Key Takeaways For Investors:

Risks have become manifest in October as stocks have stumbled to start the fourth quarter. Deteriorating breadth and momentum anticipated weakness and seeing improvements there could suggest risks are diminishing.

Sentiment data suggests pessimism is building, though not excessive. In the wake of capitulation, watch for bullish breadth thrusts.

Waning momentum and a lack of clear broad market leadership has suggested that stocks have been in an elevated risk environment and we have been Alert to Evidence of Deterioration. So far, October is living up to its reputation for elevated volatility. This week saw the first 1%+ move on the S&P 500 since late June as selling accelerated.

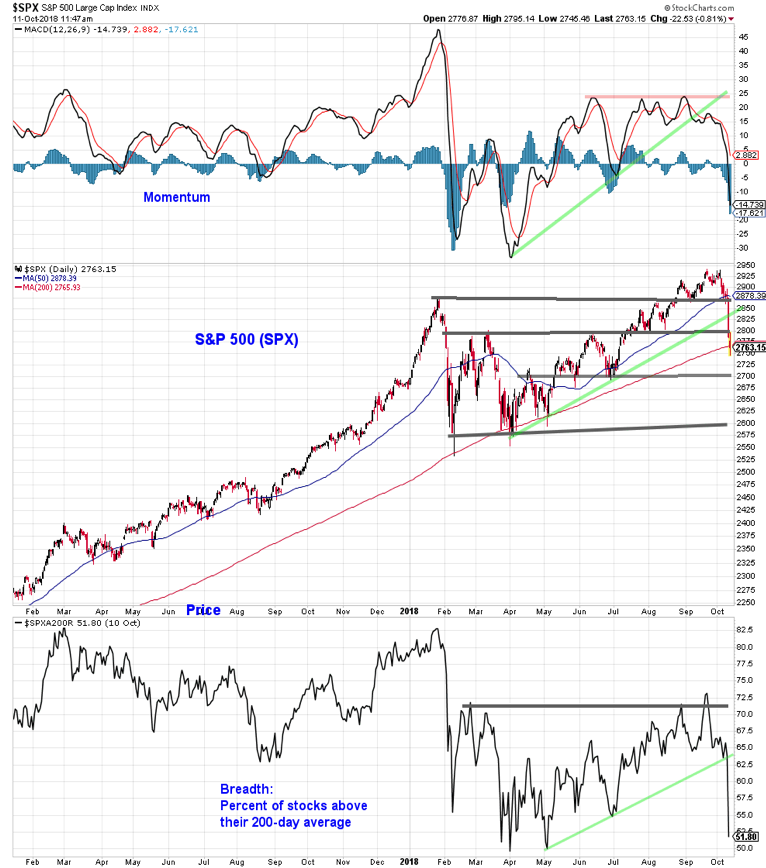

S&P 500 Chart

The August/ September rally above the January highs looks more like a false breakout, especially with the momentum and breadth trends seeing significant deterioration. The percentage of stocks trading above their 200-day averages on the S&P 500 has plummeted to just 51%, close to the April and May lows. With the bullish seasonal patterns that build over the course of the fourth quarter in view, it is natural to start looking for evidence of capitulation and a sustainable low. At this point, however, that may be premature. Caution remains warranted for now.

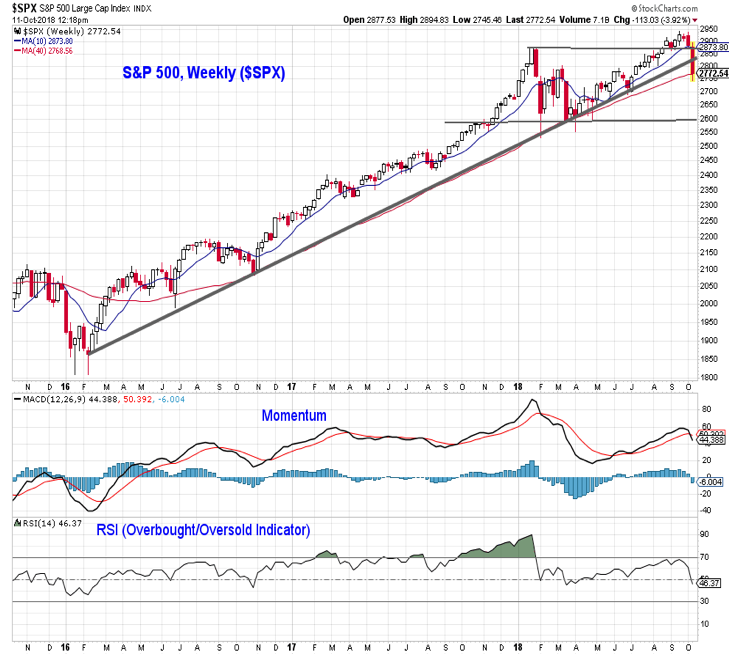

While usually best to wait until the week is complete before reviewing weekly charts, the size of this week’s move and the potential developments it portends have us making an exception this time. The weekly chart shows the S&P 500 breaking below the price trend off of the early-2016 lows as weekly momentum, which had been drifting higher over the course of the summer, turning lower. The weekly RSI (an overbought/oversold indicator) is approaching a level that should provide support if the cyclical bull market is still intact. Markets that are in up-trends tend not to get deeply oversold (RSI meaningfully below 50). Low RSI readings on either a weekly or daily basis may point more to deteriorating trends than bullish oversold conditions.

Index-level weakness is catching down to the broad market deterioration that has been ongoing for some time. At this point, however, breadth continues to weaken and has not signaled the emergence of a positive divergence. While just over 50% of S&P 500 stocks are above their 200-day averages, less than 35% of the stocks on the NASDAQ are above their 200-day averages (the lowest level since mid-2016.

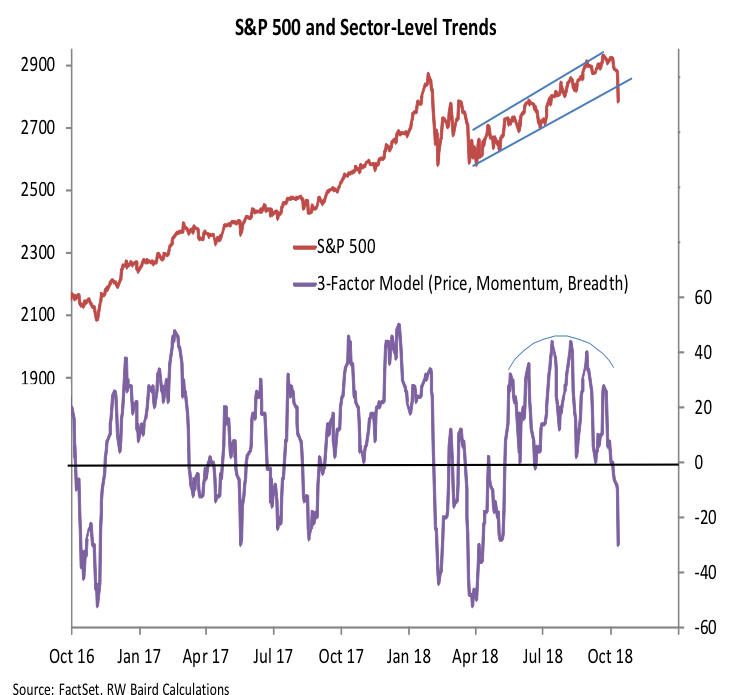

The list of stocks making new lows is expanding and the percentage of industry groups in up-trends is declining. Our sector-level trend indicator has broken down during the recent weakness, suggesting the reemergence of conditions similar to what was seen in the first quarter of this year. Breadth needs to stabilize and improve before thinking about sustainable lows in the indexes emerging.

This week’s selling saw the expansion of downside volume relative to upside volume. NYSE data showed a 10-to-1 down day and data for the NASDAQ was tilted 7-to-1 on the downside. Ned Davis Research data that looks at operating company-related volume, says it was above 26-to-1 on the downside. A surge in downside volume is usually necessary, but not sufficient, evidence of capitulation.

To gain confidence that selling is washed out, we should see at least one day (and probably multiple days) where upside volume outpaces downside volume by better than 10-to -1. Until then, suggestions of climactic selling are premature. The silver lining to this is that widespread selling now could help support the eventual emergence of bullish breadth thrusts, which were conspicuously absent coming off of the early-year lows.

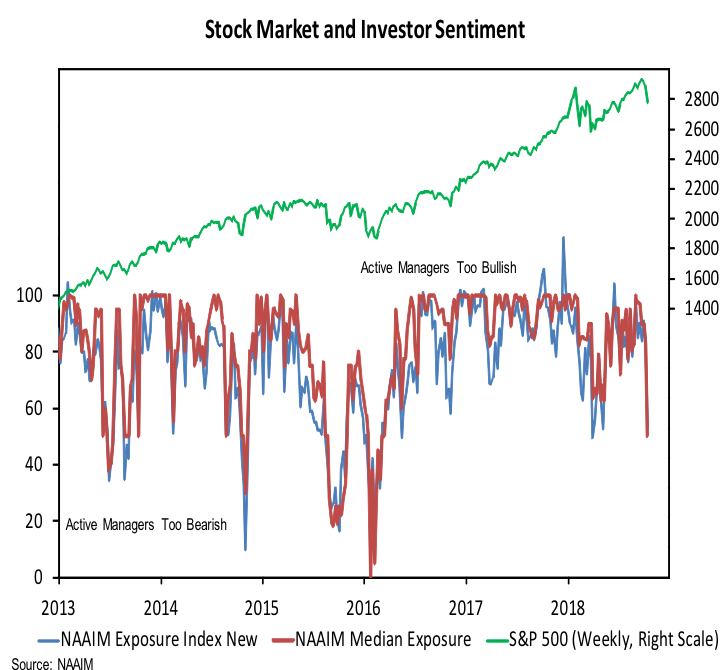

Seeing a continued shift from investor optimism and complacency to investor pessimism and fear would also be reassuring evidence that selling could be getting to the point of exhaustion. This week saw a modest drop in II bulls and an even larger decline in AAII bulls. Even more dramatic was the 30-plus point decline in the NAAIM exposure index (with the median falling to its lowest level since early 2016).

The surge in the VIX and up-tick in the put/call ratios are also evidence that complacency is being replaced with fear. While there has been a move away from optimism, there is not yet strong evidence of deep-seated pessimism. Looking at the chart of the NAAIM data, the move from 85% to 54% may be a step along the way toward a sub-30% reading. While excessive pessimism can be bullish for stocks, moving from optimism to pessimism is usually a headwind.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.