The stock market is sliding once again on Monday as the correction intensifies.

This comes on the heels of last week’s poor performance, where the S&P 500 Index (NYSEARCA: SPY) and the Dow Jones Industrials (NYSEARCA: DIA) dropped more than 1.00%.

The damage was more pronounced in other areas last week as the Dow Transports fell 4.39% and the Russell 2000 Index (NYSEARCA: IWM), that tracks small-cap stocks, dropping 2.57%. This is a big reason the markets are red again today…

The full-year return for the S&P 500 Index, including dividends, is down slightly, which is in line with our forecast issued in the 2018 Baird Economic & Stock Market Outlook.

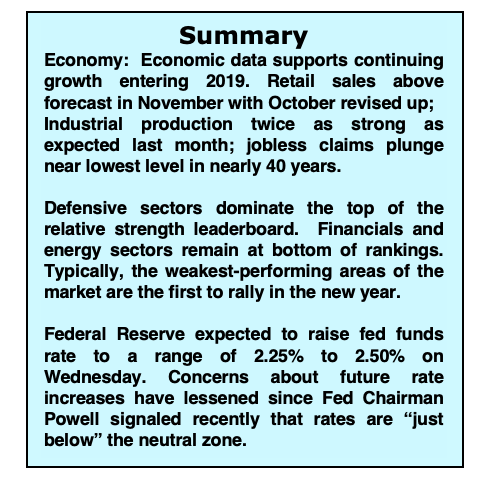

The Federal Reserve announced at its November meeting that a rate hike at the December meeting is likely based on its assessment of near full employment and steady economic growth. At the November meeting, a few participants indicated that uncertainty had increased pointing to trade tensions that could slow economic growth, inflation concerns, and global developments.

Offsetting the downside risks were comments that greater-than-expected effects of a strong economy driven by corporate tax cuts and deregulation with high consumer confidence could lead to stronger-than-expected economic outcomes.

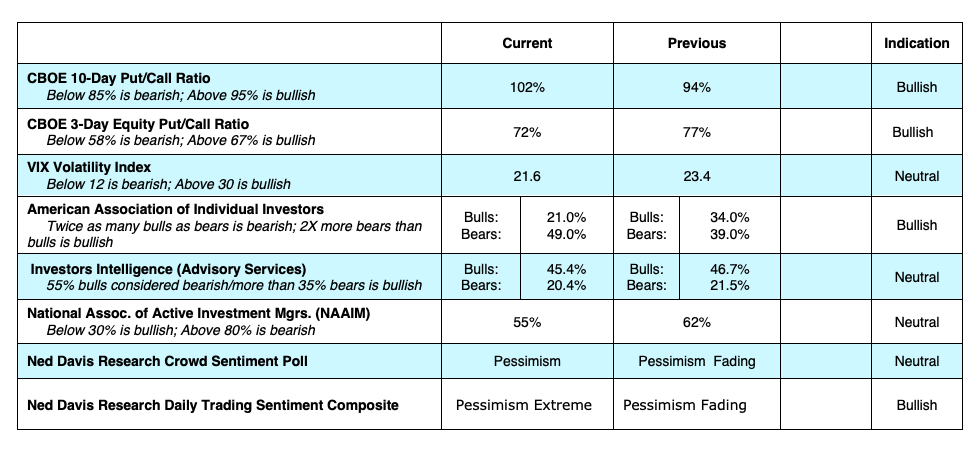

As we look forward to 2019, investors are weighing the themes of slower global growth, tighter monetary policy and trade and tariff disputes. Last week, the survey by the American Association of Individual Investors (AAII) showed a plunge in the bullish camp to just 21% with the outright bears soaring to 49%.

At the same time investors, according to the Lipper Data Service, pulled a record $46 billion from mutual and ETF funds with most of it going into money market accounts. The money piling into money market funds, in addition to the $2.5 trillion sitting on corporate balance sheets that can be summoned for stock buybacks, represents the potential fuel for the return to the secular bull market according to Ned Davis Research.

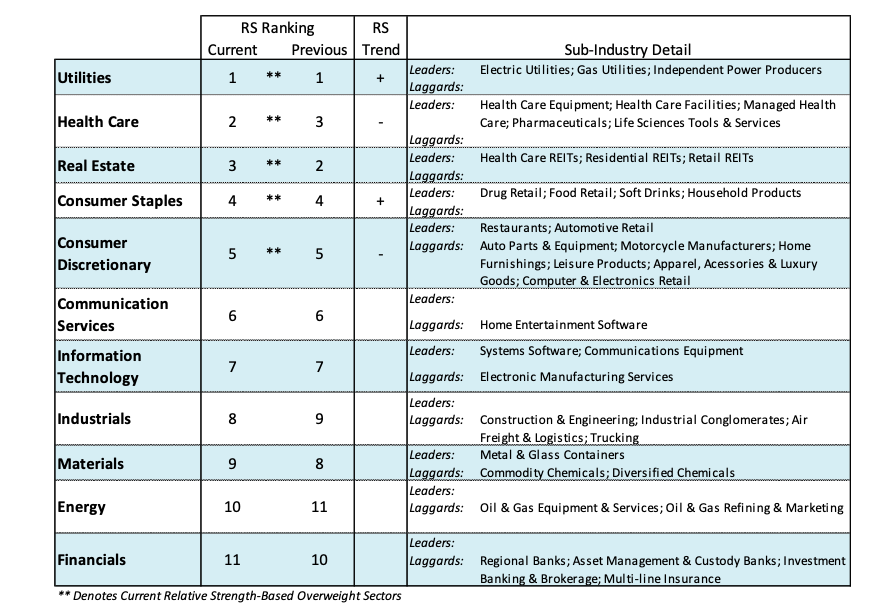

Stocks typically rise in December, but this year could be an aberration. What to do now: Focus on defensive sectors including utilities, consumer staples and heath care (refer to the Baird Weekly Sector Analysis for the strongest groups and sectors). Historically, important market lows are formed when volatility peaks.

The CBOE Volatility Index (VIX) is currently near 21 and we would expect it to reach 35 or higher to signal an important buying opportunity. At that juncture, the relative strength of defensive sectors should begin to fade and be replaced by sectors closely aligned with the economy including materials, energy, technology and industrials.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.