The S&P 500 Index (INDEXCBOE:.INX) was virtually unchanged last week despite the fact that the vast majority of reporting companies beat second-quarter earnings estimates.

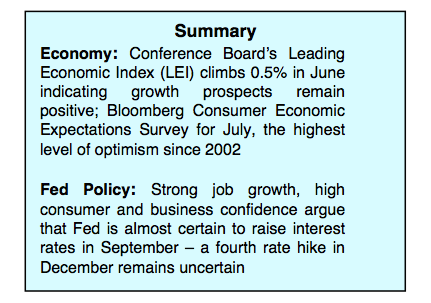

Improving economic fundamentals at home are being offset by concerns over the potential widening of the trade conflict and deteriorating trends in economies in Europe and China.

Evidence of this is being reflected in the increased volatility in the world’s currency markets where the dollar has gained 5% the past three months while the Chinese yuan has fallen to a 12-month low against the greenback.

This week the markets will be supported by a flood of potentially strong earnings numbers and a report from the Bureau of Economic Statistics that second-quarter GDP growth soared to 3.8%.

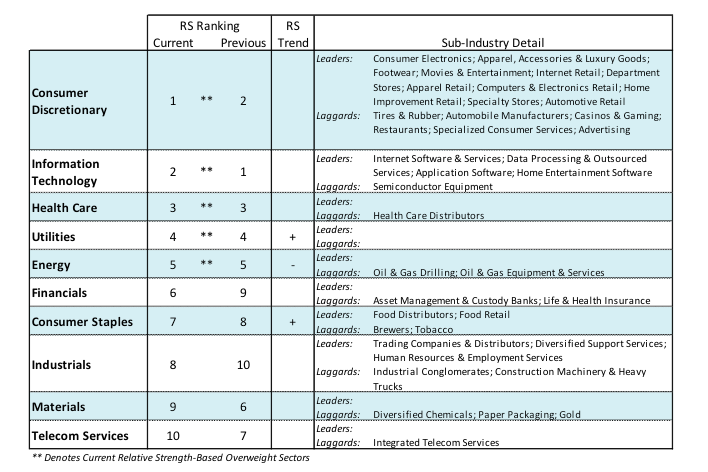

Nevertheless, the stock market is a forward-looking mechanism suggesting much of what is known about profits and the economy could already be built into current prices. Our immediate concern is the weakness in the commodity markets the past two months. Commodity price are considered by economists to be a reliable indicator of the health of the global economy. Declining trends in raw material prices have not gone unnoticed by the equity markets as defensive sectors of the stock market have increased in relative strength at the expense of cyclical sectors since May.

Additionally, the Administration’s signaling of more tariffs on China and criticism of the Federal Reserve position on further rate hikes adds to the level of investor anxiety. The fact that the yield curve is flattening supports the prospect that the second-quarter GDP numbers could represent the high point for growth this year. As a result, investors should focus on defensive sectors including health care, utilities and consumer staples.

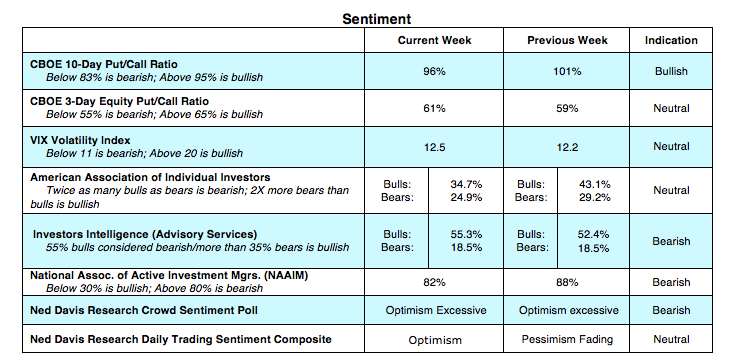

The weight of the technical indicators is supportive of a cautionary approach as we enter the two weakest months of the year for stocks. Historically, the Dow Industrials in a mid-term election year have tended to peak in early August, bottom in October and enjoy a strong year-end rally after the election regardless of the outcome. Seasonal outcomes should not be used as the primary indicator of market trends. In the present example, the potential for weakness leading up to the election is also supported by the fact that investor optimism is running at levels that from a contrary opinion perspective argues for caution.

Consumer optimism is near the highest level in more than a decade. Although this is positive for the economy, high levels of consumer confidence have often occurred prior to corrections in the stock market according to studies by Ned Davis Research. Stock market breadth is also a concern as the broad market continues to lag the popular averages. Despite new record highs by the NASDAQ in July, only 56% of NASDAQ stocks are trading above their 200-day moving average.

Additionally, over the past two weeks, despite new highs in the S&P 500 Index, stocks advancing versus stocks declining over that period are flat and as a result momentum has struggled to establish a positive trend.

Bottom line is that the strong economic fundamentals are offset by deteriorating global conditions and with the mid-term elections expected to be highly contested, a defensive approach is recommended.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.