This is the fourth and final article in our sector review series. Today, we shift our focus to the following 3 stock market sectors: Consumer Staples (NYSEARCA:XLP), Consumer Discretionary (NYSEARCA:XLY) and Health Care (NYSEARCA:XLV).

Note that this post was written with Chris Kerlow.

The headlines have not been favorable in regards to the group. Big-box retail is feeling the Amazon (NASDAQ:AMZN) effect, mall traffic is declining, consumer stocks are dealing with rising minimum wages and Health Care is dealing with uncertainty due to political bureaucracy south of the border, where the government is trying to overhaul the entire system.

Despite this, returns for these sectors have been quite robust year-to-date.

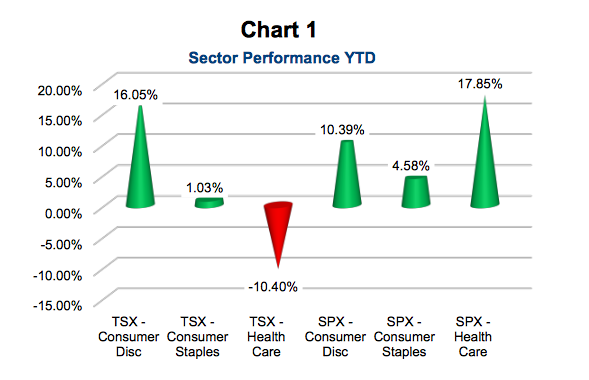

Chart 1 below looks at sector performance YTD:

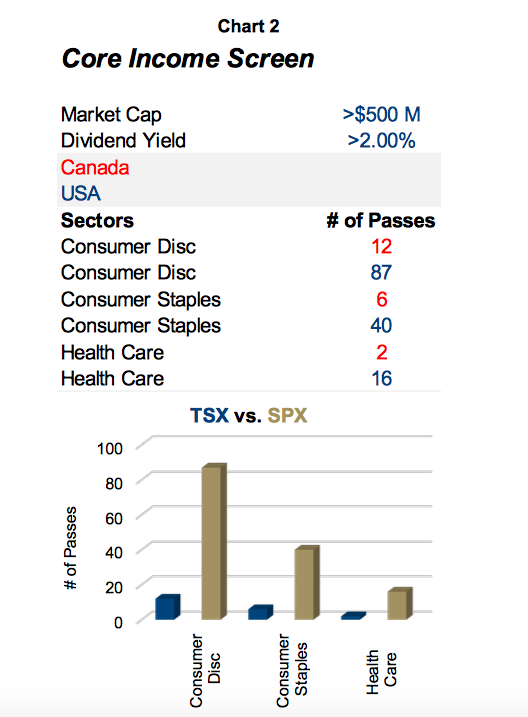

Across these three sectors, the investment universe is quite diverse. Some industries have been negatively impacted by the aforementioned themes. Even so, there are select beneficiaries of the disruptive changes that are occurring. We certainly weigh secular changes in our investment process. However, not every public company is available for purchase in our dividend-focused North American strategy. We typically do not invest in stocks with a market cap lower than $500mm because of liquidity concerns. Moreover, we tend to focus on names that have a reasonable dividend yield, supported by strong free cash flow generation. Using those screening criteria, the qualified investments in Canada are quite bleak. That is why we often use part of our U.S. allocation to access names in these sectors (Chart 2).

Health Care

There have been limited opportunities for us to get Health Care exposure here in Canada ever since Catamaran Corp was acquired by United Health Group for a healthy premium. That said, we are in the midst of ground-breaking research in Health Care and we want our unitholders to prosper alongside companies that are doing it. The scientists at Bristol Myers (NYSE:BMY) are real-life Sean Connerys from the 1992 drama Medicine Man. The company has a new drug Opdivo, which is expected to release stage three trial results later this year or early next year. We are hopeful that they will show that Bristol Myers has a viable solution for treating lung cancer across a variety of patients.

The results are highly anticipated but there is a risk that they are less favorable than the street is expecting. Regardless, oncology sales at BMY are expected to grow to 12.5bb in 2021 from 6.8bb last year. Our other Health Care holding is Amgen. It does not have the same innovation-driven growth profile as Bristol Myers; however, it is a free cash flow generating machine. Amgen has several blockbuster drugs that are patent protected, in high demand and will provide support for growing the dividend for years to come. This mega-cap biotech company is, ironically, in those awkward tween years when it transitions to a smaller pharma, which are less known for innovative growth and focus on generating cash flow from existing drugs. We own the name because of its low valuation and attractive dividend yield.

Consumer Staples

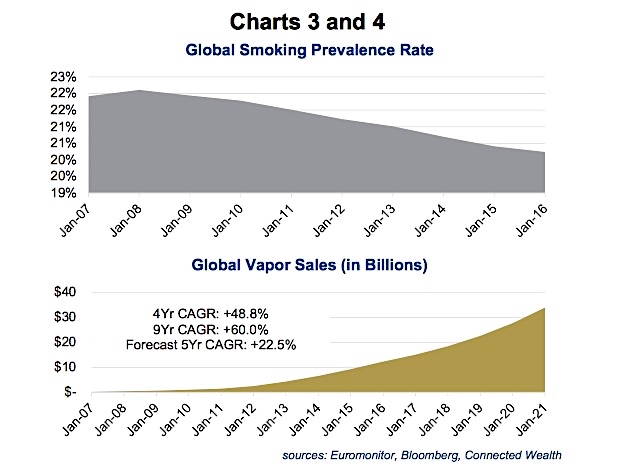

There is a peculiar problem plaguing certain biotechs. After they discover lifesaving cures, their opportunity sets shrink as they cure diseases. That is exactly what happened to Gilead. Philip Morris is dealing with the opposite problem and that is why it is placing more and more emphasis on its heat-not-burn solution, iQOS. This new system is gaining acceptance, with eye-popping conversion rates among not only casual smokers but also those who have been lighting up for years. Philip Morris’ traditional business has continued to see declining volumes due to falling smoking prevalence (Chart 3 below).

Still, the company has been able to grow sales by offsetting those declines with price increases. Cigarettes aside, growth in heat-not-burn smoking has been prolific (Chart 4 below).

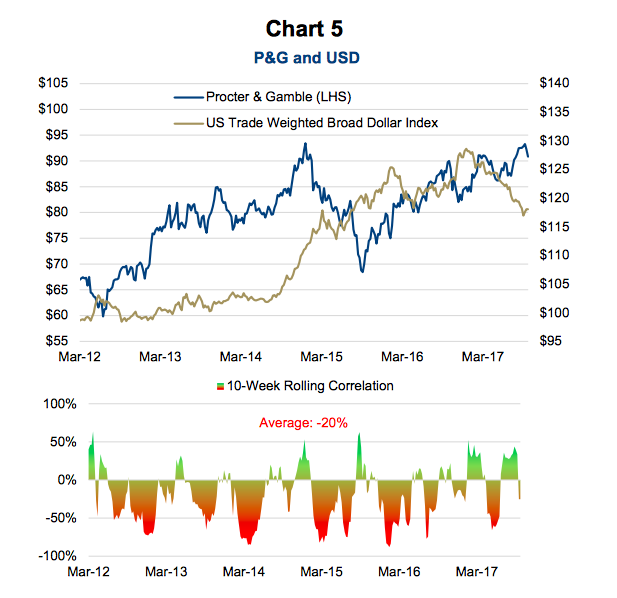

This new platform is what we expect will drive dividend growth. The name also provides a great USD hedge for the fund because all of its sales come from outside of the U.S. Proctor and Gamble (NYSE:PG) provides a similar USD hedge because it generates 65% of its sales outside of the U.S. (chart 5).

P&G’s portfolio of brands is world class. It owns Tide, Tampax, Pampers and many others. P&G’s breadth of products gives them incredible negotiating power with buyers. This often gets the company preferential product placement and visibility in stores. Valuation remains reasonable and the stock is certainly defensive in nature. Diapers for your baby and washing detergent for your clothes are way down on the list of things to cut back on during a recession. It is challenging to find value in the Staples sector. Investors have flocked to these high-yielding, traditionally low-risk stocks, making them more expensive. Luckily, we found one gem in the great white north, a discount retailer focused on rural areas way up in the Northern hemisphere. North West Co. is a mid-cap grocer that has been growing both organically and through acquisitions. It recently acquired a small airline to vertically integrate its supply chain. Amazon could expand into desolate markets; however, we believe it is a small threat. Either way, North West Co.’s brand equity and existing brick and mortar establishments should have staying power in these regions.

Consumer Discretionary

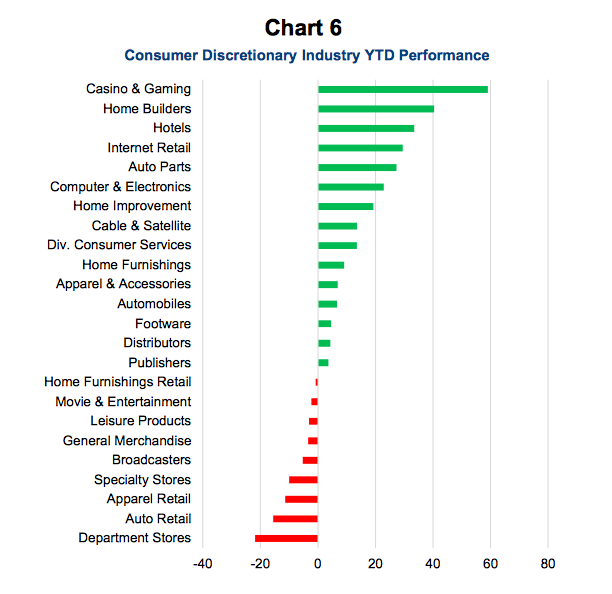

This should be the best of times for the Consumer Discretionary sector. Jobs are bountiful, wages are growing, home prices are rising and so is the stock market. That is all good; however, consumer tastes are changing. Traditional discretionary goods are being shunned in favor of experiential spending while travel, dining, and entertainment are stealing share from big-box retail and from intermediaries such as Footlocker or GameStop (Chart 6).

That is why we don’t own any disrupted names and hold Carnival, A&W, and recently added Cineplex. The only large retailer we own is Home Depot. The stock has been a top performer as the company has been refocusing the business to immunize the Amazon effect. Home Depot has seen tremendous growth with professional clients and with larger ticket items. This has been more than enough to offset slowing sales on smaller items purchased by retail clients who found better deals online. The unfortunate natural disasters caused by Harvey, Irma, Jose and potentially others are a boon for HD, which benefits when the necessary rebuilds take place.

The rest of our holdings are a play on the experiential theme. Carnival has benefited from an expanding user base as it now provides onboard Wi-Fi, which caters to millennials and to business travelers who used to shun the experience. Lower fuel prices and increased onboard spending have increased profitability, lifting the stock price. A&W, the iconic Canadian burger joint, trades at a discount to its peer group and is structured as a royalty corporation, giving us a tasty yield. The space is competitive; but, at a lower price point than other gourmet burgers, the company’s revenues are probably more defensive. Cineplex was a long time holding that we sold earlier this year, after it reached our target price. Subsequently, the stock got beaten up following weak earnings and continued to trend lower to a valuation that we once again found attractive. We only have a small position at this time and are trying to determine whether the recent underperformance was an aberration or structural. We are encouraged by the fact Cineplex is diversifying away from just movies with initiatives like the Rec Room and with its recent acquisition of Top Golf. Both are lots of fun and I encourage you to give them a try.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.