The Junior Gold Miners ETF (NYSEARCA:GDXJ) have taken their lumps over the past 3 months. The ride has been volatile and included a couple of steep declines.

The most recent decline comes on the heels of a drop in gold prices (NYSEARCA:GLD). Note that the senior gold miners (NYSEARCA:GDX) didn’t get hit nearly as hard.

BUT both rallied hard during the second half of last week. Could the rally have legs?

The big question here then is: Is the correction in the Junior Gold Miners ETF (GDXJ) providing an opportunity?

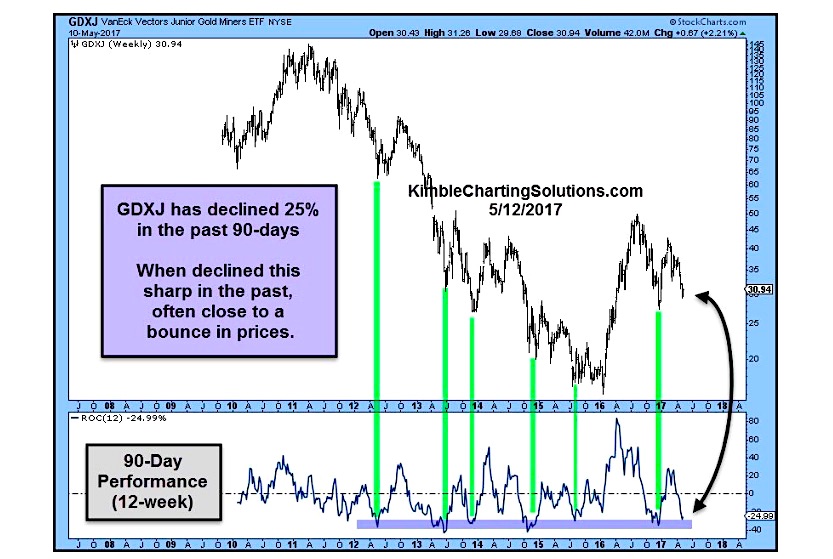

The chart below looks at the performance of GDXJ over 3 month windows since it began trading.

From top to bottom, GDXJ declined almost 25% (during a 3 month span). Looking back at historical precedent, it appears that GDXJ is closer to a trading bottom (than a top).

Below is another chart looking at the pattern of GDXJ vs the GDXJ/GDX ratio.

These charts help to explain the rally that started this past week.

Thanks for reading and have a great weekend.

ALSO READ: The VIX Is Near 2007 Lows: What It Means For Stocks

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.