The retail sector soared after the CPI (Consumer Price Index) report last week, as represented by the SPDR S&P Retail Sector (XRT), the lead shopper of Mish’s Modern Family.

The latest Consumer Price Index (CPI) reading came in at 7.7% versus 7.9% showing 0.20% less than expected, and markets celebrated.

After rebounding off support levels at the 50-day moving average, Granny XRT gapped higher. XRT has continued to rise and may see further resistance at the 200-day moving average.

Several retailers, beginning with Walmart, report earnings this week, and retail sales figures will be revealed on Wednesday. This data will be pivotal for Granny Retail’s price trajectory.

Granny Retail XRT currently displays market leadership with our Triple Play indicator, and our Real Motion indicator demonstrates strong momentum trend strength.

The current XRT rally can always retrace, so paying attention to our proprietary indicators will signal if Granny might reverse course.

What is expected to happen this week to retail and beyond in 2023?

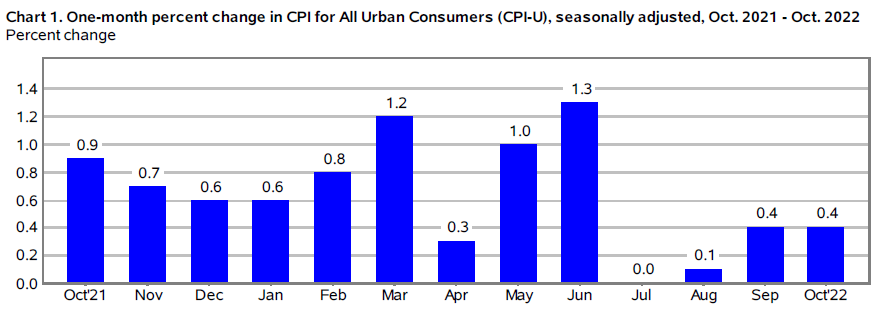

CPI inflation was softer than expectations at 7.7% versus 7.9% but rose 0.4% for October.

Unfortunately, there isn’t a simple answer.

If you think inflation is fully addressed or peaking because CPI came in 0.20% less, you could be in for an inflation shock.

The October print rose the same as in September shown above. The positive market reaction doesn’t mean we are in a new bull market.

Walmart will report before the opening on Tuesday.

Key points to watch for include guidance on inventory levels and transportation costs headwinds, as well as updates on pricing and Walmart+ subscriber growth.

Households are feeling the pinch from inflation, and this trend will likely continue into 2023.

The retail sector is in for a challenging quarter and year ahead, as global inflation, loss of purchasing power, and weak consumer sentiment continue to weigh on retail.

We will keep a close eye on Granny Retail as an early indication of the holiday season and the economy’s overall health.

Mish in the Media:

CMC Markets 11-09-22What’s next for key sectors after US midterms?

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) 393 support and 398 resistance

Russell 2000 (IWM) 182 support and 187 resistance

Dow (DIA) 333 support and 339 resistance

Nasdaq (QQQ) 283 support and 289 resistance

KRE (Regional Banks) 62 support and 67 resistance

SMH (Semiconductors) 215 support and 224 resistance

IYT (Transportation) 225 support and 233 resistance

IBB (Biotechnology) 132 support and 136 resistance

XRT (Retail) 62 support and 67 resistance

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.