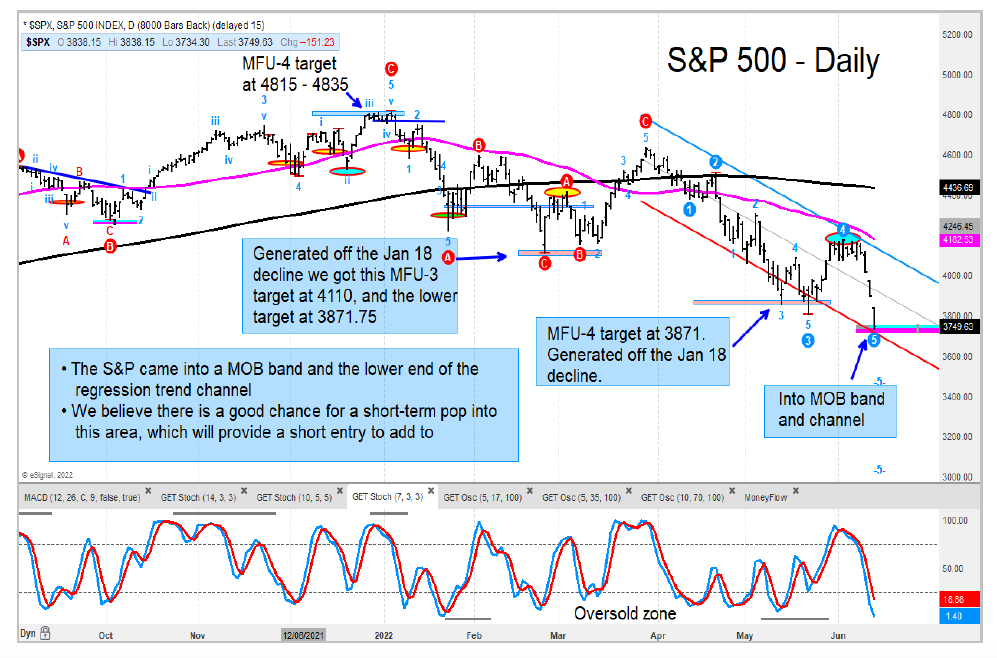

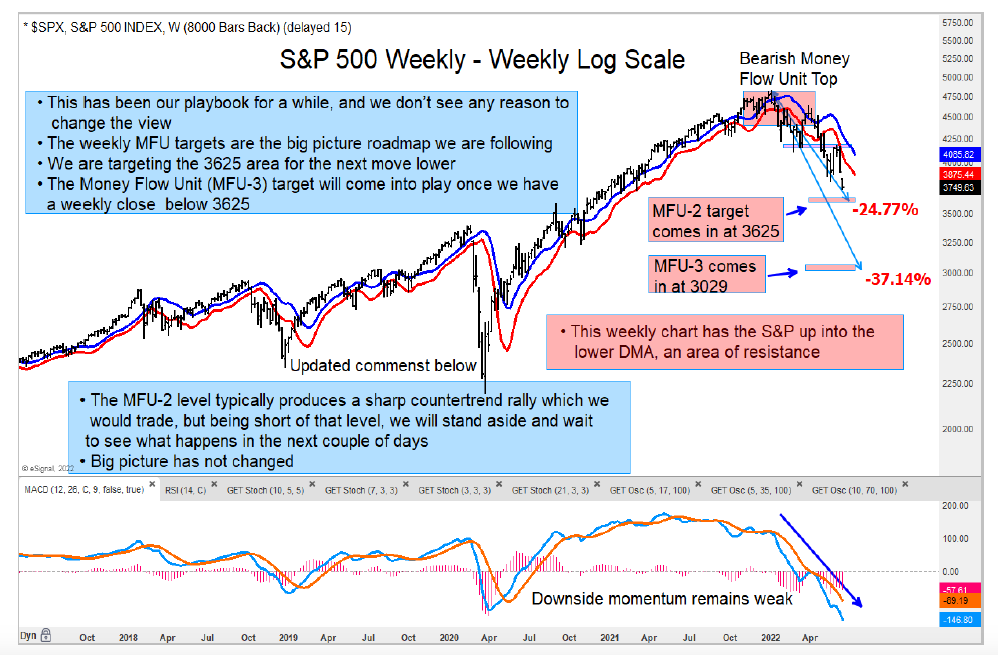

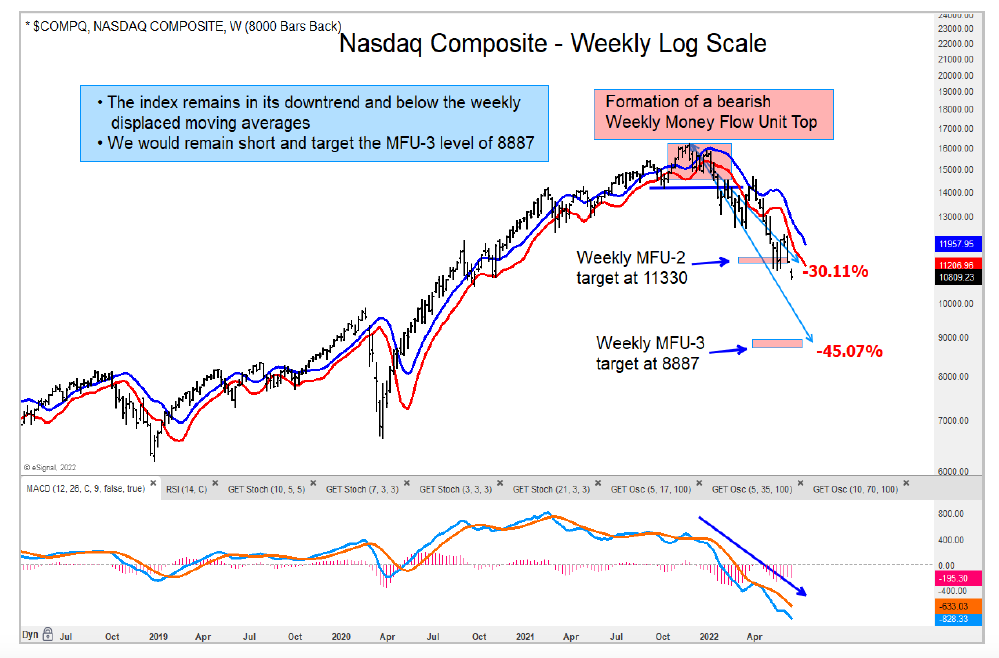

The S&P 500 Index, Nasdaq 100 Index, and Nasdaq Composite have declined into daily MOB price target bands, which is a zone where we may see a pause and possibly a short-term rally/bounce.

In our opinion, this is nothing to get excited about, as the most important thing to keep in mind is the downside targets based on the weekly timeframe (which are lower).

The ACWI index gapped down to start the week’s trading. This is not a good sign and further strengthens our downside targets.

As well, charts of the German DAX and French CAC are also in gear for more weakness from their multi-month tops.

Twitter: @GuyCerundolo

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.