We are right in the middle of earnings season where a large majority of companies report their numbers for the previous three months. It is also a time when many stocks exhibit a pattern of bullishness ahead of their respective earnings dates.

There are many different strategies for trading around an earnings announcement. And some traders even trade through the earnings event, gambling on a big lottery ticket win if they happen to be on the right side of a huge move. This would have worked with McDonald’s (MCD) and Google (GOOGL), but not with Sketchers (SKX). Earnings reports often lead to binary outcomes (i.e. big moves).

So traders like myself prefer to stand aside through the announcement, choosing instead to use the earnings date as a catalyst to trade the expectation before the possible selling of the event. We often hear this referred to as “buy the rumor; sell the news”. I prefer “trade the expectation; sell the event”.

How to trade the expectation from entry to exit varies and is each trader’s art, so I will leave the finer details to each of you.

Let’s start by looking at a few recent examples using WEEKLY stock charts, which I use for direction and potential targets. The DAILY charts are for taking action (entry). I believe the former is the canvas; the latter the brush strokes. My purpose here is to provide the canvas. It is up to each trader to apply the brush.

The first 2 charts below are stocks that have already reported earnings. Again, I want to show you their chart setups into earnings to demonstrate how the broader weekly backdrop (the canvas) can help your trading into earnings. In these cases, traders could have followed the trend and expectation into earnings before selling (or using a protective strategy) into the event.

Google Inc. (GOOG/GOOGL) (Earnings 10/22)

Google (AKA Alphabet Inc) ran up to its previous earnings high from July, just a day before its event. This offered a nice trading opportunity leading up the event. Sure, Google’s stock price broke out to new highs, but it has pulled in some and may offer another opportunity on the setup.

Amazon (AMZN) (Earnings 10/22)

Similar to Google, Amazon ran up to its previous earnings announcement high in July, just a day before its earnings event. Once again, the outcome was higher (and a breakout). Amazon also gapped higher before selling off into the weekend. The rally into earnings still would have been profitable and as the dust settles, traders can evaluate the new setup.

The next company has not reported yet, but the action is the similar…

Facebook (FB) (Earnings 11/4)

Facebook still has several days before its earnings announcement but is already back to its July earnings high.

There are likely several more trade the expectation examples to look forward to in the weeks ahead. Let’s take a look at one more possibility/example in motion. Again, this is simply an educational exercise to help traders see the bigger picture.

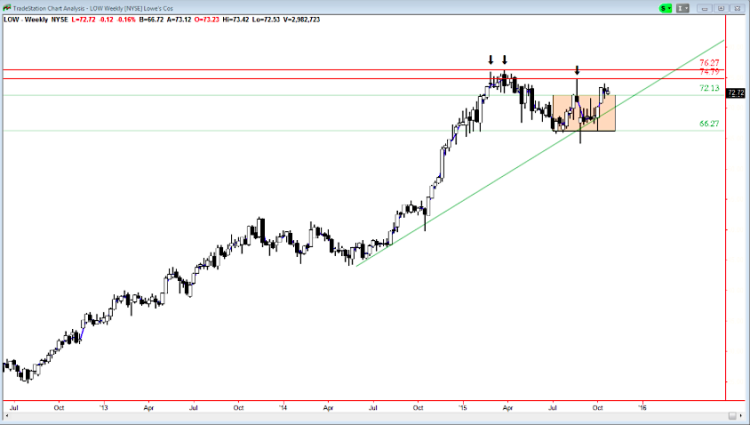

Lowes (LOW) (Earnings 11/18)

Lowes last earnings high was the wick from August. Beyond that, the all time highs from the first of the year.

As I said, there are many more stocks out there but the above should suffice as guides for the potential of trade the expectation opportunities. Of course, if the ensuing price action doesn’t meet your expectations for opportunity then there will be no trade. If it does and the ensuing price action fails to meet your profit expectations then a smaller profit or a possible loss may result. In any case, I believe riding the trend and selling into an earnings event is the best option.

Keep it simple. Thanks for reading.

Twitter: @crosshairtrader

No positions in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.