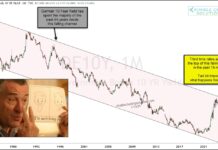

Urban Outfitters (URBN) Stock Weekly Chart

Urban Outfitters stock (NASDAQ: URBN) is trading higher on Wednesday following an upgrade by Morgan Stanley from equal weight to outperform.

However, the stock’s market cycles suggest a move lower by February and beyond.

Morgan Stanley equity analyst Kimberly Greenberger upgraded Urban Outfitters (URBN) to overweight, with a price target of $44. Of the 10 analysts covering URBN, none had recommended buying the stock.

Yet given Morgan Stanley’s recent survey of 2000 consumers on topics related to clothing preferences, Greenberger believes the retailer derives competitive advantage from its fashion credibility relative to companies in the same industry.

We disagree on her recommendation. This is based on our analysis of the market cycles for URBN. We can see that stock is in the declining phase of its current cycle. Our projections suggest a price of around $30 by February.

Beyond that, we believe the stock is in a negative cycle pattern, which suggests a downward zig-zag for months to come. Likewise, its head and shoulders top projects to a price around $20 later this year.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.