So much for the summer doldrums. Iran nuclear deal talks keep stalling. China is a mess, and while Greece is still on the back burner, it could still play a factor. It’s tough to be long right now. It’s so ‘tough’ in fact that we’ve seen signs of panic. World markets have seen major indices like the S&P 500, Shanghai Composite, and German DAX all test their rising 200 day moving averages.

Corporate earnings will start coming hot and heavy this week. According to FactSet, analysts are looking for ~4.5% decline in revenue and earnings for the S&P 500.

Without further adieu, let’s dig in. Here’s this week’s Top Trading Links.

Earnings Season Primer

@FactSet previews earnings season:

“The industrials sector has seen largest cuts to earnings growth expectations since March 31”

Thinking about trading some earnings reports? @NoanetTrader on why you should re-think that.

A reminder stock prices have diverged from corporate earnings via @Skrisiloff. BTW, be sure to check his site out for weekly management commentary updates.

Here’s a favorite corporate earnings calendar/tracker.

@estimize does a great job providing key earnings data.

Shanghai collapse in historical context pic.twitter.com/A4alLFkM3H

— Nick (@NickatFP) July 9, 2015

Trading & Investing

Want a look at a Pro’s thought process during this recent pullback? Why @RyanDetrick thought a bounce was coming before a further correction.

“The best buying opportunities are usually the ones that feel the worst.” – @fabiancapital

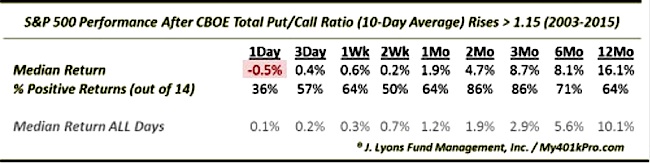

@JLyonsFundMgmt shares some data on the extreme rush for protection:

@KimbleCharting analyzes Apple’s long term chart as AAPL earnings approach:

@SJosephBurns shares his key S&P 500 levels.

Why momentum investing works via @awealthofcs

Is America seeing a slump in innovation? @TMFHousel refutes that notion:

“Someone, somewhere, right now is inventing or discovering something that will utterly change the future. But you’re probably not going to know about it for years.”

China is spectacle these days…

Shanghai collapse in historical context pic.twitter.com/A4alLFkM3H — Nick (@NickatFP) July 9, 2015

China’s richest people just lost 100 billion dollars in a month.

Several friends in China have told me that brokers have refused their sell orders.

— Patrick Chovanec (@prchovanec) July 10, 2015

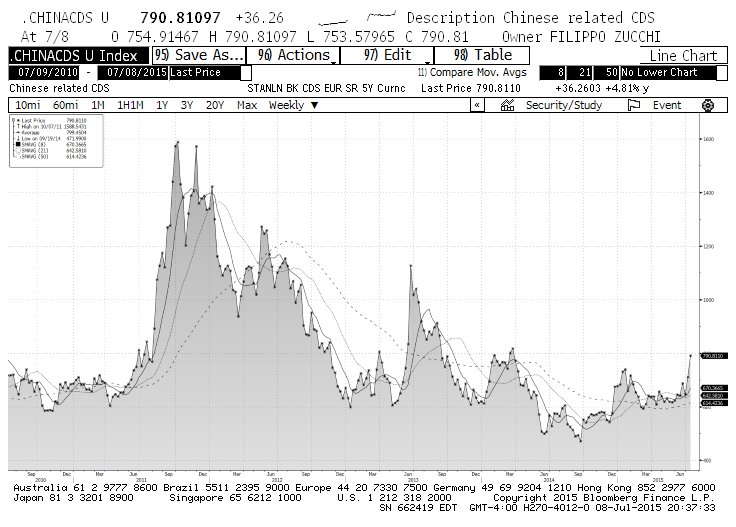

@FilZucchi diagnoses Chinese credit default swaps during the crash. They aren’t moving! Interesting!

Happenings & Research IBM announced a ‘big breakthrough on chip size. What it means:

“Basically, the move towards 7nm is …about making computing more efficient for laptops, mobile devices and other platforms. That should lead to… leaps we can’t even imagine yet.”

Oil and Gas majors are so desperate for cost cutting and growth:

Shell is trying to drill in the Arctic Seas.

They’re also invested in a Middle East project where they use solar power to help extract oil.

A look at how incentives are playing a part of the buyback boom

“By 2020,” said eXelate’s Garbaccio, “more than 75% of marketers and media companies will be using a Data Management Platform (DMP) to activate data–their own and that of third parties.” – via Nielsen.com

Mike Gault over @Recode on blockchain technology:

“A blockchain is essentially just a record, or ledger, of digital events — one that’s “distributed,” or shared between many different parties.”

Funny tweets of the week: On this week’s NYSE technical difficulties…

Nick Burns is on it. #NYSE #move pic.twitter.com/pYM5n0fXib

— Rudolf E. Havenstein (@RudyHavenstein) July 8, 2015

Hey #NYSE just remember to take the cartridge out on fixing the bug pic.twitter.com/jm4bs7unHM

— Sean Rivers (@seanmrivers) July 8, 2015

Thanks for reading! Be sure to check out our Top Trading Links archives for a goldmine of investing research and trading education.

Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.