The past week saw a nice trading bounce in December Corn Futures… but the range is intact until it isn’t.

Below is a recap of the trading action and what’s to come this week.

U.S. Corn Futures Weekly Highlights & Insights:

- Monday’s Weekly Crop Progress report showed the U.S. corn harvest improving to 38% complete as of October 22nd, which compares to 59% a year ago and the 5-year average of 59%. A number of key corn producing states continue to see their harvest progress impeded due to adverse weather. Iowa’s corn crop was reported at just 23% harvested versus 55% on average, Minnesota 14% harvested versus 55% on average, and South Dakota 19% harvested versus 51% on average. That said NOAA’s 5 and 7-day precipitation models currently show a much drier weather pattern unfolding for those 3 states in particular, which suggests next Monday’s report should show significant harvest gains in the Western Corn Belt.

- Brazil’s full-season corn planting continues; however not without ongoing debate regarding just how many corn acres will get planted. The reasons for reduced full-season corn acreage appear to be twofold:

- Low domestic corn prices trading well below $3.00 per bushel in states such as Parana (averaging approximately $2.50 Jul-Oct 2017)

- Adverse planting conditions in states such as Rio Grande do Sul (too wet) and Minas Gerais (too dry)

Approximately 35% of Brazil’s total crop year corn production comes from its full-season corn crop. The rest/majority comes from Brazil’s safrinha corn crop. There are also those that believe Brazil’s safrinha corn crop, which is primarily planted in February after the soybean harvest in states such as Mato Grosso, will also experience material acreage declines due to the aforementioned impact of low domestic corn prices.

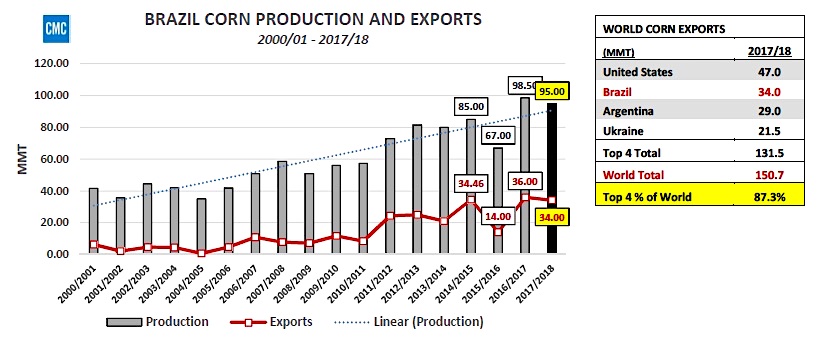

So what’s the potential market impact of lower Brazil corn production? As of the October WASDE report Brazil’s 2017/18 corn crop was still being forecasted at 95.0 MMT, just 3.5 MMT below its record-setting crop from 2016/17. Meanwhile Brazil’s 2017/18 corn exports were projected at 34.0 MMT versus 36.0 MMT in 2016/17.

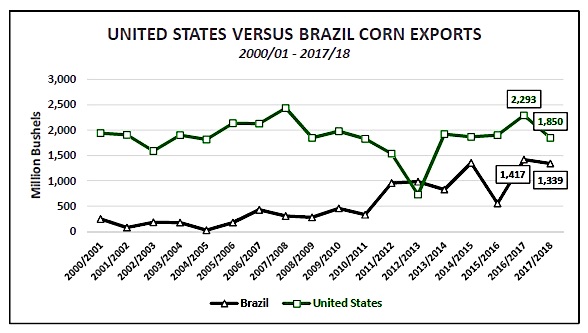

At 34.0 MMT (1,339 million bushels), Brazil stands alone as the 2nd largest world corn exporter, trailing only the United States and its 2017/18 corn export forecast of 47.0 MMT (1,850 million bushels). Where this could get interesting is if the market does eventually learn that Brazil’s 2017/18 corn acreage was reduced substantially, even more than anticipated. The impact could be a late surge in U.S. corn export business next September through January 2019. Why that window of time? Brazil’s safrinha corn harvest typically runs from June through August with those bushels then reaching world export channels from September through January. Improved U.S. corn export sales/shipments, even if it’s an increase of 100 to 150 million bushels during that timeframe, should help put a bid back in the corn market next spring.

Please note, this should not be considered a short-term price support but rather a long-term fundamental price driver that potentially suggests better U.S. corn demand moving forward into 2018/19. That’s key however with U.S. corn ending stocks currently forecasted at 2.34 billion bushels for 2017/18.

December Corn Futures Short-Term Price Outlook

December corn closed slightly higher on the week, finishing up 4 ¼-cents week-on-week at $3.48 ¾. However the higher close was nothing to celebrate considering the Dec close was also just 6 ¼-cents removed from the current contract low of $3.42 ½ established on 10/12/2017.

Corn prices continue to struggle finding willing buyers above key topside resistance (i.e. the 50-day moving average of $3.52 ½). The reasons for this are many including:

- Actual post-harvest U.S. corn yield results have been for the most part exceptional and vastly better than expected, which has traders already anticipating a national corn yield increase coming in the November 2017 WASDE report issued on 11/9/17 (October U.S. corn yield estimate was 171.8 BPA).

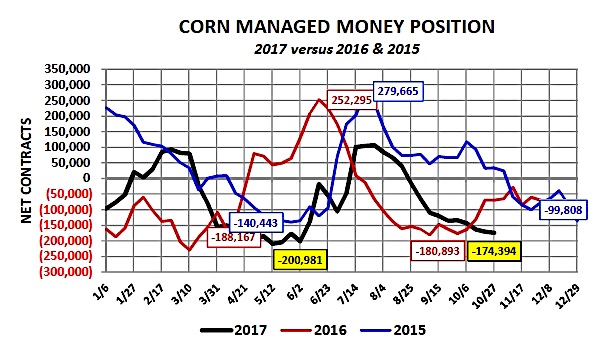

- Friday’s Commitment of Traders report showed the Managed Money short increasing yet again to -174,394 contracts as of 10/24/17. Money managers continue to add to their short positions which when combined with continuous in-flows of Commercial Hedge (sell) paper has made sustaining rallies back into the mid-to-upper $3.50’s extremely difficult.

Is the current CZ7 contract low in danger of being taken out? It’s possible…both the 5 and 10-year price seasonals support sideways to lower price action through approximately December 5th. Furthermore, last year during the month of November, December 2016 corn futures drifted down to a day low of $3.35 ½ on both 11/14 and 11/29. Considering the similarities between the 2017/18 U.S. corn S&D and 2016/17 U.S. corn S&D are many, a break to new contract lows in November certainly appears plausible.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service