These have been some pretty wild markets.

Just three weeks ago top signals were showing up in Bonds and Gold. Now I’m getting Extremehurst(TM) topping signals on the high beta “risk-on” small caps and mid caps. Looks like stocks are getting overheated here.

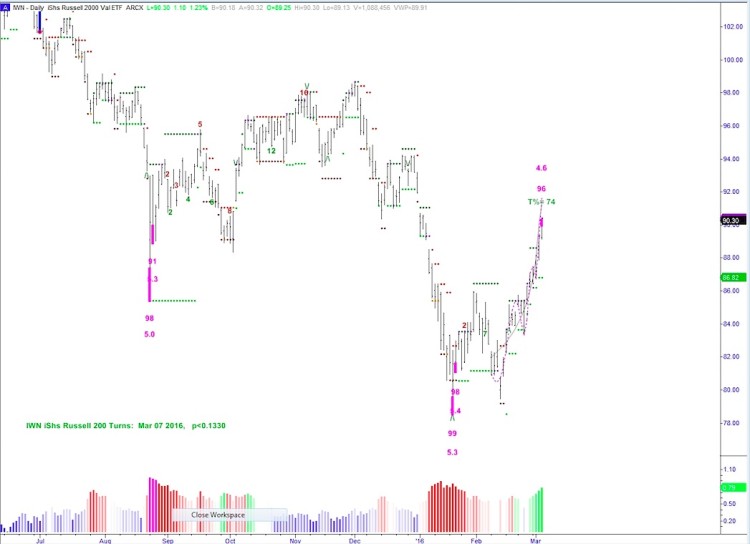

In the charts below, I highlight these signals that are showing overextended price action for both the Russell 2000 Value Fund (IWN) and the Mid-Cap Index CME (IDX).

Remember Extremehurst signals indicate END of TRENDS (within a designated time frame) not necessarily reversals. Might be time for a breather here.

Russell 2000 Value Index (IWN)

S&P 400 MidCap Index (CME:IDX)

Note that Extremehurst(TM) signals are provided by Parallax Financial Research, a partner that I work with. You can learn more about Extremehurst signals by watching this video.

Thanks for reading and have a great weekend.

Further reading from Alex: “Gold And US Treasury Bonds Are At Price Extremes”

Twitter: @interestratearb

The author is looking for related directional trades and may have a position in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.