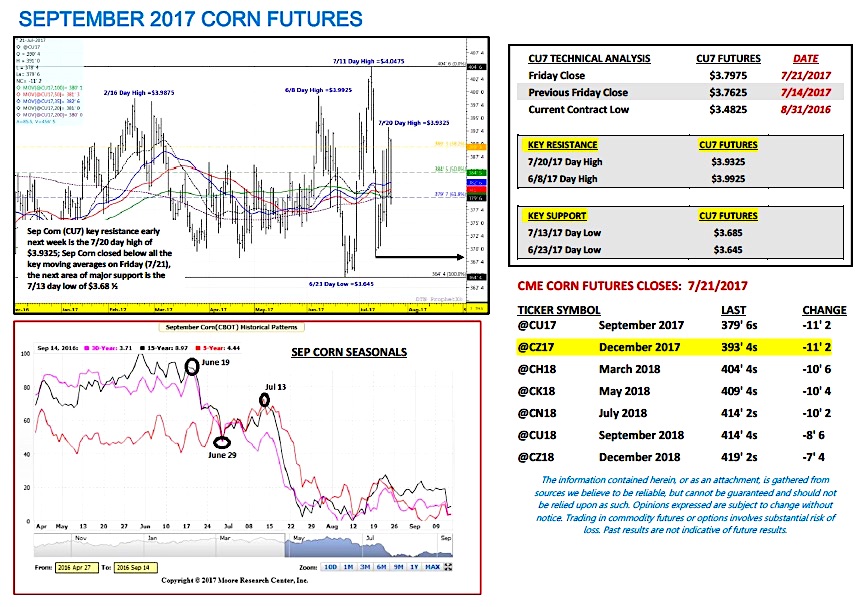

September corn futures moved slightly higher this week, closing up 3 ½-cents per bushel week-on-week, finishing on Friday (7/21) at $3.79 ¾.

Despite the higher weekly finish, Friday’s 11 ½-cent lower close provided yet another major price setback for Corn Bulls.

Weekly Corn Price Drivers:

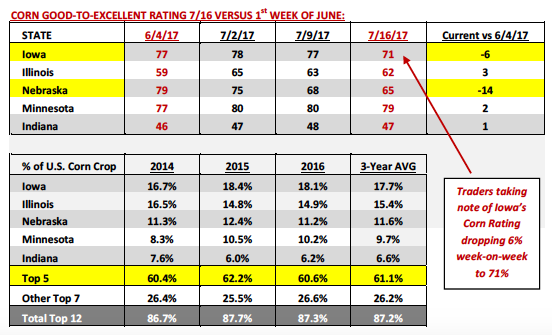

U.S. Corn Crop Ratings: Monday’s Crop Progress report showed the U.S. corn good-to-excellent rating falling 1% week-on-week to 64% versus 65% last week and 76% last year. The trade was expecting a 1 to 2% decline. The most notable state decrease was a 6% cut to Iowa’s good-to-excellent rating, which fell to 71% versus 81% in 2016. The market had a strong reaction to Iowa’s corn ratings decline due to its standing at the largest corn producing state in the country.

Additionally at this stage in the 2017 summer growing season Iowa and Minnesota have been the two major corn producing states pulling the national corn yield up and compensating for potentially trend to slightly below-trend yields in Illinois, Nebraska, and Indiana. Therefore with Iowa slipping this past week, traders remain wary of yet another ratings drop next week. If this were to happen I would fully expect more and more private U.S. corn yield estimates in the 164 to 166 bushel per acre ranges.

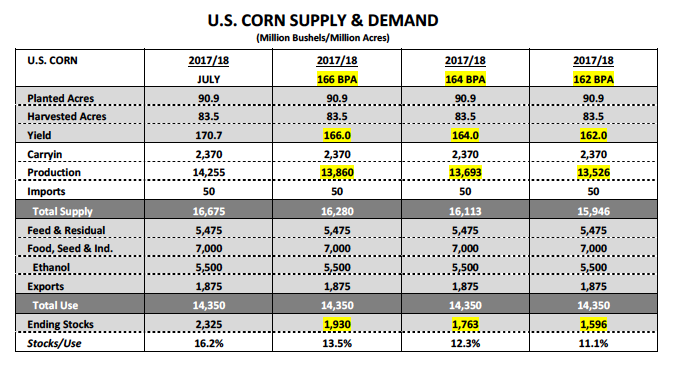

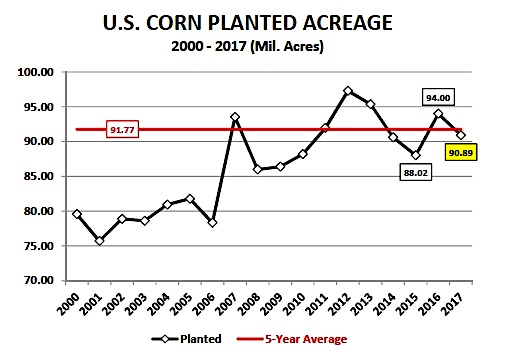

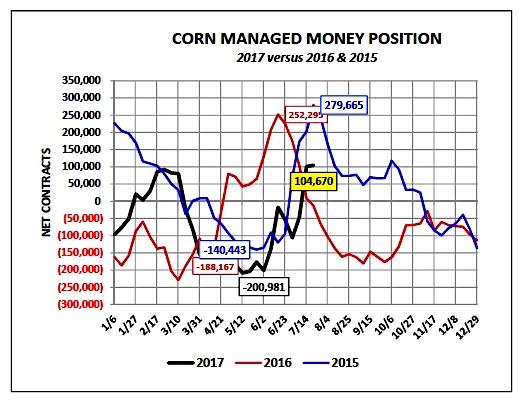

As I’ve stated the last couple weeks, I truly believe corn traders are desperate for a significant rally in corn futures. Therefore there’s a strong sense of “FOMO” (fear of missing out) when analyzing the production prospects for 2017. There are clearly enough problems with this year’s corn crop to fuel a mildly Bullish undertone; however the question I continue to have, “Is a counter-seasonal corn rally in last half July sustainable with carryin stocks of 2.37 billion bushels (largest since 1988/89) and planted acreage of nearly 91 million acres?” That supply cushion can go a long way in offsetting a slightly below-trend U.S. corn yield.

Weather… Weather… and More Weather: Corn futures clawed their way back Tuesday, Wednesday, and Thursday with a growing and well-organized chorus of both private wires and private Twitter accounts working hard to promote all that is not well with this year’s corn crop. That said NOAA’s latest Drought Monitor did show “moderate drought” conditions expanding into NW Iowa with a strip through Central Iowa as well, which Corn Bulls gravitated to immediately. The challenge however is that this summer’s Midwest weather pattern has not been an all-encompassing drought. We’re essentially debating how many bushels have been lost in sections of North Dakota, South Dakota, Nebraska, and now Iowa. As far as the overarching influence on total U.S. corn production the conclusions I continue to draw are as follows:

1. North and South Dakota have continued to be the primary casualties of this summer’s drought in the WCB. However collectively they have accounted for on average 8.3% of total U.S. corn production from 2014 – 2016. Therefore they alone don’t have the ability to significantly lower the U.S. corn yield. For example based on 2016 data…theoretically had North and South Dakota’s combined corn production fallen 15% due to an expansive drought the U.S. corn yield would have declined only 2.3 bpa (172.3 bpa versus 174.6 bpa). I wouldn’t refer to this outcome as entirely inconsequential; however once again, with 2017/18 U.S. corn carryin stocks of 2.37 billion bushels there is some built in margin for error regarding a slightly below-trend U.S. corn yield in 2017.

2. As far as Nebraska is concerned, Nebraska’s corn crop is nearly 60% irrigated. Therefore it’s very hard to “kill” Nebraska’s corn crop. Even in 2012 when the rest of the Corn Belt was experiencing year-on-year state corn yield declines of 30 to 35% (Illinois’s corn yield of 105 bpa was off 33% in 2012 versus 2011) due to the worst drought in decades Nebraska’s final corn yield averaged 142 bpa, down just 11% from 2011. Once again I would attribute this ability to manufacture a respectable corn crop even in the midst of a “100-year” drought to Nebraska having so many irrigated corn acres. That said I’m not ready to discount Nebraska’s state corn yield just yet with it still rated 65% good-to-excellent (as a point of reference in 2012 Nebraska’s corn crop was rated 33% good-to-excellent and still produced the aforementioned 142 bpa yield).

3. And finally Iowa, the market was hyper-sensitive to Iowa’s 6% ratings decline. That said the reality is 71% of Iowa’s corn crop remains in good-to-excellent condition with 23% rated “fair.” Therefore 94% of Iowa’s crop is in fair-good-excellent condition. Comparatively in 2014, 93% of Iowa’s corn crop was rated in fair-good-excellent condition as of July 20th. That year Iowa’s final corn yield was 178 bpa. Prior to 2016 and 2015, 178 bpa was the 3rd best yield ever in the state of Iowa (versus the high of 181 bpa in 2009 and 2004). Point being Iowa’s state corn yields of 192 bpa in 2015 and 203 bpa in 2016 have somewhat distorted the market’s expectations for Iowa this summer. As I see it Iowa’s 2017 corn crop can still achieve something close to 180 bpa – 185 bpa, which feels low compared to the past 2-years; however over a 5-year lookback it still fairs exceptionally well on paper.

September 2017 Corn Futures Price Analysis

Thanks for reading.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service