It has been anything but a wild ride since the election of Donald Trump nearly 1 year ago.

If we take a step back and review the sentiment in the equity markets this time a year ago, the reader would see pessimism and some volatility (both personal and market related).

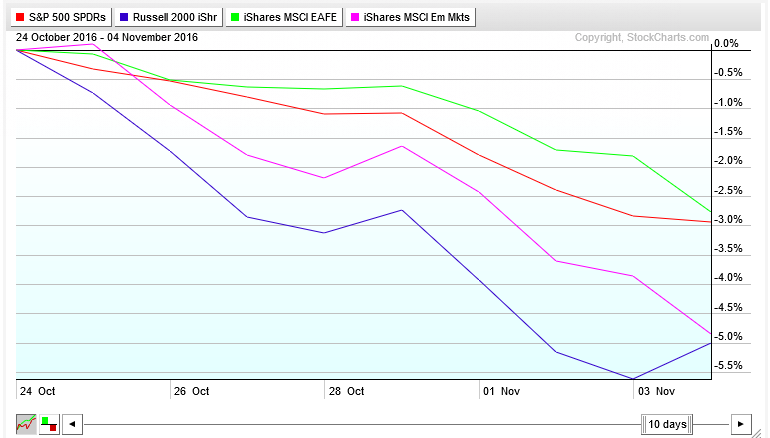

Large-cap US stocks via the S&P 500 ETF (NYSEARCA:SPY), small-cap US stocks via the Russell 2000 ETF (NYSEARCA:IWM), international developed markets (NYSEARCA:EFA) and emerging markets (NYSEARCA:EEM) were all down between -2.5% and -5% in the 10 days preceding the election. The presumption among many market analysts, political pundits and those in between was that the election of Hillary Clinton would be perhaps not overwhelmingly bullish for stocks, but surely less uncertain than if Donald Trump were elected.

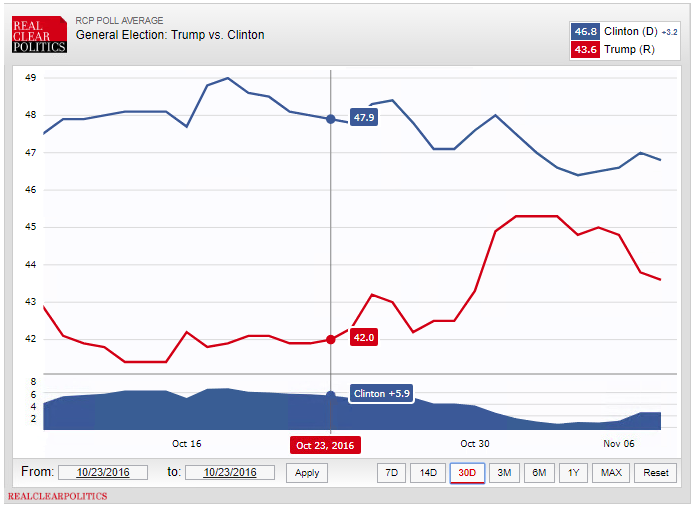

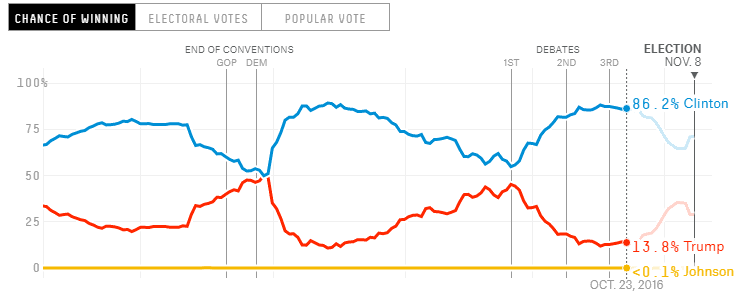

Hillary Clinton was leading seemingly rather comfortably in the now infamous polling data. The Real Clear Politics average of national polls had Clinton up by 6 points over Trump.

538’s election odds also favored Clinton, not surprisingly, with an 86% probability of Clinton winning the Presidency at this time a year ago. Remember that raw polls and probabilities are two different things, statistically. While the polls tightened somewhat as election day neared, the odds still favored a Clinton victory.

The stock market rallied immediately prior to the Tuesday night election, with US stocks gaining about 2.5% Monday and Tuesday. Pundits will always create a narrative, and they credited the market rally to increased certainty that Clinton would be victorious. Then came election night.

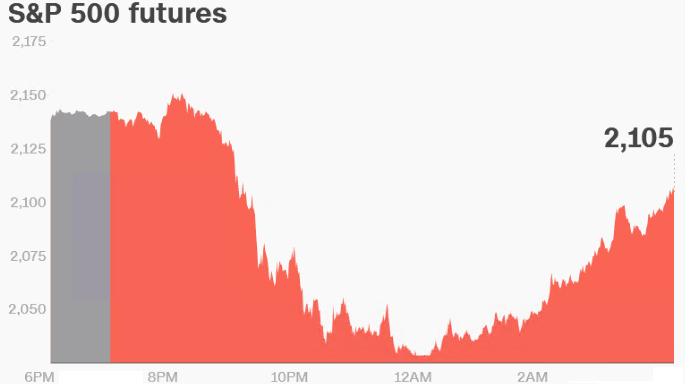

Equity futures were rather tame through 8pm ET as exit polling data, which is released prior to actual voting returns, suggested a strong night for the Democrat. Florida polls began closing, and the Sunshine State’s early voting totals came in quickly around 8pm – the results were not nearly as favorable for Clinton as the experts expected, and it became apparent that Trump could win the important swing state’s 29 electoral votes. Trump would of course go on to win Ohio, North Carolina, Florida, Wisconsin, Pennsylvania, Michigan and the Presidency.

Stock market futures reacted violently, with the S&P 500 and Dow Industrials futures briefly touching “limit down” territory around 12am, or declines of 5% from the 4:15pm ET futures close from the prior afternoon as it became nearly certain that Trump would garner enough electoral votes to become the 45th President of the United States. Futures quickly digested the shock, and then rallied even before Trump took the podium to claim victory. (photo courtesy of CNN Money)

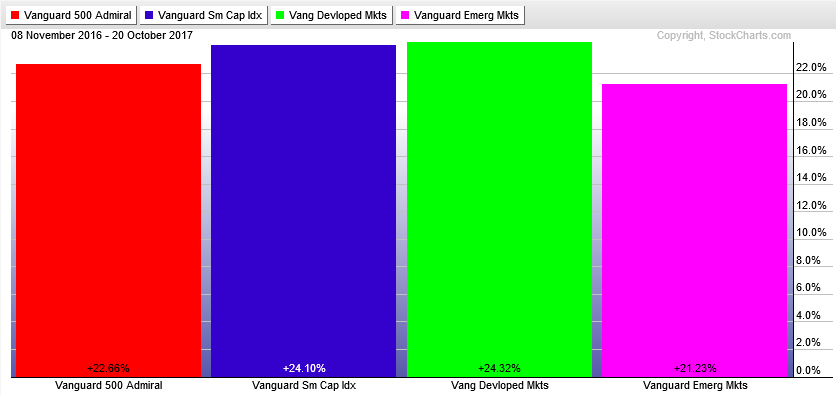

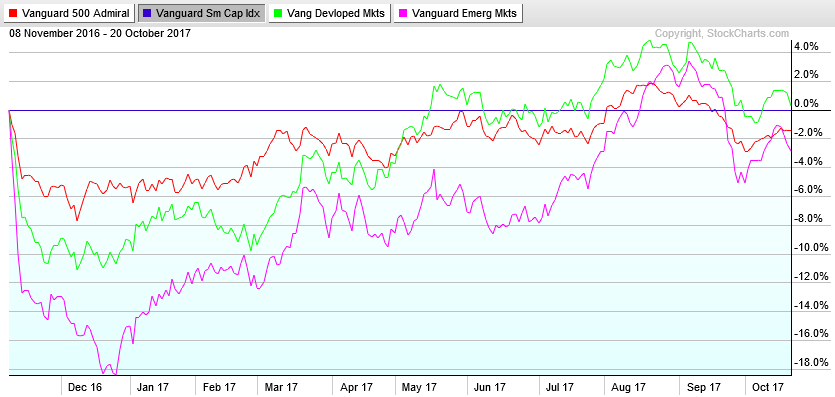

Fast forward to today, and returns among the aforementioned major equity market sub-asset classes are nearly uniform with gains of 21% to 24% using Vanguard index funds as proxies, priced daily at their respective net asset value.

While large cap US stocks, small cap US stocks, international developed market stocks and emerging market stocks have similar holding period returns since the election, their paths have been quite different in the last 50 weeks. US small cap stocks rocketed higher after election night through year-end 2016, but then underperformed international and emerging markets from January through mid-August. Small caps regained their vigor with a monster run-up in August through early October 2017 on remarkably low volatility. Putting the same 4 equity sub-asset classes in US small cap-terms, you can see the immediate underperformance among non-US stocks after Trump’s election win, then the non-US comeback for much of 2017 before US small caps returned to favor just recently.

The takeaway is that if you focus on news, pundits and experts, then try to create an investment narrative around those headlines, you may have a difficult time being a successful investor. A famous Jesse Livermore quote from many decades ago perhaps says it best, “The stock market is never obvious. It is designed to fool most of the people, most of the time.”

Twitter: @MikeZaccardi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.