Microsoft Corporation (MSFT) are trading higher on Monday morning after positive comments from Morgan Stanley hit the newswires.

Analysts at Morgan Stanley raised their price target on MSFT to $130 for the coming 12 months. This would be an increase of 42% from its closing price on Friday, putting the company’s market capitalization at $1 trillion.

Morgan Stanley believes Microsoft will achieve this through continued success in cloud services, which has a market value of $250 billion.

But with the stock already up considerably, is now the right time to buy?

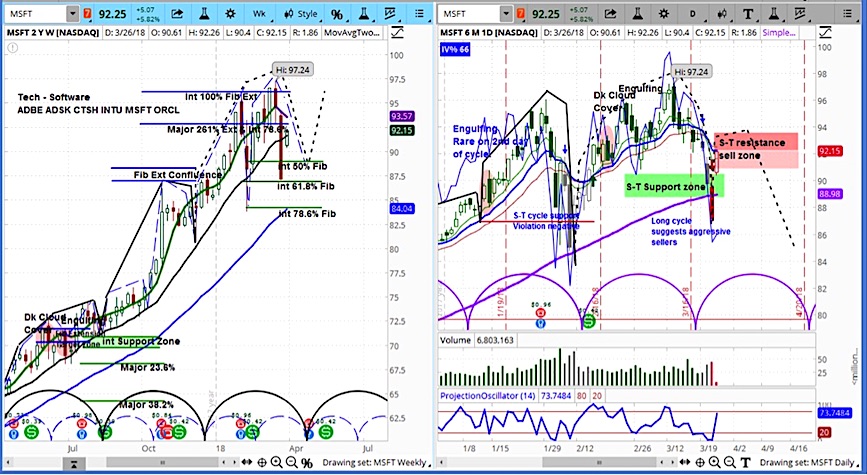

Upon reviewing the market cycles in the weekly chart below, our projection is that next month may present an opportunity to get in a lower prices.

Looking at the daily chart below, MSFT is currently trading inside a resistance zone, based on Fibonacci retracements. Should this hold the price below $94, it could mean that for short-term traders, during this rally, it might be a better time to look for short-side entries. This is because the current short term market cycle also projects lower and will last another week or two.

Microsoft (MSFT) Stock Chart with Weekly (Left) and Daily (Right) Bars

For an introduction to cycle analysis, check out a clip of our Big Picture Analysis, or visit askSlim.com and become a free Level 1 member for the full version.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.