4. ANACOR PHARMACEUTICALS (ANAC):

The stock broke out of a symmetrical triangle on Thursday and printed an inside day on Friday. A couple days of basing will form a flag and the stock can breakout if the market supports such a move. Bollinger bands are opening up nicely and momentum indicators are bullish. A break above 147.19 should carry it towards 156 at the very least.

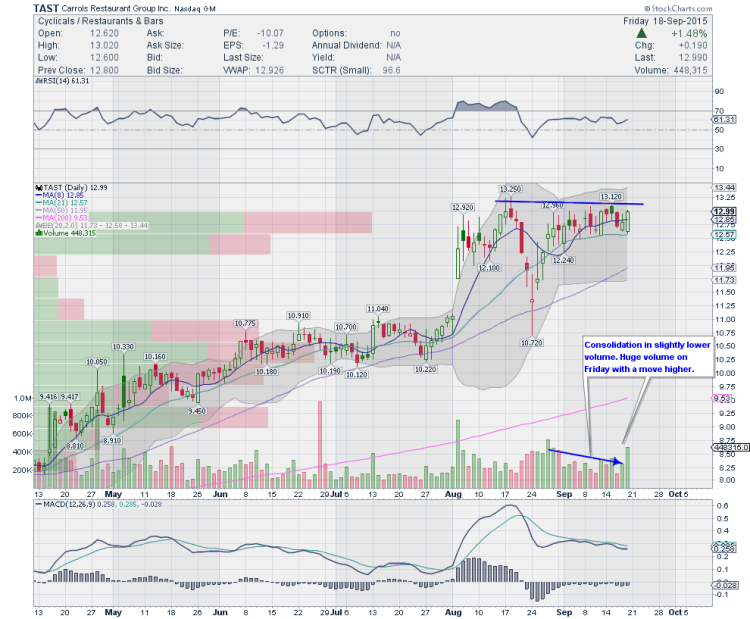

5. CARROLS RESTAURANT GROUP (TAST):

This stock showed relative strength on Friday on heavier volume after consolidating in slightly lower volume. RSI is starting to curl up after basing a bit and so is MACD. TAST’s bollinger bands are opening up as well. A move above 13.25 and this stock should breakout.

6. CHARTER COMMUNICATIONS (CHTR):

CHTR is another services company that has showed relative strength during this entire period and has formed a long base since February. Despite Friday’s candle, this stock still looks good. It may need to base a bit here to allow the price to catchup with the moving averages. Bollinger bands have opened up and momentum indicators are bullish. This is for a longer haul and not a day trade or 5-6 day trade. My price target on CHTR is approximately 50 dollars higher if this pans out. Giddy up.

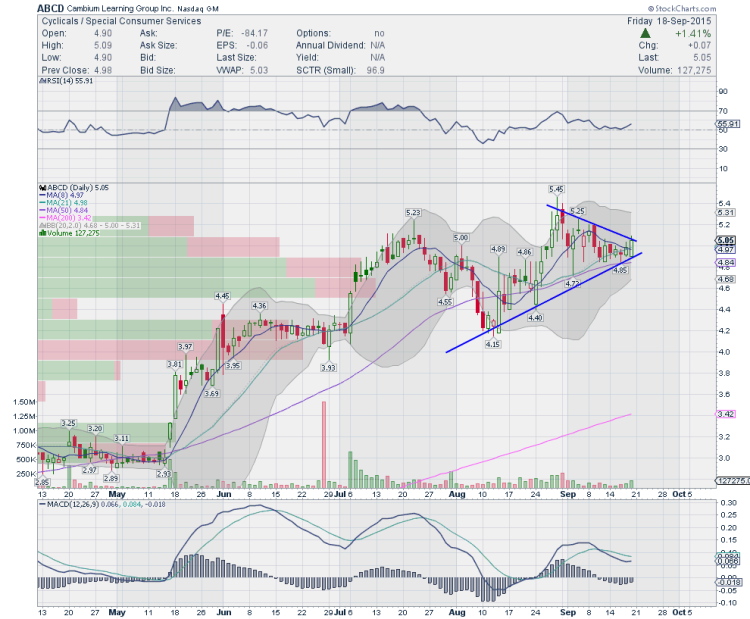

7. CAMBIUM LEARNING GROUP (ABCD):

While Cambium Learning is a less known and followed stock under $10, ABCD has formed a nice symmetrical triangle. The stock saw some very bullish action on Friday with volume coming in. While RSI is turning up, MACD which is lower is also seen turning. A break above Friday’s highs should take this stock above 6 dollars in due course.

Thanks for reading.

Twitter: @sssvenky

The author is long EPAM and owns an AMZN call spread at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.