The transportation sector is an integral part of the economy. It accounts for shipping food, goods, and cargo around the world, as well as people to their favorite vacation destinations (to name a couple).

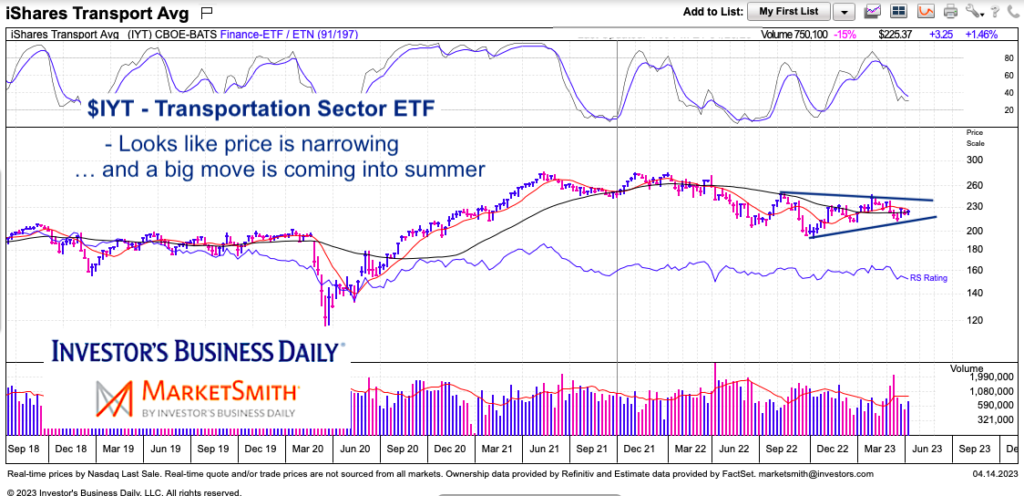

That sector seems to be stuck in the mud, with the Transportation ETF (IYT) trading sideways in a wide range for much of the past year.

Lately, $IYT has seen its price narrowing. This action often leads to volatility which may spur a breakout or breakdown.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of tools, education, and technical and fundamental data.

$IYT Transportation Sector ETF “weekly” Chart

Not much to add here… a picture often tells the story. If IYT breaks out to the upside, then I’d expect a move to around $265. If it breaks down, then we watch the recent lows around $212-$213. That’s an important level. If that gives way, then we could see a retest of last fall’s low.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.