Corn futures continued to rally with strength last week as several developments provided tailwinds to the price action.

On Monday President Trump announced that the United States, Canada, and Mexico had reached a revised trading agreement to replace NAFTA.

The new agreement (known as USMCA) was seen as a win for U.S. farmers specifically those in the dairy sector with Canada making minor tariff concessions on “Class 7” milk ingredients, effectively giving U.S. dairy farmers renewed export access to Canada’s dairy markets.

Additionally as it relates to corn… the USMCA also helped preserve strong U.S. – Mexico corn trade relations moving forward.

Mexico in recent years has accounted for as much as 24% of all U.S. corn exports (500+ million bushels; 13.8 to 15 MMT). Therefore they remain an indispensable trading partner and one critical to sustaining positive demand growth in U.S. corn exports.

Prior to this agreement taking shape there was some concern that Mexico could look to displace U.S. corn imports with purchases from Brazil or Argentina (the world’s 2nd and 3rdlargest corn exporters). In fact Mexico’s deputy economy minister even floated this possibility a year ago, attempting to exercise some leverage during what has been an intense negotiating period.

That said, if this week’s press releases are any indication, all 3 countries appear satisfied with the new trade agreement. This is very good news for U.S. farmers.

Two prominent grain market analysts offered their revised October 2018/19 U.S. corn yield and production forecasts this week. FCStone issued a 2018/19 U.S. corn yield estimate of 182.7 bpa for total production of 14.940 billion bushels. Informa Economics followed with a 2018/19 U.S. corn yield estimate of 182.1 bpa for total production of 14.890 billion bushels.

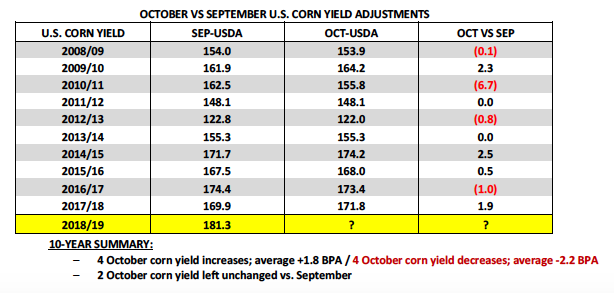

Both projections were higher than the USDA’s September estimates of 181.3 bpa and 14.827 billion bushels. The USDA will release its October 2018 WASDE report next Thursday, October 11th. Over the last 10-years the USDA has increased its U.S. corn yield forecast from September to October 4 times via an average increase of +1.8 bpa. This compares to 4 decreases averaging -2.2 bpa (see below). In 2011 and 2013 the USDA left the U.S. corn yield unchanged. Despite an inclusive 10-year trend from the USDA… it feels like the vast majority of corn traders I speak to still anticipate a minor U.S. corn yield increase coming in the October report.

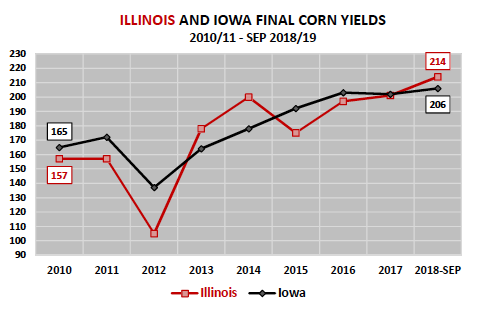

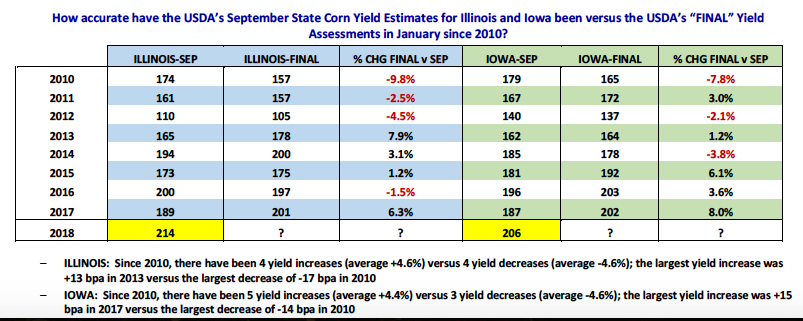

The ability of this year’s U.S. corn crop to hold on to an average national corn yield in excess of 180 bpa post-harvest will likely depend on the reliability of the USDA’s current record state corn yield estimates for Iowa and Illinois of 206 bpa and 214 bpa respectively (Iowa and Illinois account for one-third of total U.S. corn production). That said, how accurate have the USDA’s September corn yield estimates been in those 2 states over the last 8-years?

As you can see below…the USDA’s “Final” state corn yield figures for both states (finalized in the January WASDE report) have often varied greatly from the USDA’s September yield estimates. The average corn yield adjustment from Sep versus Final in Illinois has been 7.8 bpa (not specifying up or down, but simply isolating the average yield change). Similarly the average corn yield adjustment from Sep versus Final in Iowa has been 8.0 bpa. The point being I would caution anyone from establishing a significant market bias (or market position); which has been built primarily on the presumed accuracy of the USDA’s September state corn yield projections for Illinois and Iowa.

FOOD FOR THOUGHT FOR CORN BULLS — If over time the USDA lowers Illinois and Iowa’s state corn yields each by 5 bpa; those decreases alone would drop the 2018/19 U.S. corn yield -1.4 bpa to 179.9 bpa while lowering total U.S. corn production nearly 120 million bushels.

DECEMBER CORN TRADING OUTLOOK

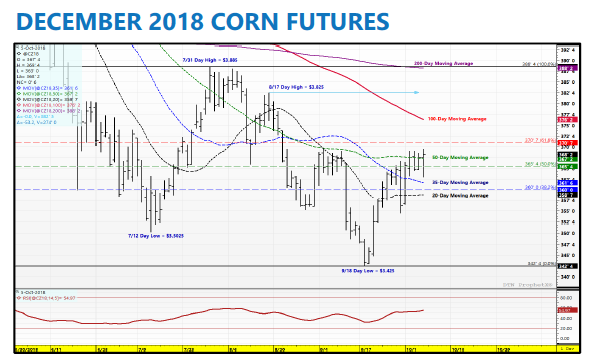

December corn futures closed up 9 ½-cents per bushel on Monday and managed to hang onto those gains into and through Friday’s close. Technically, Corn Bulls have to be content with this week’s price action and specifically Friday’s close over the 50-day moving average of $3.672. The 50-day MA had served as a major area of price resistance for approximately the last 45-days. In fact the last time CZ18 closed over the 50-day MA was on August 21st, 2018. All week CZ18 had been bumping up against that level and finally on Friday Corn Bulls found enough buying late in the session to trigger a mildly convincing close over it. Looking ahead: Assuming the market can sustain a higher opening Monday morning the next two topside targets are the 61.8% Fibonacci retracement at $3.707 followed by the 100-day moving average at $3.762.

What inspired this week’s renewed corn buying? Monday’s strength was attributed to first of the month/Q4 Index fund buying combined with a generally positive reaction to the new trade agreement between the United States, Mexico, and Canada. There were also those attempting to suggest a cool and wet 6 to 10-day forecast for the Upper Midwest, which should cause some harvest delays, was also a factor in the higher prices. However, I believe continued strong U.S. corn export sales/inspections remains the most important underlying price support. Weekly U.S. corn export sales for the week ending 9/27/2018 totaled 56.3 million bushels bringing crop year-to-date sales up to 775.5 million bushels versus 476.2 million bushels a year ago. U.S corn export sales are up 63% versus last year with export inspections (shipments) up 50%.

Looking ahead to next week all eyes will be on the USDA’s October 2018 WASDE report, which comes out on Thursday. The question will be do traders sell corn going into that report on the expectation of the USDA increasing the 2018/19 U.S. corn yield again? The argument could be made that with CZ18 already trading more than 25-cents per bushel off its contract low of $3.42 ½ Dec corn could be approaching the upper-end of a new trading range. That said I’m in the camp that wants to sell the $3.76 to $3.82 window if the money chases it early next week and/or we get a bounce post-October WASDE report due to an unexpected downward U.S. corn yield adjustment. $3.825 is a key CZ18 high dating back to August 17th. I don’t foresee the market collapsing with export demand so strong UNLESS the USDA issues a U.S. corn yield at or above 183 bpa (which is a possibility).

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service