December corn futures continued to trade in a very narrow range this week with values consolidating between approximately $3.80 and $3.70 per bushel. The 35-day moving average ($3.825) in particular has acted as the major area of price resistance on recovery attempts and has remained resistance since December corn futures (CZ5) closed below that level on October 14th.

On Friday (11/6) CZ5 closed at $3.73, finishing down 9 ¼-cents per bushel week-on-week. It’s interesting to note that on November 6th, 2014 December corn futures closed at nearly the same price, finishing at $3.71 ¼.

It’s also worth mentioning that in the October and November 2014 WASDE reports, 2014/15 US corn ending stocks averaged 2,045 million bushels, 31% larger than the USDA’s current October 2015 forecast of 1,561 million bushels.

However despite the variance in ending stocks, CZ5 futures have largely been unable to generate any upward momentum. That said is a breakout move approaching in the next 2 weeks? Let’s consider the following:

December Corn Futures Chart

US CORN EXPORT SALES

I’m running out of negative adjectives to describe the pace of US corn export sales. Export sales for the week ending 10/29/2015 totaled just 21.9 million bushels for the 2015/16 marketing year. Year-to-date sales now trail 2014/15 by 32% with total US corn exports currently coming in at just 517.5 million bushels versus 756.7 million a year ago (-239.2 million bushels). This has to improve quickly or the USDA will likely be forced to lower its 2015/16 US corn export sales forecast of 1,850 million bushels by at least 25 to 50 million bushels, which as of the October Crop report was down just 16 million bushels from the marketing year total for 2014/15 of 1,864 million. There remain a number of external market influences working against US corn exports including the Dollar Index, which recovered this week to its highest level since August 7th.

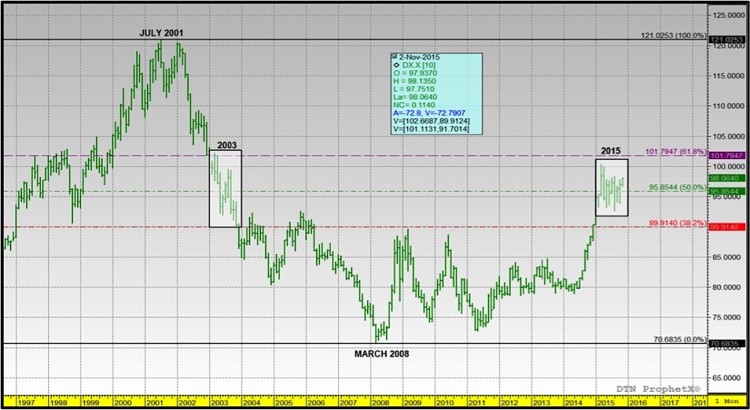

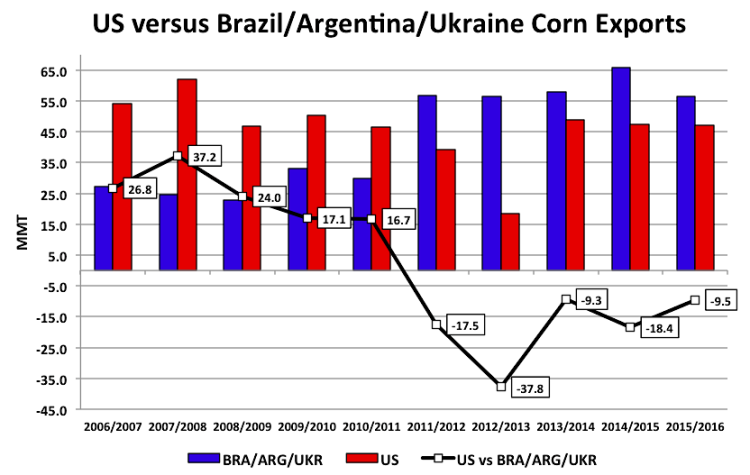

It should be noted that for the majority of 2015 the Dollar Index has continued to trade at highs not experienced since 2003. This invariably has weighed on a host of US commodity values with corn certainly not immune to Dollar strength given the alternative origins world corn importers now have access to. Ukraine, Argentina, and Brazil, collectively, are forecasted to export 9.5 MMT more corn than the US in 2015/16. That trend didn’t exist prior to 2011/12. Short-Term Price Impact of US Corn Export Sales = Bearish

US Dollar Index Chart

US Corn Exports versus Argentina Brazil Ukraine

continues reading for price and production forecasts…