It was a quiet week for stocks. The S&P 500 Index () and the Nasdaq Composite were pretty much flat, while the Dow Jones gained a 0.5% and the Russell 2000 fell 1.7%. Clearly, any profit taking occurred with higher beta small caps.

Some back and filling may be in order for the week ahead. That would fit the seasonal schedule and may lead to a santa rally at year-end.

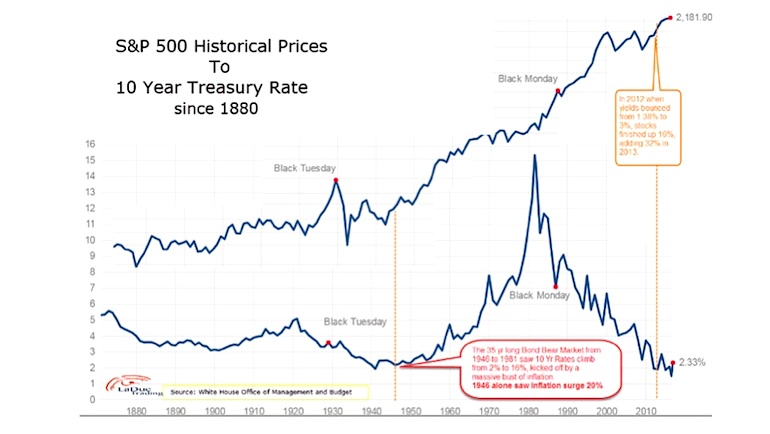

Treasury bonds continue to bleed as yields creep higher. The 10 Year Treasury Yield closed the week at 2.6%, it’s highest close in over 2 years. Precious metals are also beaten down… U.S. Dollar strength has just been too much. At some point soon, the Dollar with breathe… and perhaps bonds and gold will finally bounce.

As we move towards 2017, it’s a good time for traders to reflect on another year in the markets and what worked and didn’t work. And what themes emerged and/or are emerging. Have a great weekend and enjoy this week’s reading list.

Top trading Links: Trends, Themes, and Bond Dreams

MARKET INSIGHTS

A lowly new high in the Dow – Dana Lyons

Fund Managers’ Current Asset Allocation – The Fat Pitch

Commercial Traders are buying bonds in a big way – Gavekal Capital

Are rates set to rise in the long run? – LaDuc Trading

Crude Oil is facing huge resistance – Kimble Charting Solutions

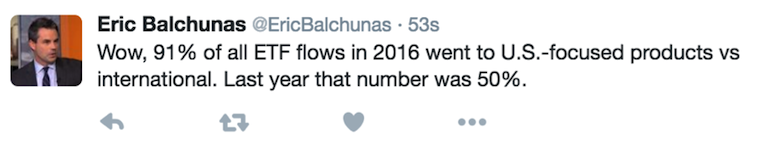

TWEET of the Week – Is it time for U.S. investors to look abroad in 2017?

Emerging Markets outlook for 2017 – FMD Capital Management

Themes and Risks of 2017 – Black Rock

NEWS & RESEARCH

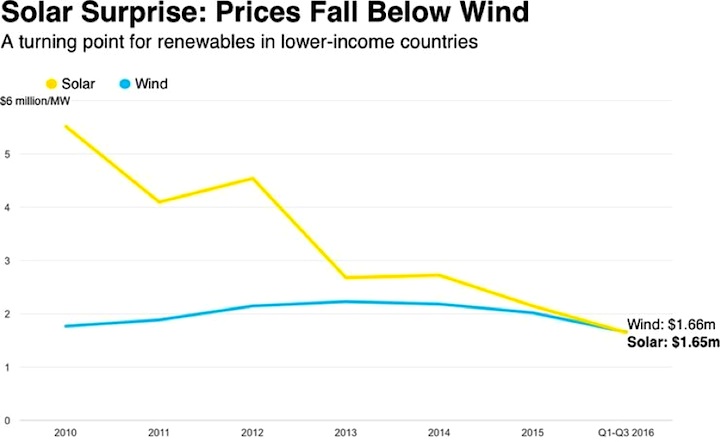

Solar power is now the cheapest form of electricity – Bloomberg

Scientists claim the ageing process may be reversible – The Guardian

Japan is now the U.S.’s largest creditor – Reuters

Don’t set too many goals for yourself – HBR

Why Elon Musk thinks a universal basic income is inevitable – Big Think

Check back every weekend for more links to some of the best trading blogs and investing research. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.