Corn Market – Weekly Highlights

Below is a list of key happenings in the Corn market and a few fundamental takeaways that traders should be aware of. Further below is a section focusing on my price outlook for December Corn Futures.

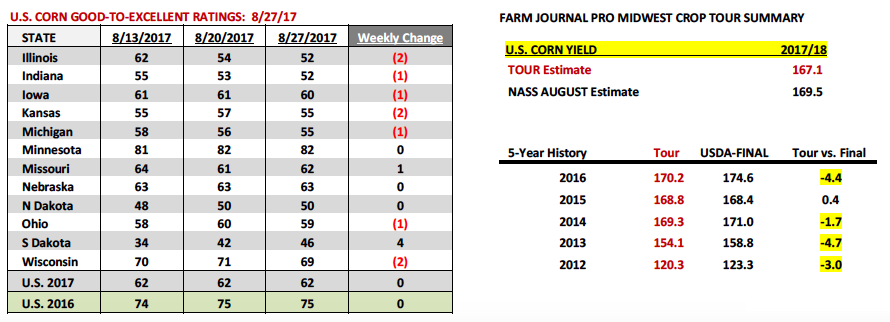

- Monday’s Weekly Crop Progress report showed the U.S. corn good-to-excellent rating unchanged week-on-week at 62% as of 8/27/17 versus 75% a year ago. Ratings slipped in the Eastern Corn Belt (Illinois, Indiana, and Ohio); however only by 1 to 2%. Illinois still stands out from the standpoint of now having experienced a good-to-excellent ratings decline of 10% in just the past 2 weeks. That said with the Farm Journal Pro Midwest Crop Tour just recently having taken samples from various sections of Illinois and coming back with a state yield estimate of a respectable 181 BPA (versus NASS’s forecast of 188 BPA in August), the market once again seems largely disinterested in the direction and perceived yield implications of state crop ratings.

- Final takeaway from the Farm Journal Pro Midwest Crop Tour 2017: The Tour’s final U.S. corn yield forecast for 2017/18 was 167.1 BPA, just 2.4 BPA below NASS’s August yield estimate of 169.5 BPA. And while the Tour produced a yield projection less than the USDA’s, traders were quick to point out that in 4 out of the past 5 years the Tour has underestimated the “Final” U.S. corn yield by an average of -3.45 BPA (see table below). Therefore this would suggest a Final U.S. corn yield closer to 170.0 to 170.6 BPA remains a distinct possibility. Additionally the only year the Tour overestimated the Final U.S. corn yield was in 2015; however the differential that year was a largely insignificant 0.4 BPA. That said from purely a traders point of view, statistically speaking, this would suggest the lower-end of yield expectations should now be in the 166.0 to 166.5 BPA ranges.

- This reality certainly weighed on corn futures prices Monday and Tuesday. Corn Bulls were clearly hoping for Tour results that better reflected this year’s disappointing and below-average crop condition ratings for several key corn producing states including Illinois, Indiana, Iowa, Ohio, and South Dakota. That did not happen. Therefore barring an early frost, the market now seems to be heavily discounting this year’s U.S. corn yield slipping below 164 to 162 BPA. Is the “frost” fear a real card still to be played by Corn Bulls? I would say “yes” for 2017 considering it’s been well documented in several Midwest states that after an unusually cold August crops are 2 to 3 weeks behind. This will invariably require a longer tail to the growing season for crops to fully mature. That said frost could come into play and have a material consequence on total 2017 U.S. corn production.

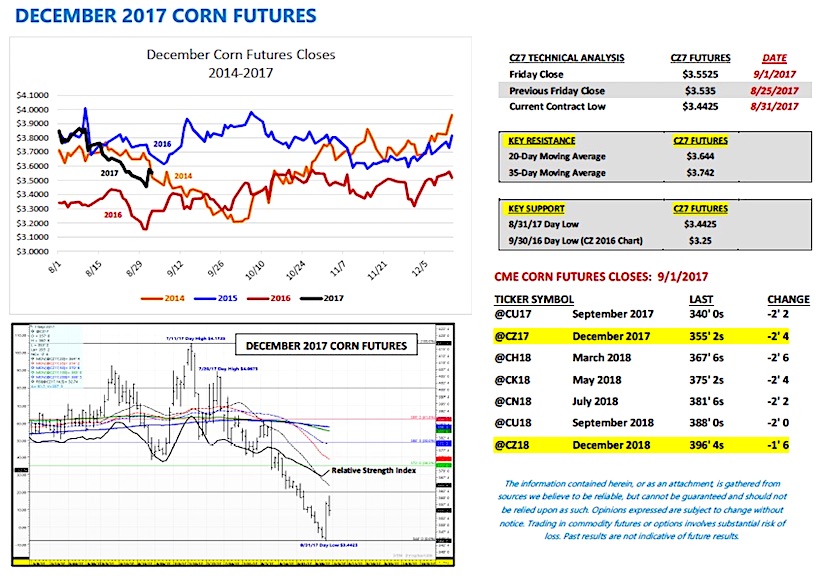

December Corn Futures… The Price Action

Price action in December corn futures Monday through Wednesday last week offered a continuation of the recent sell-off to new contract lows. Additional price pressure came from large-scale Commercial hedge (sell) paper via farmers forced to price old-crop corn (on Deferred Pricing or Basis-Only contracts) prior to First Notice Day in September corn futures, which was on Thursday, August 31st. This year there was a significant amount of old-crop corn, still on-farm, needing to be priced by Wednesday’s close and delivered prior to this fall’s new-crop (2017/18) corn harvest. That said after this selling was digested, the market rebounded closing up 12 ¼-cents per bushel on Thursday afternoon. This allowed December corn futures to carve out a slightly higher close for week, albeit just a small one with CZ7 finishing up 1 ¾-cents per bushel versus the close on 8/25.

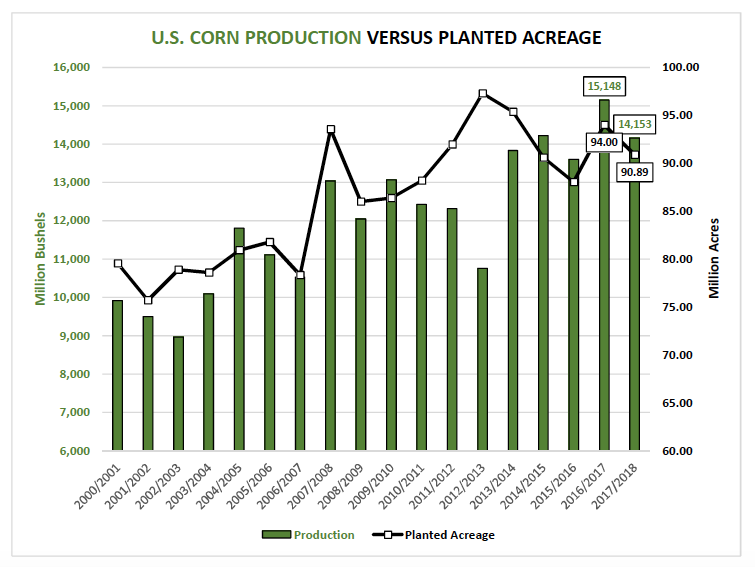

Will corn continue to move higher this week? Unfortunately for Corn Bulls I still see plenty of overheard fundamental price resistance going forward. Informa Economics released its revised September U.S. corn production and yield estimates on Friday of 14.123 billion bushels and 169.2 BPA respectively. Both figures were only slightly below the USDA’s August projections of 14.153 billion bushels and 169.5 BPA. However what Informa’s estimates reinforced was that talk of this year’s U.S. corn yield dropping down to 164 to 162 BPA have now been tabled. The majority is coming to the conclusion that the 2017/18 U.S. corn yield will likely fall between 167 to 170 BPA. Even the low end of that yield range would leave 2017/18 U.S corn ending stocks above 2.0 billion bushels for the second consecutive year. That doesn’t support $3.80 to $4.00 December corn futures.

As I said previously, Corn Bulls need a frost to change the narrative in the weeks ahead. In the absence of a frost I see December corn futures as range bound to the upside with immediate nearby price resistance at the 20-day moving average of $3.644.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

Data References:

- USDA United States Department of Ag

- EIA Energy Information Association

- NASS National Agricultural Statistics Service