December corn futures closed down again last week putting corn bulls on the ropes.

How much longer will corn bulls have to endure a difficult environment?

Let’s review the latest data and market trends for Corn (NYSEARCA: CORN) with a look at the week ahead (November 26).

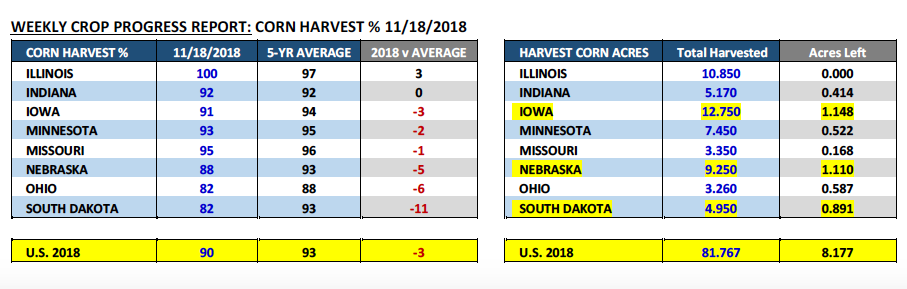

Monday’s Weekly Crop Progress report showed the U.S. corn harvest improving to 90% complete as of the week ending November 18th, 2018 versus 89% a year ago and the 5-year average of 93%.

Illinois’s corn harvest reached 100%. Meanwhile Indiana, Iowa, Minnesota, and Missouri were all reported at over 90% harvested. The 4 notable states with some work left to do were Nebraska at 88% harvested, Ohio 82%, South Dakota 82%, and Wisconsin 80%. Comparatively the U.S. soybean harvest reached 91% complete versus 96% a year ago and the 5-year average of 96%.

Weekly U.S. corn export inspections totaled 31.4 million bushels for the week ending November 15th, 2018.

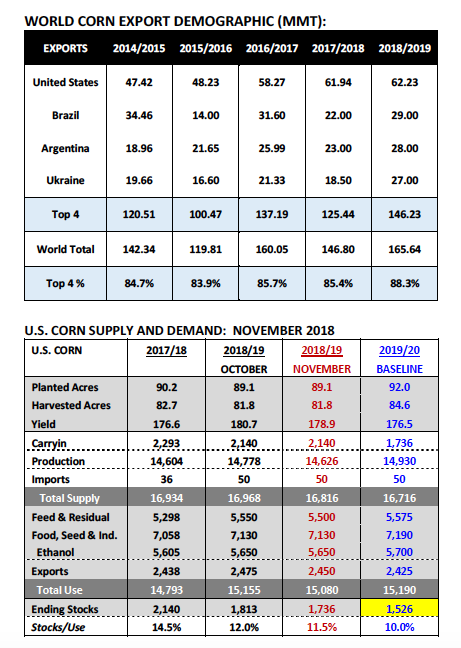

Crop year-to-date U.S corn shipments improved to 469.9 million bushels versus 261.3 million last year, up 80% or 208.6 million bushels. What remains interesting however is that despite the accelerated inspections (and sales) pace the USDA actually lowered its 2018/19 U.S corn export forecast in the November WASDE report 25 million bushels to 2.450 billion bushels. Right now the USDA is only projecting a 12 million bushel increase versus 2017/18.

This week the Ag ministry of Ukraine forecasted Ukraine’s 2018/19 corn production at 34.8 MMT.

This would be record large and 1.3 MMT higher than the USDA’s forecast in November. As a result Ukraine corn exports have been projected to reach 27 MMT in 2018/19 (also a record high). Ukraine is currently the world’s 4thlargest corn export trailing only the United States (62.23 MMT), Brazil (29.0 MMT), and Argentina (28 MMT).

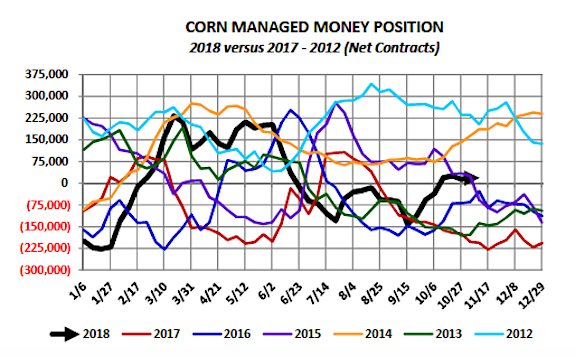

The most recent Commitment of Traders report showed Money Managers continuing to liquidate a percentage of their corn longs.As of November 13th, 2018 the Managed Money net corn long was reported at +17,981 contracts, down 8,648 contracts from the previous week.

Comparatively last year at approximately the same time Money Managers were carrying a net corn short in excess of -200,000 contracts. This corresponded to a December corn futures close of $3.45 on November 21st, 2017.

Wednesday’s Weekly EIA Petroleum report showed U.S. ethanol production dipping to 1.042 million barrels per day for the week ending 11/16/2018.This compares to 1.067 MMbpd the previous week and the 4-week average of 1.059 MMbpd.

U.S. ethanol stocks also experienced a week-on-week decline, falling to 22.8 million barrels versus 23.5 million barrels a week ago. U.S. ethanol crush margins have improved slightly this week; however industry average net margins remain negative. It’s going to take more than a one-week decrease in production/stocks to solve for excess ethanol supplies. CME December ethanol futures traded back over $1.27 per gallon on Wednesday.

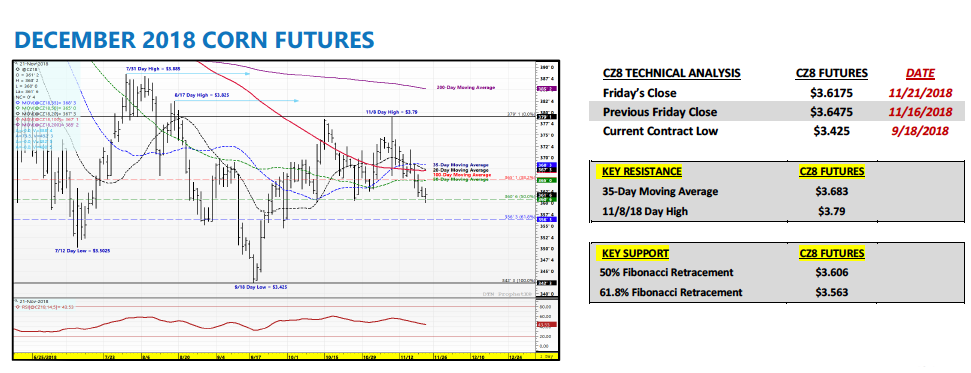

DECEMBER CORN FUTURES TRADING OUTLOOK

The corn market continues to slide sideways to lower with corn futures proving unable to gain any traction heading into the Thanksgiving holiday. With the November 2018 WASDE report now comfortably in the rearview mirror, Ag traders in general are suffering from a lack of dynamic, marketing-defining storylines, which in turn has led to narrow trading ranges featuring predominantly red closes.

That said what’s ahead for the grain markets?The G20 summit hangs in the balance with President Trump and Chinese President Xi Jinping scheduled to meet on November 30thin Argentina. Over the last several days the markets (both commodity and financial) have received mixed messages with respect to how those talks might progress. President Trump has offered suggestions of a willingness to compromise. Meanwhile Vice President Pence just this past weekend at a summit in Papua New Guinea (APEC) mentioned the possibility of the U.S. doubling its current tariffs of $250 billion on Chinese goods should China not change its ways. Needless-to-say traders remain very much in limbo regarding the potential direction of Trump-Xi Jinping trade talks later this month.

The stakes for the soybean market couldn’t be higher in my opinion with the 2018/19 U.S. soybean carryout ballooning to a record high 955 million bushels in the November 2018 WASDE report.

Losing China’s market (the world’s largest soybean importer; accounting for approximately 60% of total world soybean imports), as a result of the ongoing trade war, has had a devastating impact on U.S. soybean exports. In the November WASDE report the USDA lowered its 2018/19 U.S. soybean export forecast to 1.900 billion bushels, down 229 million bushels from 2017/18 or -11%. And although I’ll admit renewed soybean export channels to China won’t immediately solve the U.S.’s excessive soybeans stocks situation, it would go a long way in terms of seeing a potential home for those stocks over time. As it stands today, 2018/19 U.S. soybean export inspections remain 43% below 2017/18 through the week ending November 15th, 2018. That would then suggest the USDA still hasn’t fully accounted for the lost soybean export business to China.

And make no mistake, the ills of the soybean market remain very much a problem for the corn market in 2019. The higher the soybean carryout goes…the higher next spring’s U.S. planted corn acreage base goes.

Additional Chart / Data Reference:

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service