Another day, another surprise in the financial markets.

Another day, another surprise in the financial markets.

Following yesterday’s fairly broad stock market rally and a strong close under fairly bearish sentiment conditions, I fully expected to see continuation higher today and a push on the S&P 500 through the 2110-2115 level.

As often happens, the market did not care about what I expected and reversed and gave up all of yesterday’s gains. This tarnished several short-term long trading setups, and, as you’ll see below, created some new short trading setups.

As always, the pundits are searching for reasons why this happened. Maybe it’s because of China, maybe it’s because of oil or the Dow’s dreaded “Death Cross.”

Regardless of what it is, the “why” is secondary and we have to focus on what the price action is telling us, often despite the news and headlines.

Bottom line: We are back to watching how the current range on the S&P 500 will be resolved. Given the overall price action we cannot be surprised to see the 200 day moving average support finally break and the S&P 500 move toward 2040 or lower. Then again, we cannot be surprised if the market again does the unexpected either.

The following are five trading setups I will be watching tomorrow:

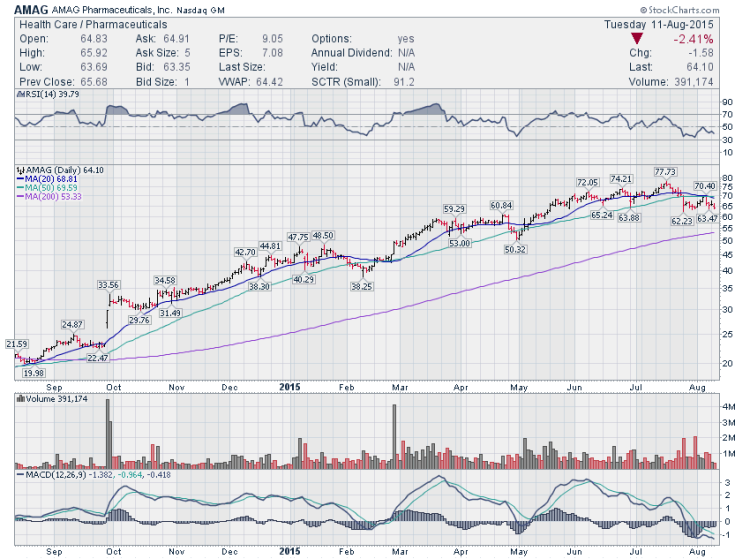

AMAG Pharmaceuticals (AMAG) SHORT: AMAG is sporting a bearish flag and price consolidation under the 20 and 50 day moving averages. The path of least resistance is additional downside toward 55 and the 200 day moving average.

Chegg (CHGG): Constructive but somewhat sloppy five-month consolidation base on Chegg’s stock chart. CHGG had an interesting uptick in buying volume late in today’s session; it now needs continuation through 8.60-8.70.

Bank Of The Ozarks (OZRK) SHORT: Another bearish flag under the 20/50 day moving averages. Should the 43.50 level fail to hold, it is likely to head lower toward 40.

Select Comfort (SCSS) SHORT: This one is starting to look fairly oversold on the daily chart. But the recent price structure is bearish and a mix of a bear flag and a mini- rising wedge suggests there could be more downside toward 22 for Select Comfort (SCSS).

Ulta Salon (ULTA) – Here’s a stock showing impressive relative strength and consolidation near its all time highs. ULTA seems to be getting ready for a push through 170.

Thanks for reading and have a great rest of your week.

Twitter: @NoanetTrader

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.