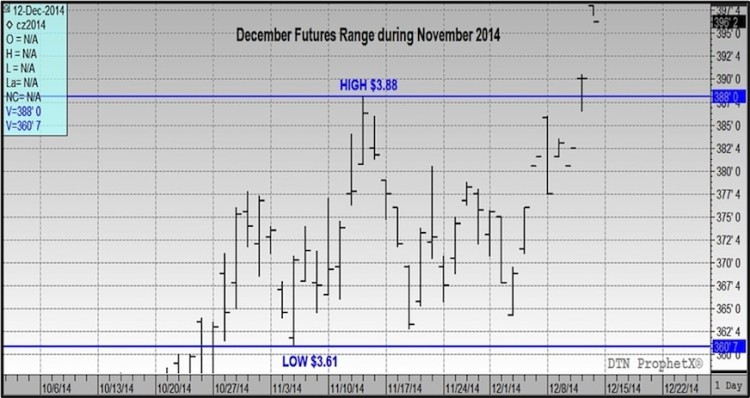

December corn futures continue to show very few signs of a significant trend change looming. A strong US dollar coupled with disappointing US corn exports, limited to no growth in corn-ethanol demand, and expectations for a bigger 2015/16 US corn crop in the November 2015 WASDE report have all but eliminated corn’s ability to sustain rallies over key moving averages. Furthermore over the last 2-years, under a similar US corn S&D backdrop, December corn futures during the month of November have closed lower on the last trading day of the month versus the close on October 31st. This year the month-end close on December corn futures for October was $3.82 ¼. I’m not suggesting a close below that level on 11/30 is guaranteed; however I do believe it’s a fairly strong indication of a market that will likely continue to struggle to sustain rallies back to $4.00.

December Corn Futures – November 2014 Price Action

Corn Supply vs Demand 2014/2015 vs 2015/2016

Thanks for reading.

Twitter: @MarcusLudtke

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.