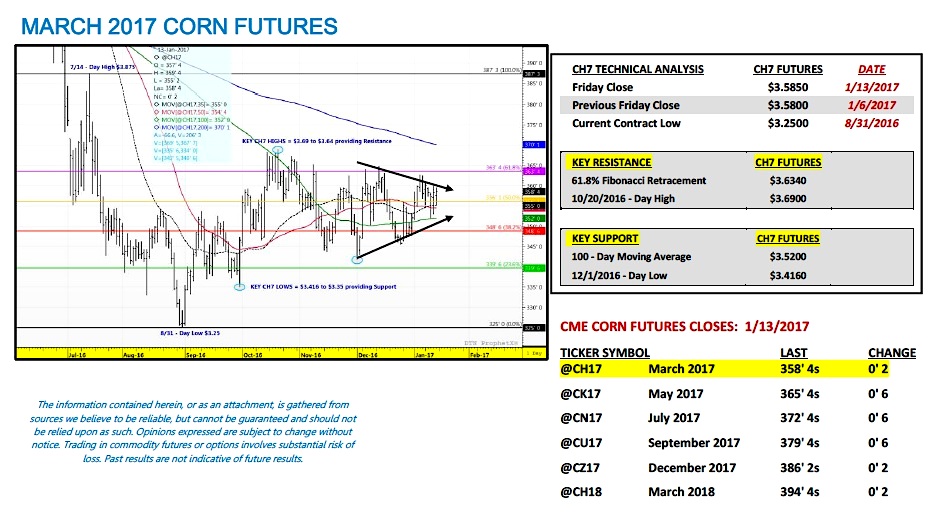

Key March Corn Futures (CH7) Pricing Considerations:

March corn futures (CH7) closed on Friday (1/13) at $3.58 ½ finishing up a ½-cent per bushel week-on-week.

Key takeaways from this week’s price action:

- Technically March 2017 corn futures hung in there pretty well this week all things considered, including what was yet another reminder of just how incredible the 2016 U.S. corn growing season was. The reality remains that until the market focus can shift past record-breaking 2016 U.S. corn production/yield figures along with the aforementioned 29-year high in U.S. corn ending stocks, corn prices will likely remain range bound to the upside ($3.64 to $3.69 in March 2017 corn futures). That said I still believe that as the attention does turn to 2017, corn prices will find support from current private estimates predicting a 4 to 5 million reduction in 2017/18 U.S. planted corn acreage. That type of downward acreage correction combined with a slightly below-trend 2017/18 U.S. corn yield would theoretically tighten up the U.S. corn balance sheet in a very short period of time.

- This week’s Commitment of Traders report showed Money Managers trimming their net short corn position exposures by 19,805 contracts week-on-week. As of the market close on 1/10 the Managed Money corn short had been reduced to -76,564 contracts versus -113,648 contracts just two weeks prior. The question is will this pattern of neutralizing their short corn positions continue? If last year’s trend is any indication, Money Managers retained their net short corn position exposures into the last week of April. In fact during Q1 2016 they continued to add to those positions with the net Managed Money corn short peaking at -229,176 contracts on March 8th, 2016. Therefore this would seem to indicate that under a Bearish S&D backdrop Money Managers have a tendency to be patient before moving to a more Bullish position and price outlook.

All of this suggests sideways, range bound futures price action is likely to continue for the time being…

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service