The daily charts of several stock market indices have all reversed at their ellipse turning point indicator, which increased the risk of a reversal from current levels.

I am bearish on the Russell 2000, which has been a big laggard off the low.

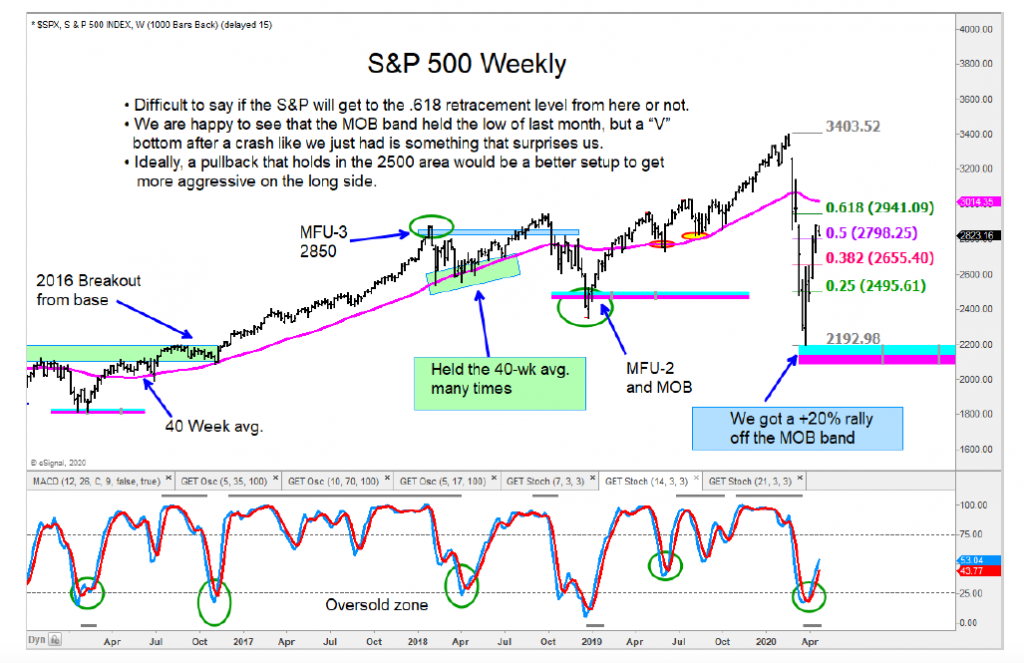

Should the S&P 500 reverse back lower here, we would like to see a higher low above 2500 before being bullish again.

Frankly, the sharp rally (V) off the lows has been surprising considering the crash (and likely unsustainable).

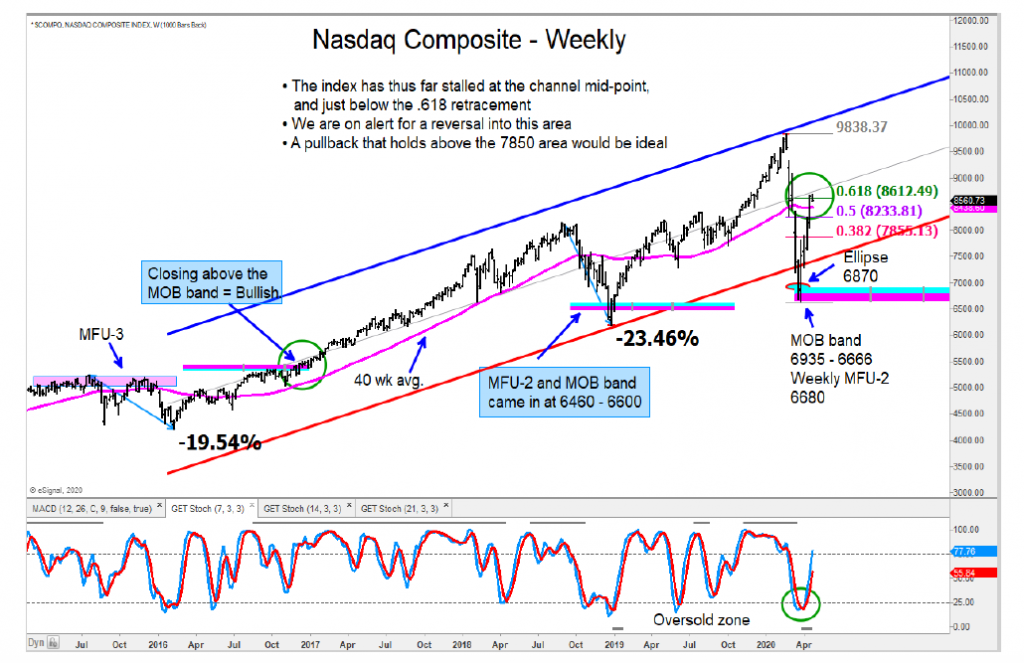

Below are charts of the S&P 500 Index and the Nasdaq Composite.

Tech has been a leader so keep an eye on that one as well.

The author may have position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.