Another productive week for market bulls is in the books. Considering the violent post-election reversal and surge higher, it was good to see the stock market digest the gains and continue to creep higher.

For the week, the S&P 500 Index (INDEXSP:.INX) was up 0.8%, while the Nasdaq (INDEXNASDAQ:.IXIC) surged over 1.5%. The only laggard was the Dow Jones Industrial Average (INDEXDJX:.DJI), up just 0.1%.

Market Bears: Momentum is slowing and some short-term divergences are forming so active investors should stay cautious over the very short-term. As well, treasury yields (and interest rates) have been shooting higher. How high can they climb before equities begin to notice?

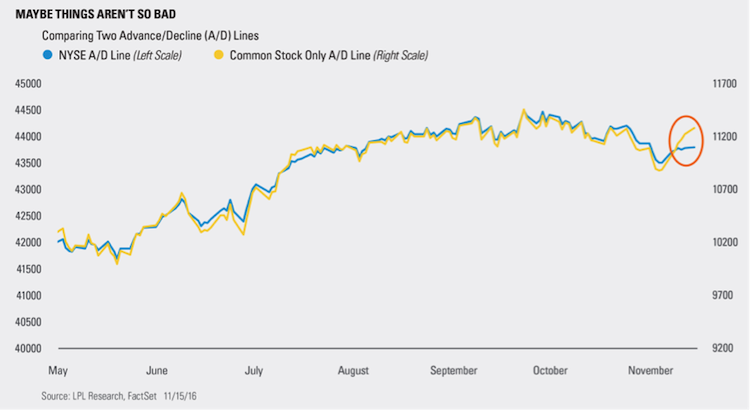

Market Bulls: The good news right now is that market breadth isn’t showing any of signs of broader weakness and the major indices are at or near all-time highs. Seasonality says higher, lower, and higher again into year-end.

Investors are still battling news & “noise”, so research and a steady process are important. Price is always the final arbiter. So tune out the noise and enjoy this week’s “Top Trading Links”.

MARKET INSIGHTS

Is the Hindenburg Omen back? – LPL Research

A look at U.S. demographics – Urban Carmel

Cyber Security comes back – Greg Schnell

Just how bullish is small cap strength? – Pension Partners

Buybacks continue to decelerate – Hedgopia

The next year may be more about multiple expansion than earnings growth – Fundamentalis

Will we see a shift out of high yield to treasuries – Andrew Thrasher

NEWS AND RESEARCH

The chairman of the SEC will step down in January – Washington Post

Capital Allocation Trends Outside of the U.S. – Michael Mauboussin

Why smart people make bad decisions – Morgan Housel

What made Charles Darwin an effective thinker – Farnham Street

How to master your intuition – Barking up the Wrong Tree

How exercise shapes you far beyond the gym – NY Mag

Humanity and AI will be inseparable – The Verge

The wave of millennial home buyers is coming – Visual Capitalist

Be sure to check back every weekend for more links to quality trading blogs and investing research. Thanks for reading “Top Trading Links”!

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.