July corn futures closed DOWN 9 3/4 CENTS per bushel week-on-week, finishing at $3.96 ½.

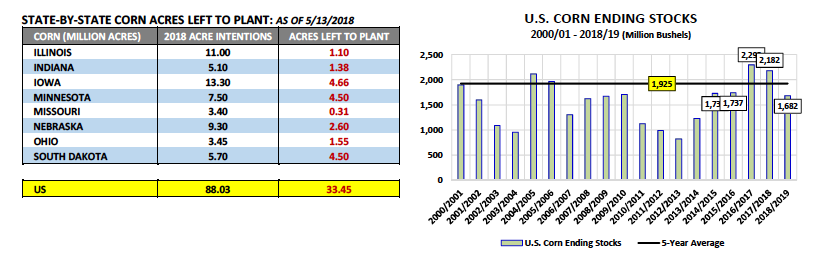

The much anticipated May 2018 WASDE report, which contained the USDA’s first official 2018/19 U.S. corn and soybean balance sheets, was released on Thursday, May 10th.

Here’s a rundown of the latest highlights:

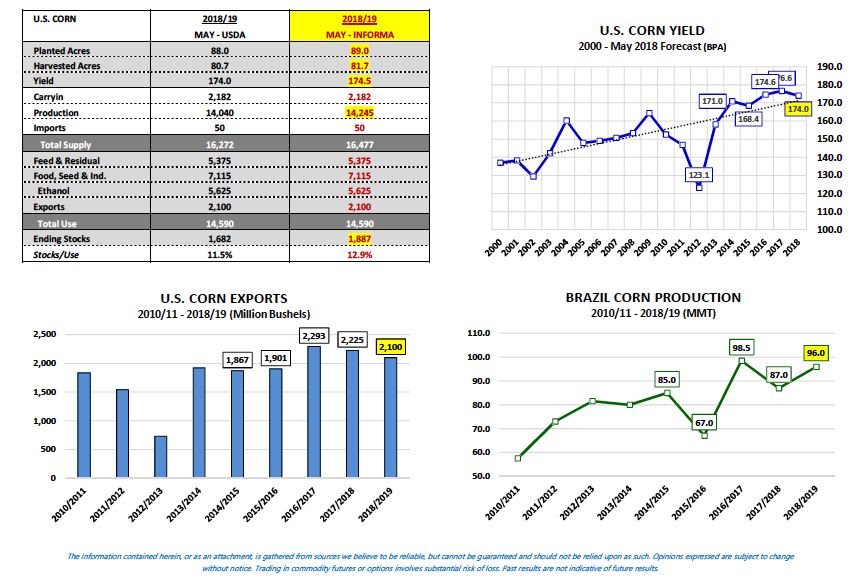

U.S. Weekly Corn Export Inspections Continue to Improve: For the week ending 5/10/2018 U.S. corn export inspections totaled 61.2 million bushels. Marketing year-to-date inspections moved up to 1.368 billion bushels versus 1.605 billion bushels a year ago. And while the crop year-on-year inspections gap is still not insignificant at -15%, that differential has narrowed considerably versus a month ago. In the first week of April, 2017/18 U.S. corn export inspections trailed the previous year by over -23%. Therefore U.S. corn shipments have accelerated the last 4 to 5 weeks. I think it’s safe to say world buyers are taking note of continued reductions to Brazil’s 2017/18 corn crop. In the May 2018 WASDE report the USDA lowered Brazil’s 2017/18 corn production estimate to 87 MMT, down 11.5 MMT from 2016/17 (-453 million bushels). Brazil is the world’s 2nd largest World corn exporter with 2017/18 exports projected at 30 MMT.

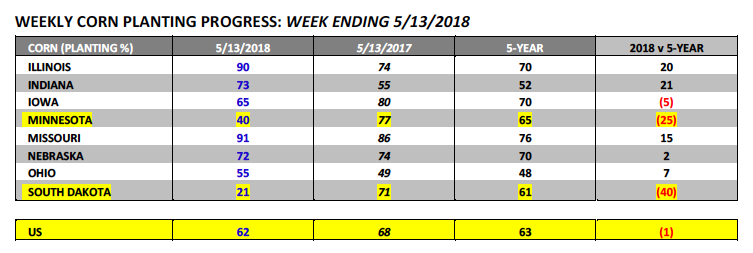

U.S. Corn Planting Progress Nearly Equal to 5-Year Average: Monday’s Weekly Crop Progress report showed U.S. corn planting progress improving to 62% for the week ending May 13th, 2018 versus 68% last year and 63% on average. Two key states off to strong starts included Illinois and Indiana. Illinois’s corn planting progress moved up to 90% versus 74% last year and 70% on average. Indiana’s planting progress was reported at 73% versus 55% in 2017 and 52% on average. On the other end of the spectrum, both Minnesota and South Dakota saw their planting percentages fall further and further behind their 5-year averages. Minnesota’s corn planting progress increased to 40%, which was 37% LESS THAN a year ago and 25% behind its 5-year average. South Dakota’s planting progress improved to just 21% versus 71% in 2017 and 61% on average.

What’s the significance of this week’s national planting progress estimate? Traditionally the market “likes” to see U.S. corn planting progress no less than 60% as of the second week of May, based on the assumption that a number equal to or greater than 60% allows for full corn maturities and maximum yield potential. In 2017 U.S. corn planting progress was 68% as of the 2nd week of May, which resulted in a record U.S. corn yield in 2017/18 totaling 176.6 bpa. In 2016, U.S. corn planting progress was 73% as of the 2nd week of May, which in 2016/17 produced a final U.S. corn yield of 174.6 bpa.

That said, does planting progress of 60% or greater INSURE above-trend yield results? No. in 2012, 87% of the U.S. corn crop was planted as of May 13th and that year the U.S. corn yield fell to 123.1 bpa (lowest yield since 1995/96) due to what was later defined as a “100-year drought.” Therefore summer weather still matters significantly and can easily trump any presumed yield advantage gained by getting corn seeded earlier than normal.

On Tuesday Informa Economics revised its 2018 U.S. planted corn acreage estimate. They issued a 2018/19 U.S. corn planted acreage forecast of 88.976 million acres (81.65 million harvested), which compares to the USDA’s March Prospective Plantings projection of 88.026 million acres (Informa = +950k acres). Informa’s 2018/19 U.S. corn production estimate then penciled back at 14.245 billion bushels (via a U.S. corn yield of 174.5 bpa) versus the USDA’s May 2018/19 forecast of 14.040 billion bushels (via a U.S. corn yield of 174.0 bpa). After applying Informa’s revised supply-side estimates, 2018/19 U.S. corn ending stocks increased to 1.887 billion bushels, +205 million bushels versus the USDA’s May forecast of 1.682 billion bushels.

How realistic is Informa’s higher planted acreage projection? Since the release of the USDA’s March Prospective Plantings acreage estimate of 88.03 million corn acres, which at the time was 1.3 million acres BELOW the average trade guess, I’ve felt the USDA would eventually raise their acreage projection over time. On June 29th the USDA will release its June Acreage report, which re-assesses U.S. corn (and soybeans) planted acreage post spring planting. I’m fully expecting U.S corn acreage to increase a minimum of 500,000 acres in that report. The Eastern Corn Belt will certainly have time to add acres and with CZ18 corn futures currently trading comfortably over $4.00, the economic incentive to do so seems justified.

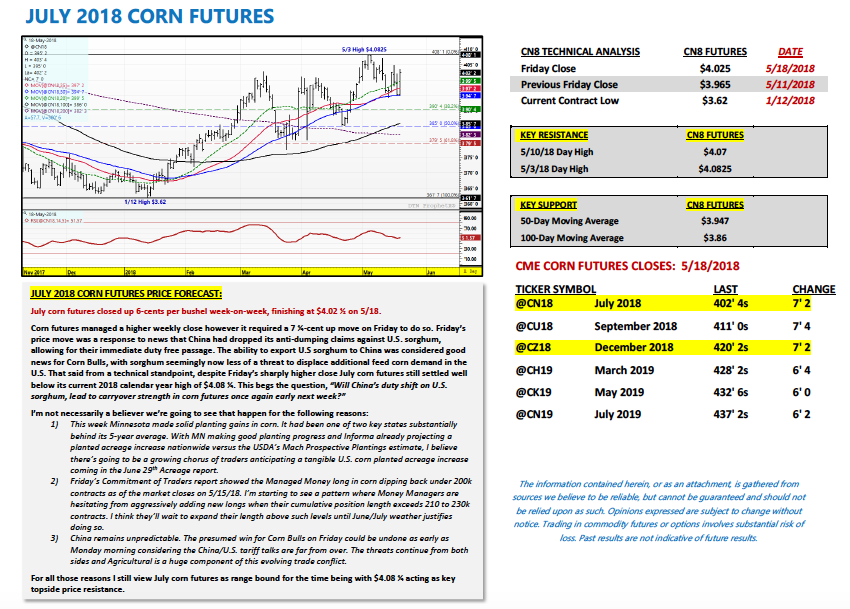

JULY 2018 CORN FUTURES PRICE FORECAST:

Corn futures managed a higher weekly close however it required a 7 ¼-cent up move on Friday to do so. Friday’s price move was a response to news that China had dropped its anti-dumping claims against U.S. sorghum, allowing for their immediate duty free passage. The ability to export U.S sorghum to China was considered good news for Corn Bulls, with sorghum seemingly now less of a threat to displace additional feed corn demand in the U.S. That said from a technical standpoint, despite Friday’s sharply higher close July corn futures still settled well below its current 2018 calendar year high of $4.08 ¼. This begs the question, “Will China’s duty shift on U.S. sorghum, lead to carryover strength in corn futures once again early next week?”

I’m not necessarily a believer we’re going to see that happen for the following reasons:

- This week Minnesota made solid planting gains in corn. It had been one of two key states substantially behind its 5-year average. With MN making good planting progress and Informa already projecting a planted acreage increase nationwide versus the USDA’s Mach Prospective Plantings estimate, I believe there’s going to be a growing chorus of traders anticipating a tangible U.S. corn planted acreage increase coming in the June 29th Acreage report.

- Friday’s Commitment of Traders report showed the Managed Money long in corn dipping back under 200k contracts as of the market closes on 5/15/18. I’m starting to see a pattern where Money Managers are hesitating from aggressively adding new longs when their cumulative position length exceeds 210 to 230k contracts. I think they’ll wait to expand their length above such levels until June/July weather justifies doing so.

- China remains unpredictable. The presumed win for Corn Bulls on Friday could be undone as early as Monday morning considering the China/U.S. tariff talks are far from over. The threats continue from both sides and Agricultural is a huge component of this evolving trade conflict.

For all those reasons I still view July corn futures as range bound for the time being with $4.08 ¼ acting as key topside price resistance.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service