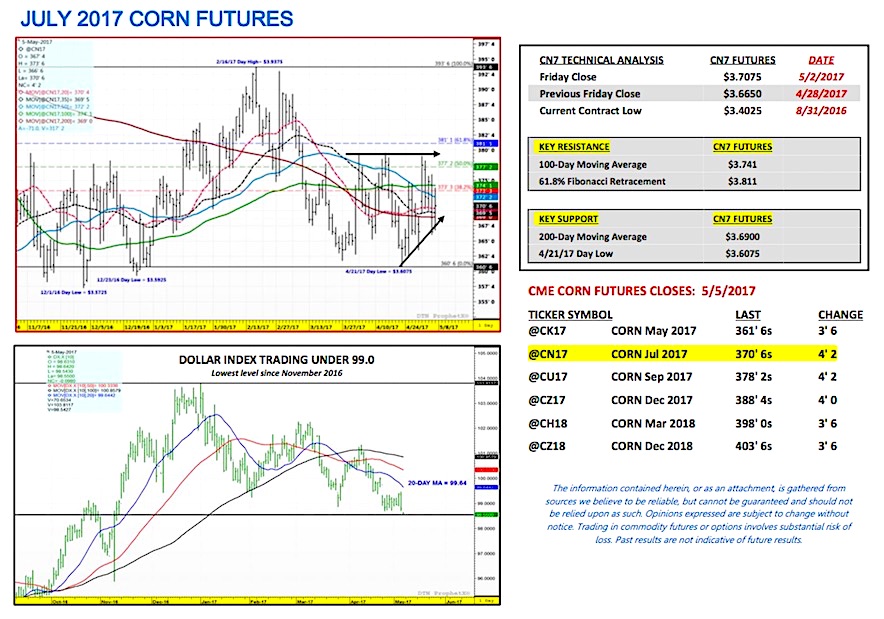

July corn futures moved higher this week, closing up 4 ¼-cents per bushel week-on-week, finishing on Friday (5/5) at $3.70 ¾.

Corn futures higher weekly close was entirely attributed to Friday’s session, which culminated with a 4 ¼-cents positive close that afternoon. This masked an otherwise disappointing week of price action for Corn Bulls.

Weekly Corn Price Drivers (5/1/17 – 5/5/17):

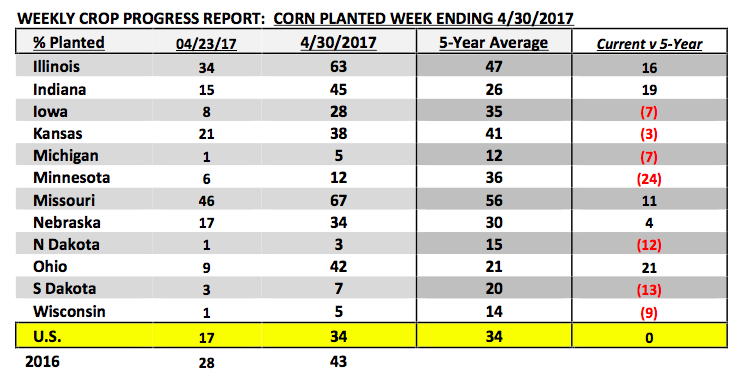

- U.S. Corn Planting Progress: Monday’s Crop Progress report showed the U.S. corn crop now 34% planted as of April 30th versus 43% in 2016 and the 5-year average of 34%. Significant gains were made in the Eastern Corn Belt with Illinois’s corn crop 63% planted, which was equal to a year ago and 16 percentage points higher that its 5-year average of 47%. Indiana’s corn crop was reported at 45% planted versus just 27% in 2016 and its 5-year average of 26%. Conversely key Western Corn Belt states such as Iowa and Minnesota continued to see their planting progress track below their 5-year averages. That said traders were quick to point out that NOAA’s most recent 6 to 10-day temperature and precipitation models suggested a shift to warmer and drier conditions specifically for those 2 states. Overall corn rallied Monday on the assumption that the USDA’s Weekly Crop Progress report, which was released AFTER the market close on Monday afternoon, would show U.S. corn planting progress below its 5-year average. That didn’t happen, which ultimately thwarted follow through buying on Tuesday morning.

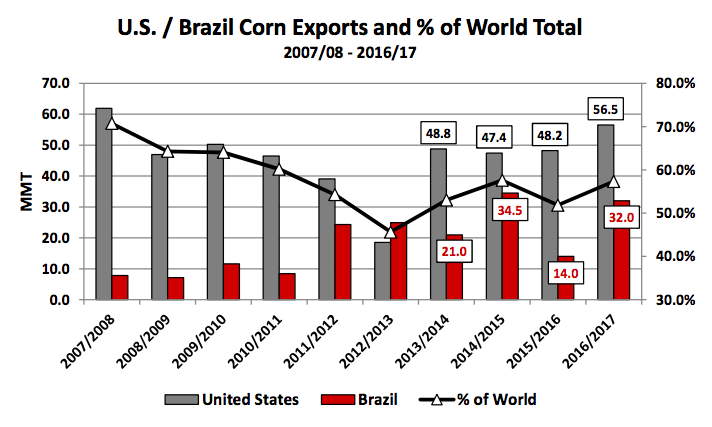

- Brazil Government Offers Corn Subsidies: It was reported this week that Brazil’s government was intending to compensate for low domestic corn prices in the state of Mato Grosso by offering subsidies via 3 electronic auctions. I viewed this announcement as yet another price negative for Corn Bulls both short and potentially long-term. Obviously offering agricultural price supports/subsidies isn’t an uncommon practice; however the reality is if the goal is to lower planted corn acreage in both the U.S. and Brazil to bring back into balance what are currently record high World corn stocks, price distorting subsidies don’t help. Producers need to feel the weight and consequence of current planting economics specifically in those two countries (the U.S. and Brazil are the world’s top 2 corn exporters). Mato Grosso in particular represents the largest state producer of safrinha corn with safrinha corn production now accounting for approximately 2/3’s of Brazil’s total corn crop in 2016/17. Therefore, minus any government price supports, Mato Grosso would in theory likely be forced into a position of some safrinha corn acreage contraction in 2017/18 due to depressed corn prices. That said it now becomes much harder to predict what the Brazilian farmer will do going forward.

- Slumping U.S. Corn Demand: The EIA reported weekly U.S. ethanol production of 986,000 barrels per day for the week ending 4/28/17. This resulted in revised 4-week average U.S. ethanol production of 988,000 bpd (week ending 4/7/17 through 4/28/17). This compared to a 4-week average of 1,040,500 bpd from 3/10/17 through 3/31/17. Therefore the market has seen a sizable drop in weekly ethanol production, which in turn has at least for the moment lowered the demand for corn as its primary feedstock. Additionally, U.S. corn export sales have slowed of late with sales of 30.4 million bushels reported for the week ending 4/27/17. Crop year-to-date corn sales are still nearly 37% ahead of 2015/16; however that gap has narrowed considerably in recent weeks. Furthermore traders remain wary of a soon-to-be harvested record breaking safrinha corn crop in Brazil, which is sure to displace additional U.S corn export business in the June-July-August timeframe.

All things considered it was not a good week for Corn Bulls from a “news” perspective. Corn values continued to show an inability to sustain anything beyond a one-day sharply higher close. Monday’s (5/9) Weekly Crop Progress report should set the tone for price action early next week.

July Corn Futures Pricing Considerations:

July corn futures (CN7) closed on Friday (5/5) at $3.70 ¾ finishing up 4 ¼-cents per bushel week-on-week.

Key takeaways from this week’s price action:

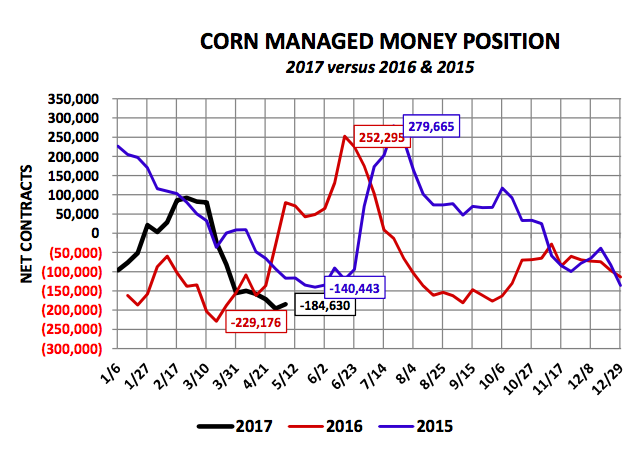

- Technically the one positive for Corn Bulls is that from purely a supply and demand standpoint, as far as it relates to what many traders believe the USDA will publish for 2017/18 U.S. corn ending stocks in next Wednesday’s May 2017 WASDE report (stocks of 2.2 to 2.3 billion bushels), a strong argument could be made that July corn futures are currently 20 to 30-cents overpriced. And yet time and again, even with this burdensome forward view on U.S corn ending stocks (and an aggressive Managed Money short in excess of -180k contracts) corn futures continue to hold key price support. In fact on Friday afternoon July corn futures closed back over the 200-day moving average of $3.69. Furthermore July corn futures also resisted a retest of the recent key day low of $3.60 ¾ from April 21st.

- What then is preventing the next breakout move lower? Ultimately it comes down to one word…WEATHER. The corn market’s maintaining a fairly significant weather premium and likely will continue to do so until the crop gets planted and traders get a better view on the extended summer forecasts for the Midwestern U.S. Recently there’s been excess precipitation and well-documented flooding in sections of Missouri and Illinois, which again has brought into question the possibility of corn acres being lost in those 2 states specifically. This type of “uncertainty” correlates directly into traders hedging a percentage of their topside position exposures on price corrections back to key levels of support. However the danger is over time…eventually that weather premium will be eliminated after the vast majority of critical spring/summer weather concerns have been dismissed or at the very least quantified. Corn traders witnessed how quickly this can happen last June with July corn futures breaking $1.05 ¼ per bushel in just 12-trading sessions from 6/17 – 7/3. What created the huge momentum shift in price? Rain and in particular more consistent rain events in the extended weather forecast…

That said I still believe corn futures will generate a rally of substance sometime in the next 45-days (due to a perceived weather scare). However, given the huge supply cushion heading into the 2017/18-crop year via U.S. carryin stocks in excess of 2.3 billion bushels that’s likely a move that needs to be sold and not a day too late.

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service