It’s become clear that the global easing environment has reached the next stage as major investors in the east are now panicking about not having ‘high enough returns’. Investor behavior is also getting kind of nutty in China. On top of that, bond markets have become illiquid and Switzerland issued 10 year bonds with a negative yield. Phew! The world must be ending.

All of that said, breadth in the U.S. equity market is still quite strong and suggests higher prices. Check out the NYSE Stock Only A-D Line:

I hope you enjoy this week’s “Top Trading Links” – it’s bigger and better than ever. Some seriously awesome research and links in here.

MARKET INSIGHTS

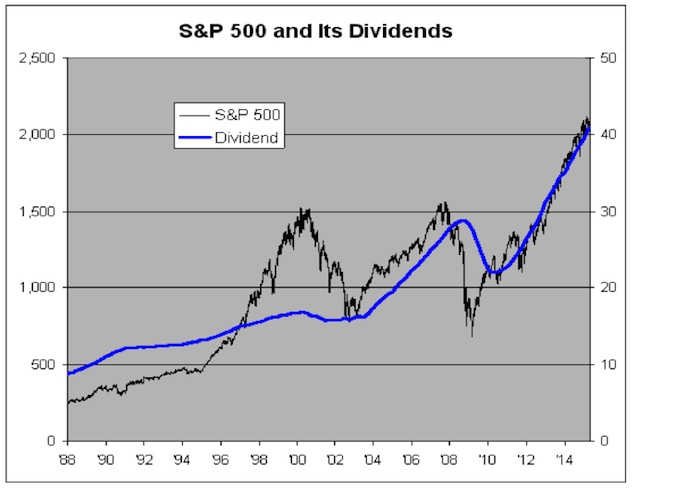

- @EddyElfenbein notes dividends grew 15% year over year in Q1. They sure have tracked the S&P 500 of late haven’t they?

- Are active traders all-in for equities? @JLyonsFundMgmt looks into TD Ameritrade’s retail trader index.

- Earnings season is here again. Trading earnings can be very enticing, but it can be just another form of gambling. @NoanetTrader gives some great reasons to hold off.

- Howard Marks sat down with @CNBC. Here are a couple excerpts:

“There are no compelling bargains, that i’m aware of, in the markets. There’s better and there’s worse, but there’s nothing that is absolutely cheap”

“By reducing the risk free rate to 0, people with money have to go out and invest that money on the riskier part of the curve to make any money”

- @ReformedBroker gives some good reasons why it’s time for active investors to out-perform.

- @BtrBetaTrading shares a pretty cool stock market timing tool. Granted there is no holy grail, but it’s an interesting way to look at things.

- @todfrancis digs into common characteristics of winning startups in the early stages.

- Fundamentalis shares the four common characteristics of the glorious U.S. post financial crisis rally. H/T @ReformedBroker

“Street and financial media expectations every quarter entering earnings season are typically downright depressing, (note last October ’14) and yet actual SP 500 earnings growth each quarter has been at least mid-to-high-single-digits each quarter, i.e. Q4 ’14’s +9% ex-Energy, despite the roundly pessimistic outlooks. Let’s face it, there have been many doubters around earnings for the last few years, and it has been consistent every quarter, with the latest meme being earnings growth is mostly due to large stock repurchase plans in Corporate America”

- @MishGEA is buying Russia. Are the tough sanctions and collapse in energy prices actually a good thing?

RESEARCH

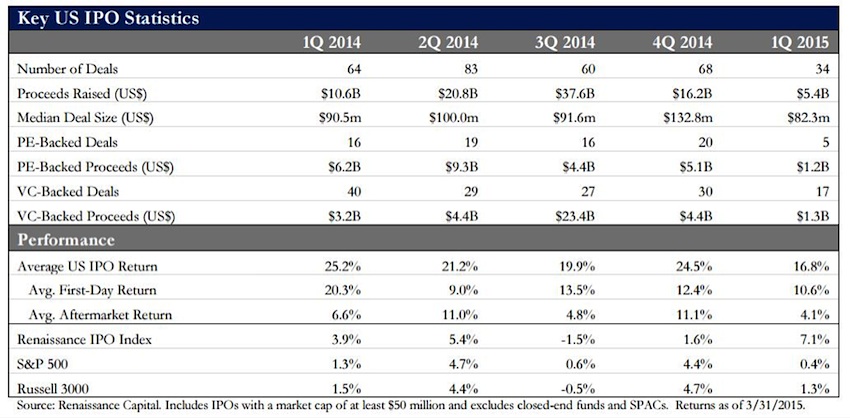

- It was a very slow Q1 for IPOs. @IPOtweet shared their Q1 IPO market review:

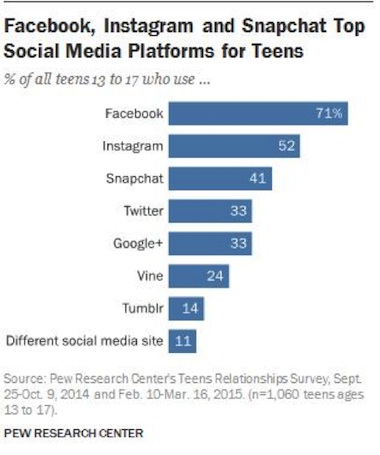

- @pewresearch released their study on teen’s tech habits – Facebook (FB), Instagram, Snapchat round out the top 3, with Twitter (TWTR) a close 4th.

- @toddwenning discusses what he looks for in a ‘perfect stock’

TRADECRAFT

- Congrats to Brian Shannon on nine years blogging @alphatrends. To celebrate, he shared 9 trading truths he’s learned over the years. Here’s a glimpse:

“There is a tendency for many traders to complicate the process by doing “advanced” technical analysis, cluttering their charts with unnecessary indicators and oscillators. There is nothing wrong with having a pet indicator or two on your charts but it all boils down to price action.”

- Beliefs are so underrated in market operations. That’s likely because you can just say you believe this or that. Beliefs have to be deeply rooted to be truly effective in trading. @crosshairtrader has a constructive set of trading beliefs.

- When you step into the world of trading, you’re either resilient or you fail….or you might just fail anyways. @steenbab composed an insightful piece on resiliency. Sometimes you have to dig deep:

“What’s the key to becoming a resilient, gritty person? I strongly suspect it’s the ability to tap into hidden reserves of energy–that mental, emotional, physical, and spiritual second wind–that become available to us under conditions of high challenge.”

- @HowofTrading discusses core elements of a winning market methodology.

- Why brainstorming works better online via @HarvardBiz.

- We can follow our favorite investors, but we have to apply what we’ve learned from them on our own via @awealthofcs.

HAPPENINGS

- We know many new drugs are overpriced, but who’s doing anything about it? Well, Kyle Bass has put a fund together to short pharma companies and then challenge their patents.

- Folks are trading stock tips at street corners in Shanghai. In case you missed it, they are also opening trading accounts at break neck speed.

- Japanese endowment funds are highly concerned about not having high enough returns. (@WSJ Subscription required)

- Jamie Dimon warns of potential bond market liquidity risks.

- @WSJ notes a lack of liquidity in the repo market. (subscription required)

- The ECB is implementing measures in an attempt to add liquidity to their repo market.

Thanks for reading. Check out our “Top Trading Links” archives and be sure to tune into Top Trading Links every weekend.

Follow Aaron on Twitter: @ATMcharts

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.