The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

- March CPI data was not what the bulls wanted to see, just as concerns about household spending emerge

- This week, we profile a pair of domestic consumer companies, one from the Staples sector and one from Discretionary, with off-trend Q1 reporting dates

- Both firms hold shareholder meetings next month which could also bring about stock-price volatility

Q1 earnings season is in full swing. We’ve already seen mixed results from major companies in the Financials sector, and concerns have been on the rise regarding macro conditions elsewhere. Not only was the March CPI report on the hot side, but the Philadelphia Fed reported last week that US credit-card delinquency rates rose to a new high in Q4 2023.1 The good news is that wages are keeping up with the higher cost of living.

Now is an ideal time of year if you love digging into economy-wide conditions and how those translate into firms’ bottom lines. With more than three months under their belts, CEOs and CIOs now have a sense of how 2024 is unfolding. Comments from executives over the next several weeks could offer color on financial guidance numbers through the end of the year. We’ve already seen cautious comments from the likes of Nike (NKE) and Lululemon (LULU).2

It’s also key to scrutinize earnings dates relative to the historical norm. While there are a myriad of possible reasons why a company would delay or pull forward its quarterly earnings date, our research finds that such anomalies can be impactful on stock prices.

Fundamental Headwinds

This week, we focus on two consumer companies – one from the defensive Consumer Staples sector, the other from the risk-on Consumer Discretionary space. The pair are impacted by macro trends on the spending front and have been put in a bearish light by some analysts for being in the crosshairs of obesity medications and weight-loss drugs.

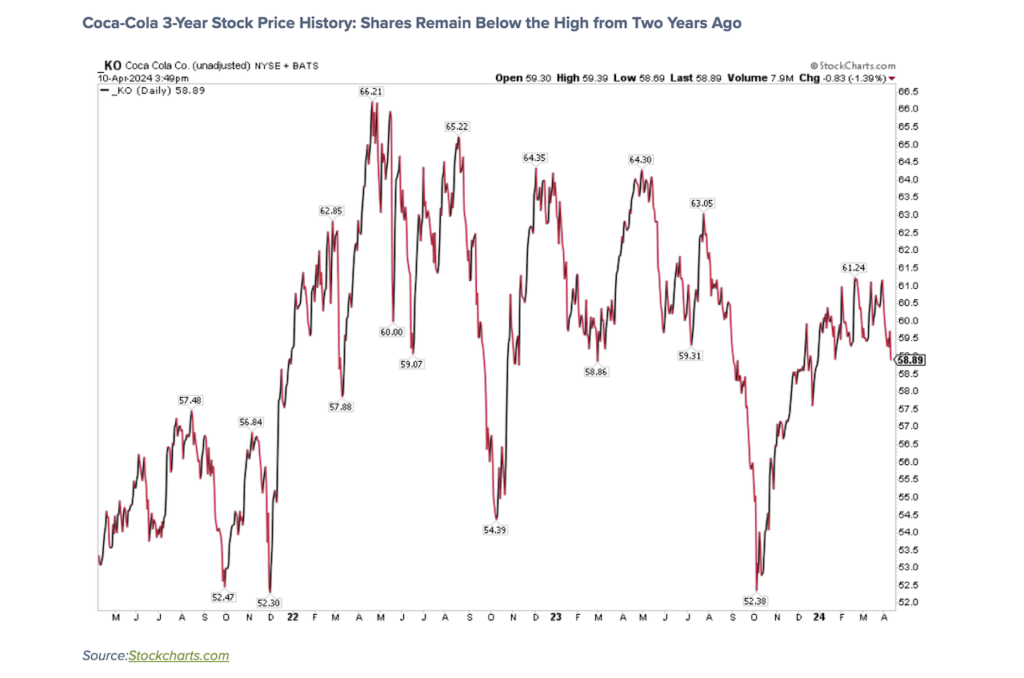

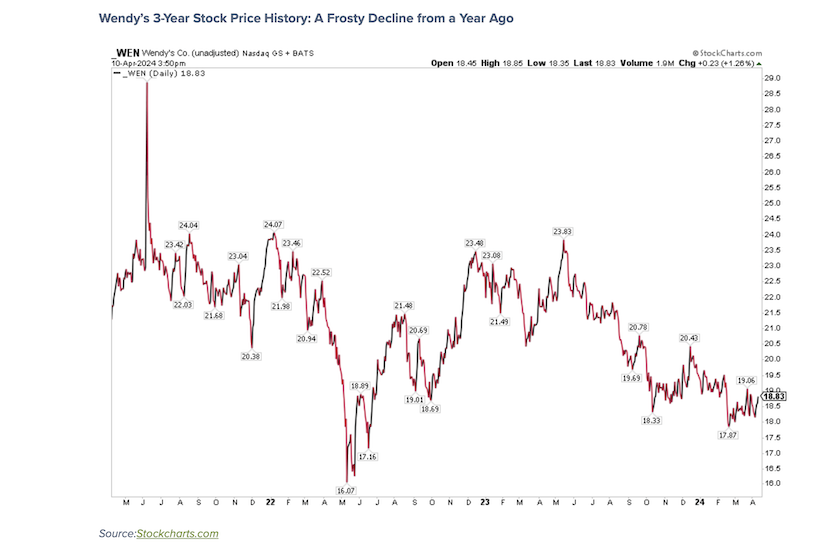

It’s been more than 8 months since shares of Eli Lilly (LLY) and Novo Nordisk (NVO) surged after the former reported strong Q2 2023 results and boosted its full-year outlook. Since then, Coca-Cola (KO) and Wendy’s (WEN) shares are in the red, sharply underperforming the S&P 500®.3 Both companies have unusual earnings dates relative to their respective usual Q1 reporting dates.

Coca-Cola: Late Earnings Date

Coca-Cola normally reports first-quarter numbers on April 22, according to Wall Street Horizon data. On March 28, The Atlanta-based $257 billion market cap soft-drink maker confirmed its earnings release to take place on Tuesday, April 30 BMO with a conference call immediately after the figures are released. The resulting DateBreaks Factor is -2, which indicates a statistically significant later-than-usual reporting date.

Now, it’s important to recognize that Coca-Cola holds its annual shareholder meeting the following day. Whether the earnings date indicates unusual news to be shared with the street is unknown, but no matter how it shakes out, the stock could see elevated volatility around the turn of the month due to the confluence of corporate events. As it stands, KO features a low 16% implied volatility percentage while data from Option Research & Technology Services (ORATS) show an implied stock price move of just 2.0% as of April 10, 2024.

Coke has topped analysts’ earnings estimates in each of the last 12 reports, per ORATS. Back in February, its management team hiked KO’s quarterly dividend from $0.46 per share to $0.485.4 So, while innovations in the Health Care sector could change demand for KO’s sugary soft drinks, there appear to be some fundamental tailwinds and signals lately. Investors will know a whole lot more after the Q1 report and shareholder meeting.

Coca-Cola 3-Year Stock Price History: Shares Remain Below the High from Two Years Ago

Wendy’s: Early Earnings Date

Turning to Wendy’s, the restaurant stock has been a nothing-burger since the start of Q4 2023. Technically, WEN trades below its long-term 200-day moving average, and shares traded lower post-earnings in early February. With rising food-away-from-home costs, families may find eating out more of a luxury compared to a year ago – even at fast-food joints. Looking ahead to its Q1 report, the May 2 BMO earnings event, six calendar days earlier than its historical norm, was confirmed on February 16. The resulting Datebreaks Factor is 3. It also hosts a conference call that morning.

Those who have followed the company closely in recent weeks might feel that they have a decent beat on its fundamental happenings – its management team presented at a trio of industry conferences in March. But new information could hit the tape next month at Wendy’s shareholder meeting on Tuesday, May 21.

Wendy’s 3-Year Stock Price History: A Frosty Decline from a Year Ago

The Bottom Line

Robust economic growth has resulted in inflation that remains above the Fed’s 2% target. As macro conditions shift, there are company-specific implications that investors must consider. Many consumer stocks have underperformed in recent months, both in the Staples and Discretionary areas. Coca-Cola and Wendy’s are firms with off-trend reporting dates in the weeks ahead. Executives at the two companies may provide additional details on consumer trends at their respective shareholder meetings in May.

Sources:

[1] Credit-Card Delinquency Rates Were Worst on Record in Fed Study, Bloomberg, Alexandre Tanzi, April 10, 2024, https://www.bloomberg.com

[2] Nike, Lululemon sink as annual forecasts disappoint, Reuters, Savyata Mishra, March 22, 2024, https://www.reuters.com

[3] Stock comparison, StockCharts, April 12, 2024, http://stockcharts.com

[4] Board of Directors of The Coca-Cola Company Approves 62nd Consecutive Annual Dividend Increase, the Coca-Cola Company, February 15, 2024, https://investors.coca-colacompany.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.