Part of my regular screening process involves finding sector and industry ETFs breaking to new 13-week highs and lows. This can be a great way to identify emerging leadership as well as potential underweights.

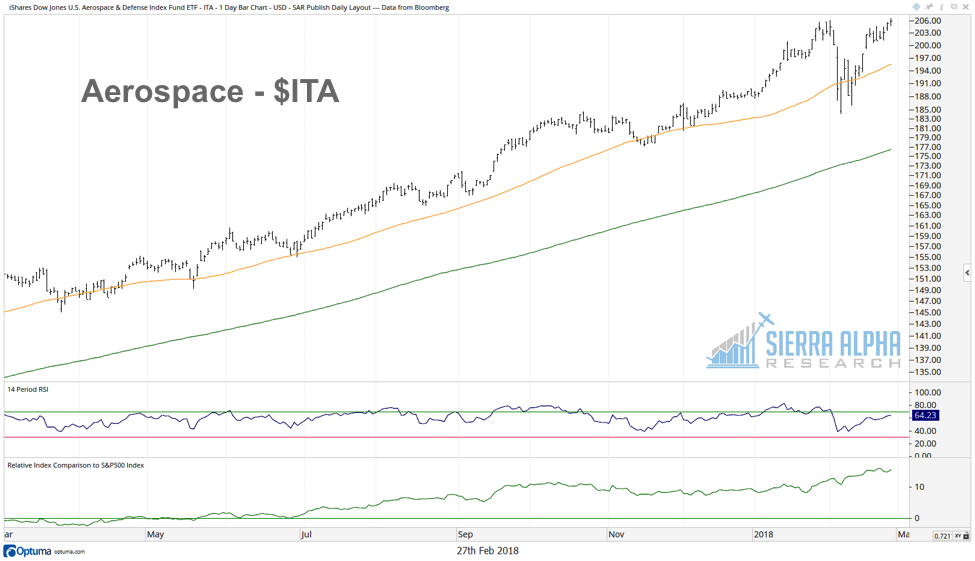

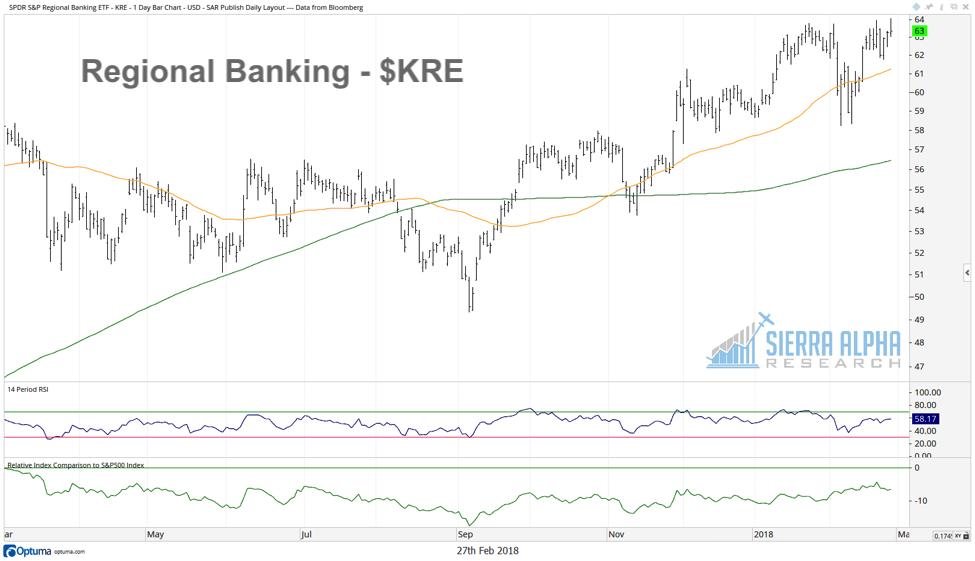

I noticed three key industry ETFs at or near long-term highs today: the Market Vectors Semiconductor ETF (SMH), the iShares Dow Jones US Aerospace & Defense Index Fund (ITA), and the SPDR S&P Regional Banking ETF (KRE).

These groups have easily outperformed the S&P 500 index since the beginning of 2018. Semiconductors have returned 10.7%, aerospace/defense are up 9.6%, and regional banks have returned 7.6% while the S&P 500 is up only 3.8%. Also these three industries are all breaking to new highs while the S&P is still 3-4% below its January high.

The SMH broke down through support during the recent correction, almost reaching the 200-day moving average after it traded through its December low around $96. The semiconductor ETF quickly reversed, returning to all-time highs this week.

The ITA broke below its 50-day moving average a number of times in early February, but never confirmed it with a lower close. Every breakdown was immediately followed by a recovery day.

The regional banking ETF traded down to support in the $58.50 range before coming back up to long-term highs. The KRE has now built up quite a base around resistance at $64. A confirmed close above this key level would suggest higher highs.

Interestingly, none of these three ETFs are overbought using RSI, an indication that they are not yet overextended even with the recent rallies.

You can gain deeper insights and more meaningful analysis over at Sierra Alpha Research. Thanks for reading.

Twitter: @DKellerCMT

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.