JULY corn futures closed down last week.

Here’s a look at the week ahead and what I’m watching in the corn market… and how July Corn futures are shaping up.

Weekly Highlights & Corn Outlook

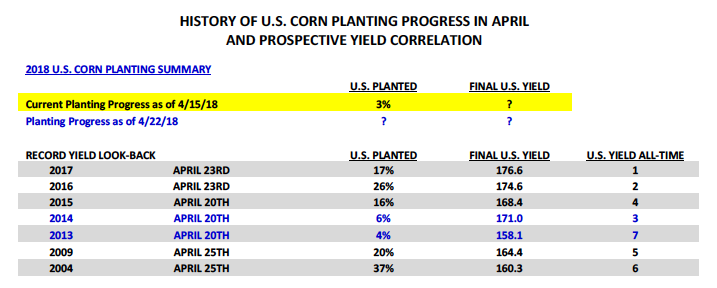

Monday’s Weekly Crop Progress report showed the U.S. corn crop just 3% planted as of April 15th versus 6% last year and 5% on average.

And while there are several Corn Bulls trying somewhat desperately in my opinion to create some fear over the increasing probability of considerable playing delays in the weeks to come and the presumed negative impacts on U.S. corn yield potential, recent history would argue those concerns are largely unsubstantiated. In 2014 and 2013, the U.S. corn crop went in the ground at what was (and remains) a historically slow rate. As of April 20th in 2014 just 6% of the U.S. corn crop had been planted. In 2013 the pace was even slower with just 4% of the U.S. corn crop planted as of the same date. However roll forward to June 1st of both years and in 2014 U.S. corn planting progress had improved to 95% complete versus 94% on average. In 2013, 90% of the U.S. corn crop had been planted. Point being May eventually provided a window to get nearly the entire crop in the ground in all of the key Midwest corn producing states.

That said was there a notable U.S. corn yield drag in either 2014 or 2013 due to the majority of the crop going in slightly later than normal (which can shrink the growing season if there’s an early frost and/or push corn pollination into mid-to-late July, which in theory subjects the U.S. corn crop to a greater risk of hot and dry conditions during this key development stage)?

In 2014 the U.S corn yield achieved what was then a record high of 171 bpa (still 3rd best through 2017) while 2013’s yield was finalized at a respectable 158.1 bpa, 4th highest at that time (still 7th best through 2017).

Therefore…all of this data would seem to indicate that Corn Bulls will likely have a hard time swaying public opinion on the merit of rewarding current spring planting delays with higher corn prices.

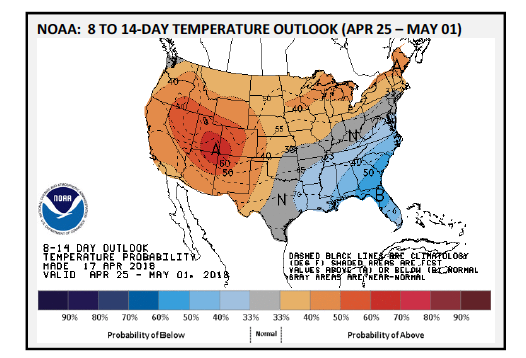

Furthermore NOAA’s most recent 8 to 14-day temperature outlook shows that warmer weather is FINALLY headed the way of the U.S. Corn Belt (see page 2). The April 25th – May 1st window should provide signs of life for producers across the Midwest.

China was back in the news this week announcing on Wednesday that they intend to issue a 179% duty on U.S. sorghum imports siting “anti-dumping” concerns.

This the latest salvo in a continuing trade dispute between the U.S. and China. Earlier this month China announced its plans to levy a 25% tariff on U.S. soybean imports, which led to an immediate and sharp sell-off in soybean futures on April 4th. China is the largest buyer of U.S. soybeans (representing approximately 50% of the U.S. soybean export market). Soybean futures have since recovered; however China’s latest move has renewed fears that they could eventually follow through on the tariff.

Weekly U.S. corn export sales totaled 43.0 million bushels for the week ending 4/12/18. Crop year-to-date corn export sales improved to 1.940 billion bushels versus 1.971 billion a year ago (-2%).

However on Monday crop year-to-date U.S. corn export shipments were reported at 1.092 billion bushels, -20% versus 2016/17. That differential (sales versus physical shipments) is still alarming and a possible indication that world buyers continue to hedge their future corn needs with U.S. purchases “on paper” until they feel better about the size and quality of Brazil’s safrinha corn crop (which represents approximately 2/3’s of total Brazil corn production and is harvested during Jun/Jul/Aug). Some of the latest private 2017/18 Brazil corn production estimates range from 87 MMT to 88.6 MMT. This compares to the USDA’s April estimate of 92 MMT and 2016/17 Brazil corn production of 98.5 MMT. Brazil is the world’s 2nd largest corn exporter. Therefore whether or not current U.S. corn export sales actually translate into export shipments/inspections will still largely depend on the fate of Brazil’s safrinha corn crop.

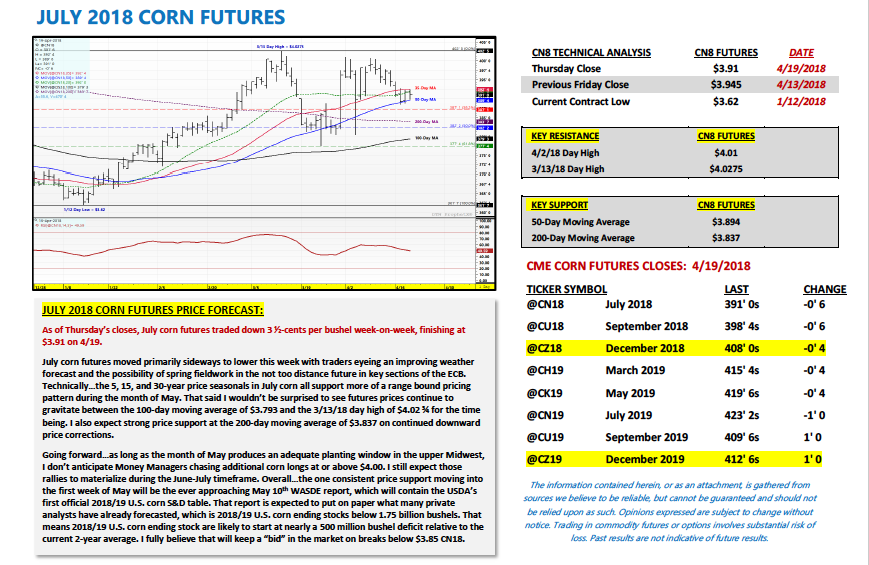

JULY 2018 CORN FUTURES PRICE FORECAST:

As of Thursday’s closes, July corn futures traded down 3 ½-cents per bushel week-on-week, finishing at $3.91 on 4/19.

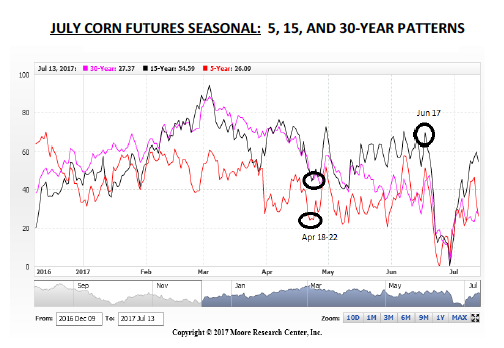

July corn futures moved primarily sideways to lower this week with traders eyeing an improving weather forecast and the possibility of spring fieldwork in the not too distance future in key sections of the ECB. Technically…the 5, 15, and 30-year price seasonals in July corn all support more of a range bound pricing pattern during the month of May. That said I wouldn’t be surprised to see futures prices continue to gravitate between the 100-day moving average of $3.793 and the 3/13/18 day high of $4.02 ¾ for the time being. I also expect strong price support at the 200-day moving average of $3.837 on continued downward price corrections.

Going forward… as long as the month of May produces an adequate planting window in the upper Midwest, I don’t anticipate Money Managers chasing additional corn longs at or above $4.00. I still expect those rallies to materialize during the June-July timeframe. Overall…the one consistent price support moving into the first week of May will be the ever approaching May 10th WASDE report, which will contain the USDA’s first official 2018/19 U.S. corn S&D table. That report is expected to put on paper what many private analysts have already forecasted, which is 2018/19 U.S. corn ending stocks below 1.75 billion bushels. That means 2018/19 U.S. corn ending stock are likely to start at nearly a 500 million bushel deficit relative to the current 2-year average. I fully believe that will keep a “bid” in the market on breaks below $3.85 CN18.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service