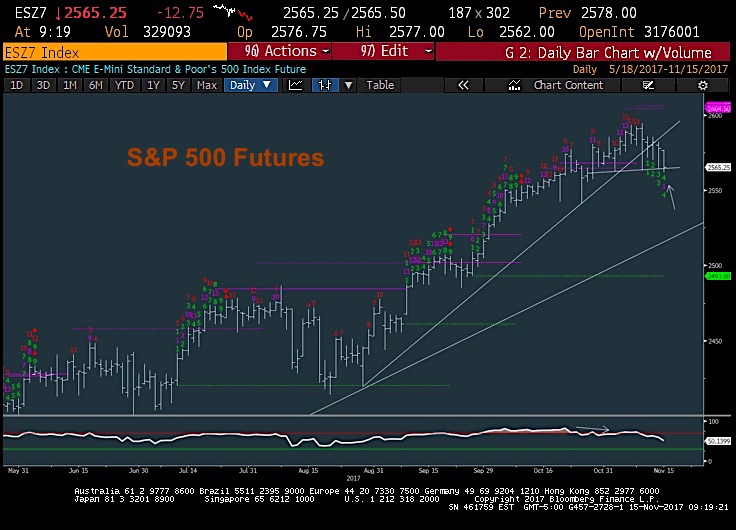

S&P 500 Trading Outlook (2-3 Days): BEARISH

The S&P 500 Index (INDEXSP:.INX) remains locked in range-bound consolidation, and has now overcome multiple pullback attempts. But each ensuing rally / recovery has come in spite of deteriorating breadth and momentum.

The price area to watch is 2562. This level has held three times since early November, and will be important when broken. Bears have fumbled the ball several times during the latest leg higher in equities, but it does seem that a pullback is finally nearing.

As well, the Financials Sector (NYSEARCA:XLF) and stocks like Apple (NASDAQ:AAPL) have begun to rollover, making it difficult to expect a big breadth surge to the upside.

On balance, I believe it’s right to be bearish equities here near-term, looking for an eventual downside break.

TECHNICAL THOUGHTS

Tuesday was an unsatisfying day for Bulls and Bears alike, and today may be more of the same. S&P 500 Futures once again came down to test important support and has bounced once more. This action hasn’t helped market breadth, as advancing-declining issues, amongst other indicators, continues to show weakness.

Three developments worth mentioning:

First, Crude Oil looks to have made an important reversal (Tuesday) – this “about-face” came near its prior peak in January.

Second, fan favorites like Apple (AAPL) look to be peaking out, having confirmed counter-trend sell signals, and have dropped to multi-day lows.

Third, much of this Tuesday’s late-day rally has yet to do much good with breadth or momentum, which continues to worsen.

Overall, stocks look to have turned lower, and stock indices are moving sideways. This range-like movement, though, does not necessarily reflect the underlying damage being done to the U.S. equities market.

Twitter: @MarkNewtonCMT

The author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.