Twitter (NYSE: TWTR) traded 6% lower on Wednesday morning, after reporting earnings that beat Wall Street expectations.

The company reported earnings per share of $0.16 and total revenue of $665 million, compared to analyst expectations of $0.12 and $608 million.

Twitter estimates their Q2 earnings to come in between $245 and $265 million, compared to estimates of $218 million.

The stock nearly hit $35 in the premarket session, before falling to almost $28. As has been the scenario for many stocks, sellers may be waiting to sell the news on a day when the market is down overall.

As well, investors may be reacting to cautious comments from management during the conference call. For example, CEO Jack Dorsey said that they are still working through a business recovery that started in Q3 of last year. As well, CFO Ned Segal said that revenue growth for this year may look like it did in 2016.

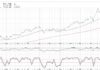

In analyzing the weekly chart below, TWTR clearly failed in resistance, which may prove to be a big top for the stock. In any case, our cycle analysis suggests a stock correction into late June.

Twitter (TWTR) Stock Chart with Weekly Bars

For an introduction to cycle analysis, check out our Stock Market Cycles video.

Twitter: @askslim

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.