That said every penny matters at the moment with a number of U.S. farmers still staring at below breakeven corn values for 2016/17.

The next 3 weeks are extremely important for Corn Bulls for the following reasons:

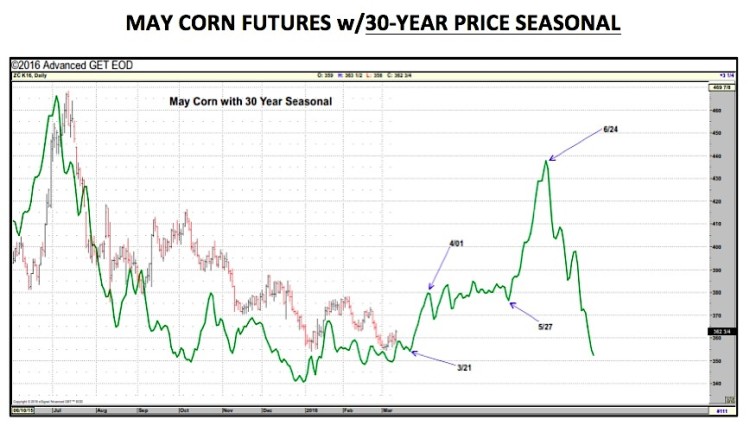

- Arguably the most predictable rally all calendar year (even in years with Bearish fundamentals) is the higher price move into the March 31st Prospective Plantings report; however the direction corn futures take immediately after those acreage estimates are published is often volatile and trend-setting for as long as the next 2 ½ months.

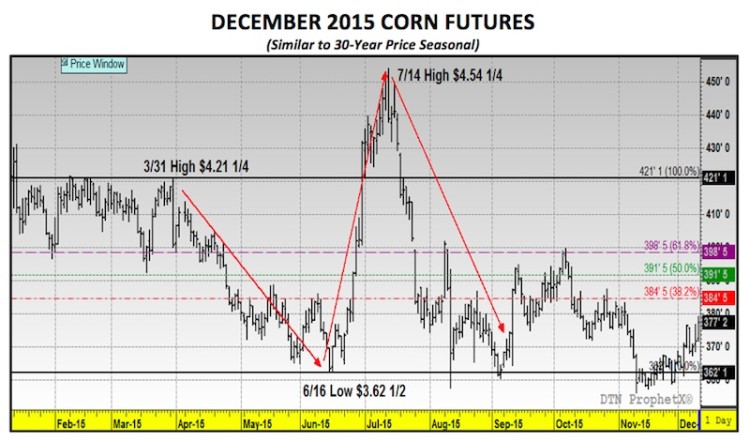

- I’ve mentioned in prior columns that 2016 is shaping up to look a lot like 2015 going into this prospective plantings report given the U.S. corn market S&D similarities between crop years (high carryin stocks, static demand curve, and more than adequate acreage expected). Last year on March 31st, December corn futures scored a day and month high of $4.21 ¼, which occurred BEFORE the report came out, only to eventually close down 17 ½-cents by session’s end. (see chart on page 3)

- That said the penalty for Corn Bulls and/or Corn Producers of not selling corn on 3/31 was a corn market that trended lower (largely unimpeded) into 6/16 with December corn futures establishing a day low of $3.62 ½ on that date. Therefore the high-to-low move from March 31st through June 16th totaled 58 ¾-cents per bushel.

What’s going to be the biggest challenge this year?

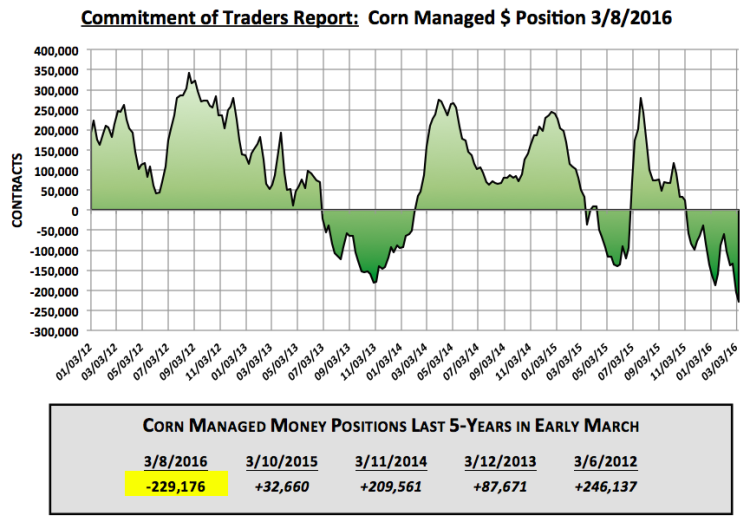

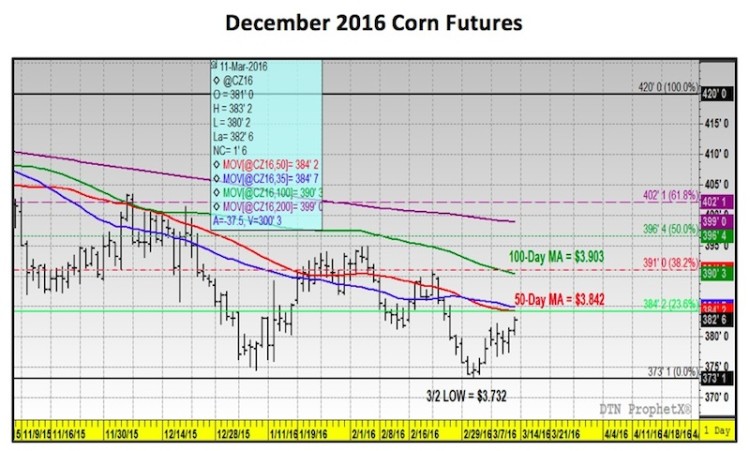

It might be having to settle for selling a 3/31 high and December corn futures price below $4.00 because of the risk of a post-report sell-off similar to 2015. Clearly the desire for both producer and spec alike is to sell something with a “4” in front of it, which means $4.00 is already shaping up to be a very big resistance area. Consequently for corn futures to rally up to and though that key resistance level Money Managers will likely have to play an essential role. Friday’s Commitment of Traders report showed the Managed Money position increasing once again to yet another new record net short of -229,176 contracts as of the market close on 3/8. In my opinion their current position combined with corn futures holding last week’s new contract lows favors Corn Bulls going into the prospective plantings report. I believe the likelihood of Money Managers covering a healthy percentage of this record short position going into 3/31 is high. However trying to estimate exactly what kind of rally this could produce remains very hard to quantify.

The “farmer” remains a substantial physical, cash corn long of both old and new-crop bushels. Therefore the producer’s need to take advantage of even 5 and 10-cent rallies to price corn should provide the natural offset to Money Managers looking to neutralize their short positions. This in turn will likely inherently limit corn’s ability to sustain rallies even with active Managed Money buying.

May Corn Futures 30 Year Seasonality Chart

December Corn Futures 2015 vs 2016 CHARTS

Thanks for reading.

Further reading from Marcus: “December Corn Futures In The Spotlight“

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service