A strong 2-day rally to finish the week has several stock market sectors nearing critical resistance.

One example is the transportation sector (IYT).

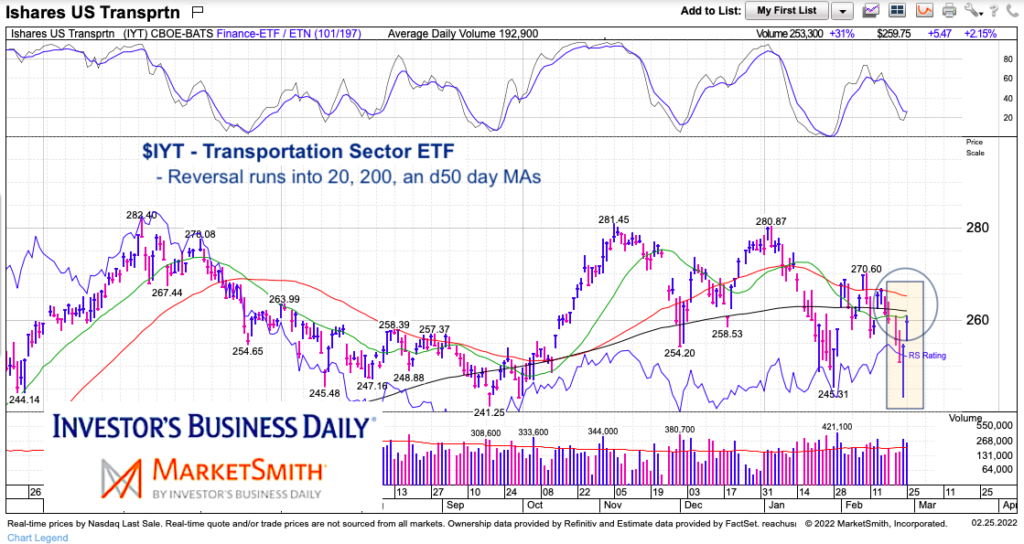

The Transports rallied (from lows to highs) about 18 points (or 7%) in just two days. This reversal IYT nearing a confluence of resistance that may take time to overcome.

Let’s look at the chart.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$IYT Transportation Sector ETF Chart

As mentioned above, the Transports (IYT) are quickly nearing resistance. For bulls, the first task at hand is taking out the 20- and 200-day moving averages. Just above that is the falling 50-day moving average (which also marks the downtrend (high and lower high invisible line – not shown in chart).

At any rate, transports need to rally another 4 to 5 percent before bulls can believe the downward price action has been neutralized.

Twitter: @andrewnyquist

The author has a trading position in mentioned securities or similar at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.