The reality is going forward that as ethanol production continues to grow; the amount of corn needed to produce those additional gallons may stay largely the same.

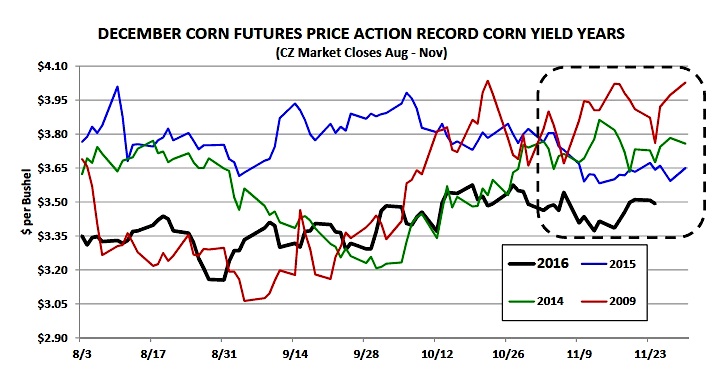

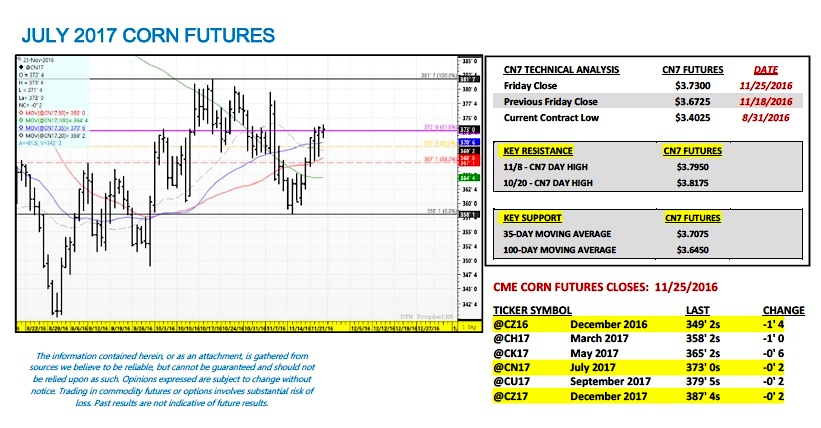

December Corn Futures Price Forecast

Ultimately I do believe the USDA will increase 2016/17 U.S. corn-ethanol demand by +25 to +50 million bushels over time. That type of increase however won’t have much, if any, impact as far as materially reducing the U.S.’s current 29-year high corn carryout estimate of 2,403 million bushels, which is 665 million bushels larger than a year ago. Regardless…given the fact that U.S. corn-ethanol demand now represents more than 36% of total U.S. corn usage, this demand sector will continue to play a vital role in displacing record large U.S. corn supplies.

Does the EPA’s revised conventional biofuels mandate of 15 billion gallons dramatically change the current corn-ethanol demand view for 2017? The short answer is no. As I already mentioned above, U.S. ethanol production has averaged 1,011 thousand barrels per day for the month of November, which equates to an annualized rate of production of 15.541 billion gallons. This is already substantially higher than the EPA’s conventional biofuels mandate for 2017 of 15.0 billion gallons. Therefore although the EPA’s renewable fuels increase was on “paper” a win for the ethanol industry, it doesn’t necessarily create a new demand source that exceeds the industry’s current operating capacity. That said I don’t foresee it having any upward influence on corn-ethanol demand for 2016/17.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service