The equity markets suffered modest losses last week due to a surge in volatility in the world currency markets.

Stocks are struggling with the prospect that the turmoil in the Turkish and Russian currencies could spread to other areas such as occurred in the late 1990s.

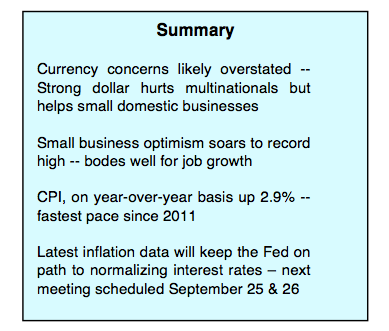

This has boosted the U.S. dollar to a one-year high, while raising concerns that S&P 500 (NYSEARCA: SPY) earnings could be negatively impacted as the profits of multinational companies are diluted when translated back to dollars.

A strong dollar can be a positive force for the stock market as it attracts foreign investment and reduces import costs and has deflationary implications, which helps the Fed maintain a policy of a measured approach to raising interest rates.

The bottom line is that the volatility (INDEXCBOE: VIX) seen in overseas currency markets does not change the immediate picture for the stock market.

The market continues to be driven by improving economic conditions.This is underscored by a report last week showing confidence among small businesses at an all-time record high, which bodes well for continued strength in the labor markets. The largest negative on the horizon is the reluctance of either the U.S. or China to back down from tariff threats, which could eventually lead to a slowing of global economic growth.

Over the near term, we view the risk in the stock market to be 2775 using the S&P 500 Index with the likelihood that stocks remain in a trading range in the third quarter.

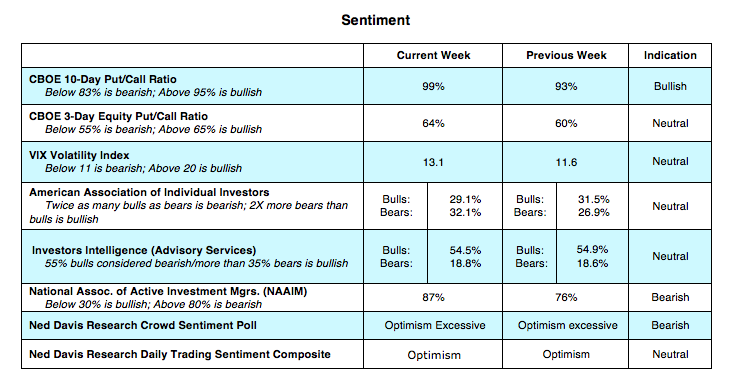

The technical indicators of the stock market remain mixed. Measures of investor psychology are neutral on balance. Put/call ratios are near-term bullish but the various surveys offer mixed messages with the latest data from the American Association of Individual Investors showing the bulls and bears nearly equal weighted.

There was a sharp increase in the professional money managers allocation to stocks to 87% from 76% the previous week according to the National Association of Active Money Managers (NAAIM).

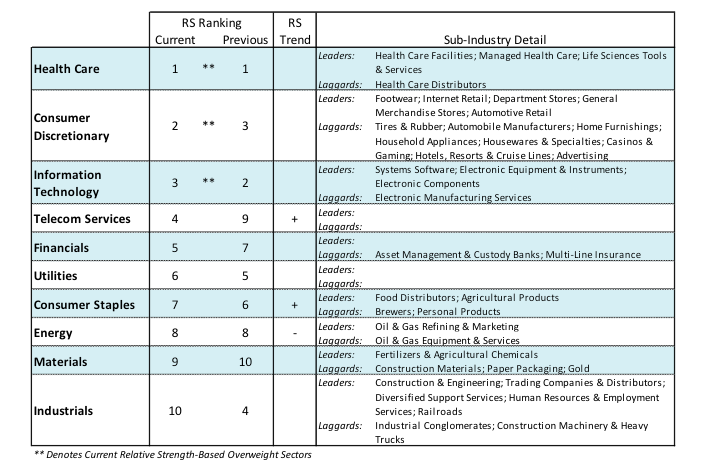

Stock market breadth remains problematic. Seven of the S&P 500 sectors were down at mid-year but only the Utilities has climbed back up 1.00% for the year according to Ned Davis Research. The four sectors that account for all of the gain in the S&P 500 are technology, consumer discretionary, health care and energy. Also, since May, defensive sectors have outperformed cyclicals and we continue to recommend diversification into health care, utilities and consumer staples entering the seasonally weak period of August through early October.

Despite the rapid rise in corporate earnings in 2018, valuations remain historically high. The median price/earnings ratio for the S&P 500 is 23.8X. This is quite a bit above the 54-year norm of 17.1X. The S&P 500 median price/sales ratio is at an all-time record high suggesting that much of the growth in revenues going forward is already built into current prices.

We should emphasize, however, that valuations metrics are not a good tool for predicting the future direction of the stock market but they do offer valuable insight when measuring risk, which could be important given the Fed is raising interest rates and the history of stocks struggling in front of mid-term elections.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.