September corn futures closed up nearly 11 cents per bushel week-on-week, finishing at $4.10 on Friday August 9. NYSEARCA: CORN

Important Corn News and Market Drivers for this week:

Monday’s Weekly Crop Progress report showed the U.S. corn good-to-excellent rating falling 1% week-on-week to 57%; this for the week ending August 4th, 2019.

Illinois saw its state rating drop 3% to 41% good-to-excellent. Meanwhile Nebraska’s corn rating fell 4% to 71% good-to-excellent.

Of all the ratings adjustments this week I felt the dip in Nebraska’s corn rating was the most concerning and a trend the market won’t want to see replicated over the next two to three weeks. Why? Right now the market’s counting on Nebraska pulling the national corn yield up this year given the already well-documented yield concerns in the Eastern Corn Belt.

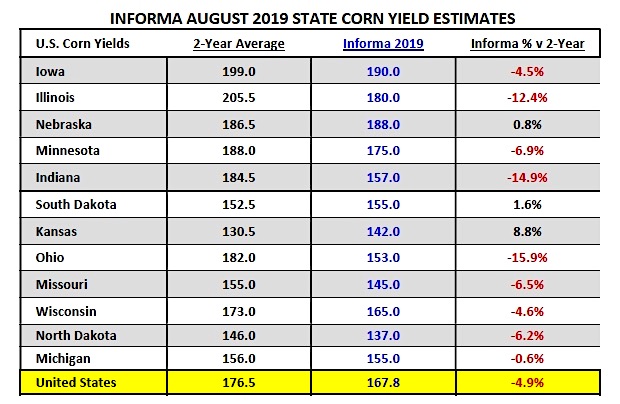

For those Corn Bears leaning toward the U.S. corn yield surprising to the upside in 2019 (closer to 168 to 170 bpa), ultimately you’re banking on Iowa (currently rated 66% good-to-excellent), Nebraska (rated 71% good-to-excellent), and Minnesota (rated 57% good-to-excellent) all producing state corn yields close to their 2-year averages. Iowa’s 2-year state corn yield average is 199 bpa, Nebraska 186.5 bpa, and Minnesota 188. Of those 3 states, at this time I can only see Nebraska producing a final corn yield close to its 2-year average.

Given the delayed planting scenarios in Iowa and Minnesota, as well as considerable drown-out in large sections of both states, I don’t see how yields come close to matching their 2-year averages. This week Informa estimated Iowa’s 2019 corn yield at 190 bpa, Nebraska 188 bpa, and Minnesota at 175 bpa.

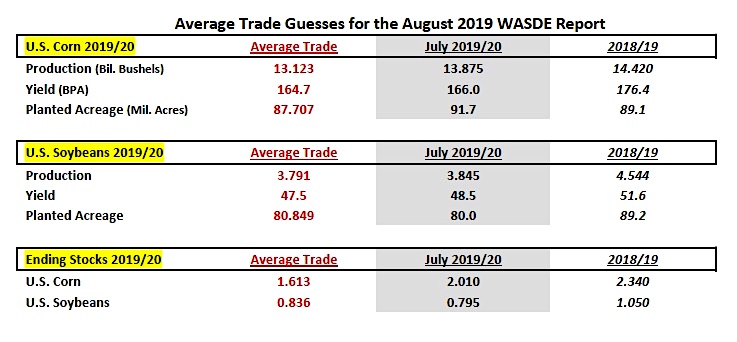

The “Average Trade Guesses” for the August 2019 WASDE report were released this week (see below).

The report comes out on Monday, August 12th. The average trade guess for 2019/20 U.S. corn production was 13.123 billion bushels, down 752 million bushels from July. The average trade guess for 2019/20 U.S. corn ending stocks was 1.613 billion bushels, down 397 million bushels from July. The market focus next Monday will likely be almost entirely on U.S. corn planted acreage. Ever since the release of the June Acreage report on 6/28, analysts have been taking NASS to task for its revised U.S. corn planted acreage estimate of 91.7 million acres, down just 1.1 million acres versus the March Intentions figure.

The market was expecting to see a planted acreage estimate closer to 86 to 87 million acres given the unprecedented planted delays across nearly the entire U.S. Corn Belt, which lasted well into the month of June.

Since then the USDA has gone out of their way to assure traders they would re-survey producers on actualacres planted versus intendedacres planted, with the June Intentions estimate largely reflecting “intended” acres. That said the average trade guess this week for 2019/20 U.S. corn planted acreage was 87.7 million acres, down 4 million acres versus NASS’s June acreage figure.

My take on Monday’s August WASDE report?

This is a huge report for Corn Bulls. The rallying cry to date has been NASS blew its acreage forecast in June, and furthermore, U.S. corn yield potential in 2019/20 is no greater than 162 to 160 bpa. This type of rhetoric has produced private U.S. corn production estimates closer to 12.0 to 12.2 billion bushels. Noted Crop Scout Michael Cordonnier has continued to issue a production figure of 12.08 billion bushels via planted/harvested acres of 85.3 million/75.5 million acres and a yield of 160 bpa. At some point Bulls need these types of figures to print in an actual monthly WASDE report.

My concern for Bulls is rather simple…this could be a year where the actual planted/harvested acreage losses and yield drag from delayed planting aren’t reflected primarily in one single WASDE report but rather over a succession of reports. The problem with this is substantive rallies need some “shock” factor to ignite large Managed Money buying. When the supply decreases are massaged over several months there’s a better chance the USDA finds additional demand destruction to mitigate a sufficient percentage of the supply cut. Therefore Bulls never get a “smoking gun” reaction from sharply lower U.S. corn ending stocks. That’s my Bullish concern…

THIS WEEK’S US CORN TRADING OUTLOOK

Corn futures managed to rebound slightly this week after essentially trending lower from July 15ththrough August 1st.

However Friday’s price action proved less than convincing for Corn Bulls with the market failing to sustain early strength, eventually closing slightly lower on the day. The 20-day moving average in September corn futures at $4.164 proved to be the stopper to the upside.

Now what? The time for waiting is over with the build-up to the August 2019 WASDE report fully complete. That report will be released on Monday, 8/12 at 11:00 a.m. CST.

At current price levels (approximately $4.10 CU and $4.18 CZ) I would argue Corn Bulls have close to 15 to 20-cents worth of risk to the downside while Corn Bears could be subjected to a limit’s move worth of risk to the upside (25-cents). Ultimately I wouldn’t discount rallies back to or above the current contract high in September corn futures of $4.68 ¾ if the acreage figure comes in under 86 million acres and the USDA lowers the yield 2 to 3 bpa. At 86 million planted acres and a U.S. corn yield of 163 bpa, even with increases to carryin stocks and reductions to usage (corn-ethanol demand and exports) on paper this suggests 2019/20 U.S. corn ending stocks just north of 1.0 billion bushels.

Furthermore traders would likely be forced to consider the possibility of the U.S. corn yield moving even lower in the Sep/Oct WASDE reports, which in turn should create the wave of buying necessary to reignite a major move back to the upside. Add in the continuation of dryness in the ECB and the pieces are place for Corn Bulls.

Friday’s Commitment of Traders report showed Money Managers continuing to shed their long positions in corn.

The Managed Money net long fell to +79,507 contracts as of the market closes on 8/6/2019. This compares to the Managed Money summer high net long of +187,929 contracts back in June. It’s not unprecedented for Money Managers to switch back to net buyers during the month of September. Therefore I wouldn’t rule out Managed Money buying interest even though we’re technically past most of the traditional summer weather threats.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.