The major stock market indices ended the trading week on a weak note with the Russell 2000 (IWM) and the Nasdaq 100 (QQQ) closing down 1.5%.

With that said, gold (GLD) and silver (SLV) while down half a percent, are holding a strong uptrend over their 10-Day moving average.

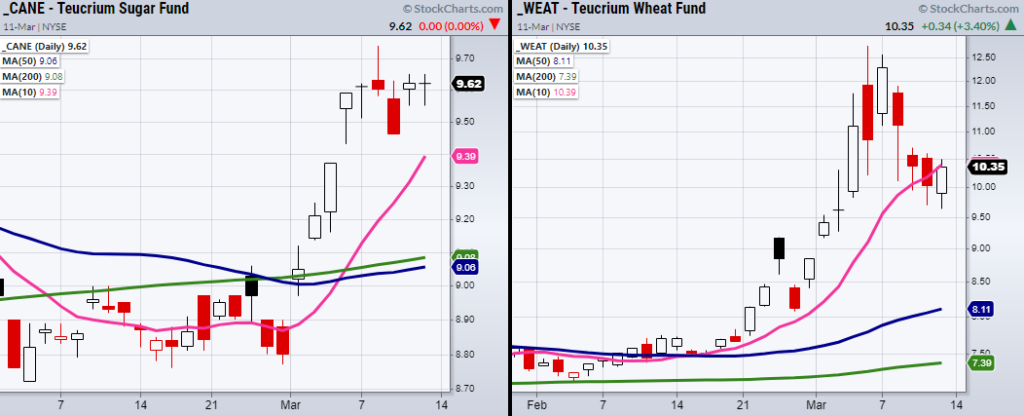

Soft commodities are also sitting in an uptrend compared to the overall stock market.

Therefore, with the indices moving closer to their pivotal support levels, we should keep watch for trade setups in the commodities space.

The above chart of the small-cap index (IWM) and the Nasdaq 100 (QQQ) both have main support from 2/24. (Black Lines)

$318 for the QQQ and $188 for IWM.

While we have seen large price runs in the precious metals, soft commodities such as Sugar (CANE), Wheat (WEAT) made large moves last week and have now put in some consolidative price action.

CANE is especially interesting if it can clear its recent high at $9.74 as it has stayed in a tight range over the past 6 trading days.

On the other hand, WEAT is teetering near its 10-DMA at $10.39 and could use more time before it’s ready to push higher.

If WEAT can hold over $10, next we can watch for it to clear through last Wednesday’s high of $10.70.

Mish talks about promising biotechnology setups on Stockcharts!

Stock Market ETFs Trading Analysis and Summary:

S&P 500 (SPY) 410-415 is price support.

Russell 2000 (IWM) 193 is price support.

Dow Jones Industrials (DIA) 322-326 is price support.

Nasdaq (QQQ) 318 is price support.

KRE (Regional Banks) Needs to hold over 69 the 200-day moving average.

SMH (Semiconductors) 239 is next price support.

IYT (Transportation) 243-245 is price support area, while 264 is resistance.

IBB (Biotechnology) 118 is price support.

XRT (Retail) 78 is price resistance, while 72 needs to hold.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.