Going into the June WASDE report there was some question as to whether or not the USDA would adjust both the U.S. corn yield and/or planted acreage.

Since 2009 there had only been two occasions where the USDA had lowered the U.S. corn yield in the June report and just one occurrence of a planted acreage reduction.

USDA Takes a Sledgehammer To U.S. Corn Supply & Demand

Traditionally, the USDA had waited to adjust its trend-line yield estimate until the July WASDE report with any planted acreage revisions often being reserved for the June 28th Acreage summary.

That said, following what has been the slowest U.S. corn planting pace on record, and with just 83% of the U.S. corn crop now planted as of June 9th versus the 5-year average of 99%, the USDA showed no such patience in waiting another 3 to 5 weeks to start slashing both its May yield estimate, as well, as it March Prospective Plantings forecast.

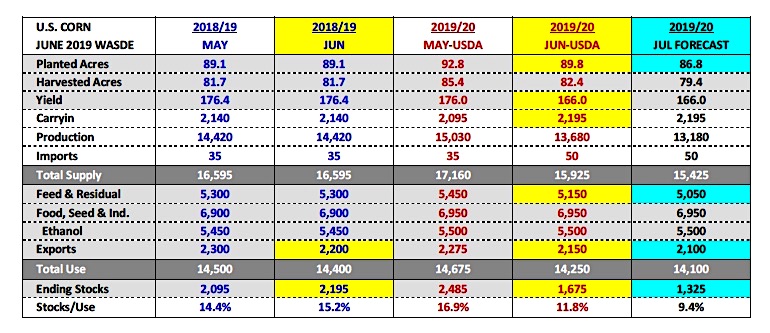

In Tuesday’s report the USDA cut the 2019/20 U.S. corn yield 10 bpa to 166 bpa while also trimming planted corn acreage 3 million acres to 89.8 million (down 3.8%). Total U.S. corn production dropped an incredible 1.35 billion bushels month-on-month to 13.68 billion bushels versus the average trade guess of 14.251 billion.

HOWEVER, the USDA wasn’t done. On the demand side the USDA lobbed off 300 million bushels of feed and residual use and 125 million bushels of exports.

Those demand decreases coupled with a 100 million bushel increase to carryin stocks prevented U.S. corn ending stocks from drifting down under 1.2 billion bushels. Instead the supply-side damage was “limited” to a revised 2019/20 U.S. corn ending stocks estimate of 1.675 billion bushels, which compares favorably to carryout figures from crop years 2014/15 (1.731 billion bushels) and 2015/16 (1.737 billion bushels).

What now? It seems Corn Bulls have regained control of the market narrative with July corn futures trading up to a new contract high of $4.57 ¼ during Friday’s session.

The prevailing “thought” from a host of notable market analysts is that the U.S. corn yield will remain extremely vulnerable this summer given the late planting dates and corresponding delayed pollination windows for several big corn producing states (Illinois and Indiana).

Right now I’m of the opinion that the June 28th Planted Acreage report will show U.S. corn plantings down at least another 3 million corn acres versus the USDA’s most recent acreage estimate of 89.8 million.

I’m assuming that of the USDA’s March Prospective Plantings estimate of 92.8 million acres, approximately 93 to 94% planted is now best case scenario. Therefore even if the U.S. corn yield stays static in the July WASDE report, total U.S. corn production could still fall as much as 500 million bushels from the June forecast via fewer planted acres (86.8 million planted, 79.4 million harvested, 166 bpa yield = total production of 13.18 billion bushels versus 13.68 billion in June). I do think the USDA will continue to trim “residual” use and exports to help mitigate the production decline; however that still suggests U.S. corn ending stocks drifting below 1.35 billion bushels.

And this is where it gets interesting…if the U.S. corn yield is further compromised, if it gets hot and dry in late July/early August, which in turn leads to a U.S. corn yield at or slightly below 160 bpa, U.S. corn ending stocks under 1.0 billion bushels is a possibility. This seems to be the thread certain analysts are running with. I’m willing to acknowledge their argument isn’t entirely irrational.

However, I think it’s also worth mentioning that just 31 days ago July corn futures were in the process of carving out a new contract low of $3.43. At that time many of these same analysts were contemplating just how low corn futures might go based on a May 2019/20 U.S. corn S&D suggesting U.S. corn ending stocks approaching a 31-year high. Point being a lot can change in 30-days, with both prices and “expert” opinions shifting aggressively in the age of the 24-hour news cycle.

Last thing I’ll leave you with, spot corn futures are now trading at their highest level since June 2014. I have no problem with being Bullish but keep in mind where futures prices are already trading.

The two most frequently asked questions I get at the moment:Can corn futures go higher?

If I knew this one I probably wouldn’t be writing this wire. The reality is corn futures are now in foreign territory relative to the last 5-years. Furthermore the supply-side price drivers requiring early growing season market premiums remain as uncertain today as they did in early April. Traders still don’t know how many corn acres got planted, and as far as this year’s national corn yield is concerned, the pollination/weather risk factors for 2019 likely won’t be resolved until the 2nd week of August at the earliest. Point being everyone I talk to is guessing to a large degree on all of the above (if they’re honest) with most establishing trading strategies on instinct, fear, seller’s remorse, their “backyard” view, and/or their daily margin calls.

I’d recommend not pursuing any of those strategies if the goal is longevity both in trading and life. Can corn go higher? Yes. “Does that mean I should lament selling 50% of my crop over the last 2-weeks?” No. Unless you waited until this week to make your first new-crop corn sale, you would have automatically been nearly 40-cents below last Friday’s close in July corn futures. That said I would focus on the corn you don’t have sold with prices at 5-year highs versus the percentage you do have sold (which are still likely at values you never dreamed possible just 31-days ago).

How high can corn prices trade?

Again, I’m not going to pretend to know exactly. However what I do know is that export sales remain extremely poor (both corn and soybeans). I also believe the USDA can and will continue to lower “Residual” use. And “Industry Average” ethanol margins remain negative and have been since mid-August 2018. I read this week from a notable Ag wire that ethanol margins were +10-cents per gallon. That is not accurate. Therefore if the goal is to rally corn prices to levels that ration usage, corn futures are already trading there. That doesn’t mean the corn rally stops here however. The “money” always exaggerates moves up and down. That said…over time, futures prices tend to gravitate back to their true economical value/equilibrium.

Friday’s COT report showed Money Managers now long in excess of +111k corn contracts. Obviously they can still add to that significantly. Therefore I think corn still has some legs to the upside with both Money Managers/Index Funds both becoming more active participants. Longer-term…the U.S. corn S&D is manageable at current prices barring a sub-160 bpa corn yield.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.