TXN – Texas Instruments

TXN- Trending up to $75-75.50 and above looks likely in the days ahead given the minor breakout from its four month base and looks to have consolidated in a constructive manner without having given too much back.

While the monthly charts have gotten overbought, there is no evidence technically of any reversal at hand and I expect this to exceed 75.50 up to an eventual target near 79-80. Only a move down under 69.96 cancels the bullish setup and would postpone this rally.

FFIV – 5 Networks

FFIV- Has risen to challenge 2011 highs, but structurally quite constructive having made a low, lower low and then low in a shape most would refer to as a reverse Head and Shoulders pattern.

While near-term stretched, this larger pattern is quite bullish on getting above 145 and likely to move to 150 very quickly with only a decline back under 134 postponing this move.

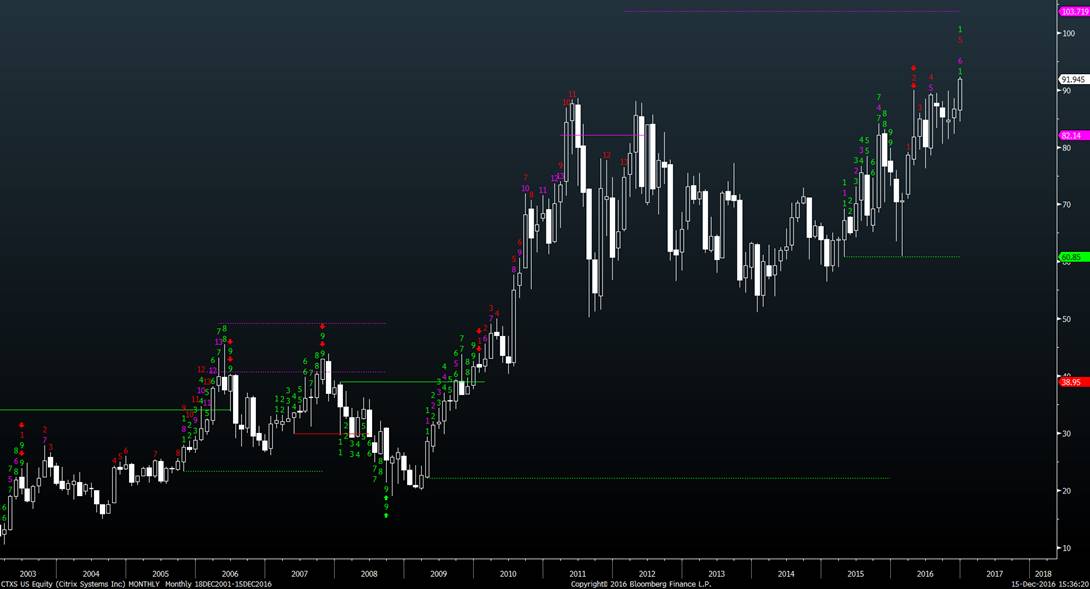

CTXS – Citrix Systems

CTXS set to exceed highs of its 5-year base, and similar to FFIV, made highs in 2011 which are now being exceeded. Bullish structure on monthly charts bodes well for this to move up

After five years of consolidation, a move back to new highs keeps this structure very bullish near-term- Additional near-term gains likely

Note that you can catch more trading ideas and insights from me over at my site, Newton Advisor. Thanks for reading.

Twitter: @MarkNewtonCMT

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.